Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated Financial Statements<br />

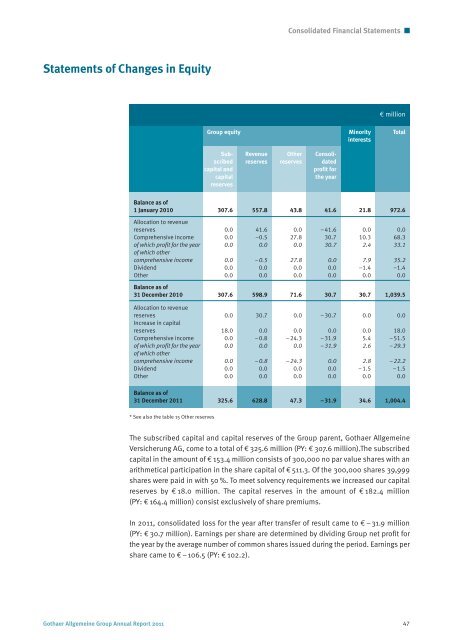

Statements of Changes in Equity<br />

€ million<br />

<strong>Group</strong> equity<br />

Minority<br />

interests<br />

Total<br />

Subscribed<br />

capital and<br />

capital<br />

reserves<br />

Revenue<br />

reserves<br />

Other<br />

reserves<br />

Consolidated<br />

profit <strong>for</strong><br />

the year<br />

Balance as of<br />

1 January 2010 307.6 557.8 43.8 41.6 21.8 972.6<br />

Allocation to revenue<br />

reserves 0.0 41.6 0.0 –41.6 0.0 0.0<br />

Comprehensive income 0.0 –0.5 27.8 30.7 10.3 68.3<br />

of which profit <strong>for</strong> the year 0.0 0.0 0.0 30.7 2.4 33.1<br />

of which other<br />

comprehensive income 0.0 –0.5 27.8 0.0 7.9 35.2<br />

Dividend 0.0 0.0 0.0 0.0 –1.4 –1.4<br />

Other 0.0 0.0 0.0 0.0 0.0 0.0<br />

Balance as of<br />

31 December 2010 307.6 598.9 71.6 30.7 30.7 1,039.5<br />

Allocation to revenue<br />

reserves 0.0 30.7 0.0 –30.7 0.0 0.0<br />

Increase in capital<br />

reserves 18.0 0.0 0.0 0.0 0.0 18.0<br />

Comprehensive income 0.0 –0.8 –24.3 –31.9 5.4 –51.5<br />

of which profit <strong>for</strong> the year 0.0 0.0 0.0 –31.9 2.6 –29.3<br />

of which other<br />

comprehensive income 0.0 –0.8 –24.3 0.0 2.8 –22.2<br />

Dividend 0.0 0.0 0.0 0.0 –1.5 –1.5<br />

Other 0.0 0.0 0.0 0.0 0.0 0.0<br />

Balance as of<br />

31 December 2011 325.6 628.8 47.3 –31.9 34.6 1,004.4<br />

* See also the table 15 Other reserves<br />

The subscribed capital and capital reserves of the <strong>Group</strong> parent, <strong>Gothaer</strong> <strong>Allgemeine</strong><br />

<strong>Versicherung</strong> <strong>AG</strong>, come to a total of € 325.6 million (PY: € 307.6 million).The subscribed<br />

capital in the amount of € 153.4 million consists of 300,000 no par value shares with an<br />

arithmetical participation in the share capital of € 511.3. Of the 300,000 shares 39,999<br />

shares were paid in with 50 %. To meet solvency requirements we increased our capital<br />

reserves by € 18.0 million. The capital reserves in the amount of € 182.4 million<br />

(PY: € 164.4 million) consist exclusively of share premiums.<br />

In 2011, consolidated loss <strong>for</strong> the year after transfer of result came to € –31.9 million<br />

(PY: € 30.7 million). Earnings per share are determined by dividing <strong>Group</strong> net profit <strong>for</strong><br />

the year by the average number of common shares issued during the period. Earnings per<br />

share came to € –106.5 (PY: € 102.2).<br />

<strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> 2011 47