Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management <strong>Report</strong><br />

For unexpected developments, individual company hedging concepts (e.g. share options)<br />

can be implemented to ensure a risk-adequate response to short-term fluctuations and,<br />

in extreme cases, limitation of the losses that occur. These hedging concepts are constantly<br />

reviewed in the light of market developments and adjusted as required.<br />

Because of the minimal volume of the share portfolio, share price risk was negligible in<br />

the <strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> at balance sheet date.<br />

In the property sector, market values continued to recover moderately in the period under<br />

review. Accordingly, net asset values were seen to move increasingly in line with the<br />

model values produced by discounted cash flow analysis in relation to the portfolio as<br />

a whole. This scenario is expected to be repeated during the next reporting period. Given<br />

the generally positive prospects <strong>for</strong> market development, however, individual value adjustments<br />

are possible. Especially in view of long terms, relatively low marketability and<br />

capital calls on existing commitments, our engagement in this asset class is long-term.<br />

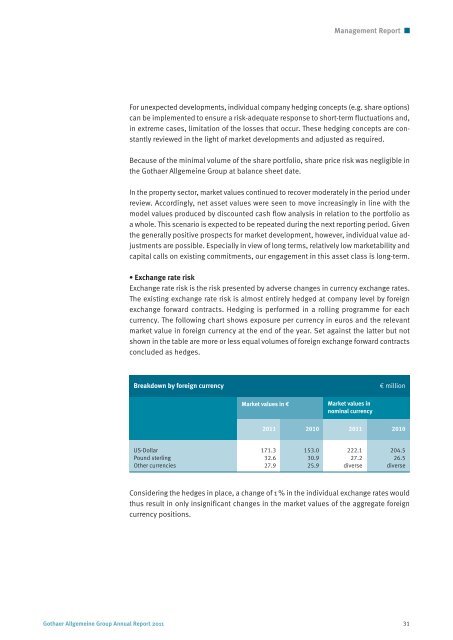

• Exchange rate risk<br />

Exchange rate risk is the risk presented by adverse changes in currency exchange rates.<br />

The existing exchange rate risk is almost entirely hedged at company level by <strong>for</strong>eign<br />

exchange <strong>for</strong>ward contracts. Hedging is per<strong>for</strong>med in a rolling programme <strong>for</strong> each<br />

currency. The following chart shows exposure per currency in euros and the relevant<br />

market value in <strong>for</strong>eign currency at the end of the year. Set against the latter but not<br />

shown in the table are more or less equal volumes of <strong>for</strong>eign exchange <strong>for</strong>ward contracts<br />

concluded as hedges.<br />

Breakdown by <strong>for</strong>eign currency<br />

€ million<br />

Market values in €<br />

Market values in<br />

nominal currency<br />

2011 2010 2011 2010<br />

US-Dollar 171.3 153.0 222.1 204.5<br />

Pound sterling 32.6 30.9 27.2 26.5<br />

Other currencies 27.9 25.9 diverse diverse<br />

Considering the hedges in place, a change of 1 % in the individual exchange rates would<br />

thus result in only insignificant changes in the market values of the aggregate <strong>for</strong>eign<br />

currency positions.<br />

<strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> 2011 31