Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Gothaer Allgemeine Versicherung AG Group Annual Report for ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management <strong>Report</strong><br />

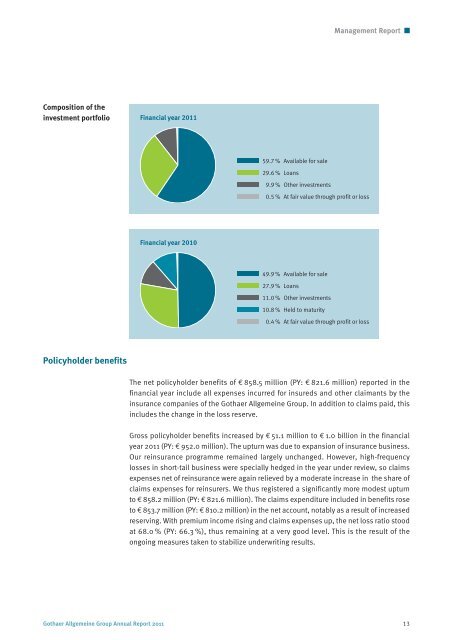

Composition of the<br />

investment portfolio<br />

Financial year 2011<br />

59.7 % Available <strong>for</strong> sale<br />

29.6 % Loans<br />

9.9 % Other investments<br />

0.5 % At fair value through profit or loss<br />

Financial year 2010<br />

49.9 % Available <strong>for</strong> sale<br />

27.9 % Loans<br />

11.0 % Other investments<br />

10.8 % Held to maturity<br />

0.4 % At fair value through profit or loss<br />

Policyholder benefits<br />

The net policyholder benefits of € 858.5 million (PY: € 821.6 million) reported in the<br />

financial year include all expenses incurred <strong>for</strong> insureds and other claimants by the<br />

insurance companies of the <strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong>. In addition to claims paid, this<br />

includes the change in the loss reserve.<br />

Gross policyholder benefits increased by € 51.1 million to € 1.0 billion in the financial<br />

year 2011 (PY: € 952.0 million). The upturn was due to expansion of insurance business.<br />

Our reinsurance programme remained largely unchanged. However, high-frequency<br />

losses in short-tail business were specially hedged in the year under review, so claims<br />

expenses net of reinsurance were again relieved by a moderate increase in the share of<br />

claims expenses <strong>for</strong> reinsurers. We thus registered a significantly more modest upturn<br />

to € 858.2 million (PY: € 821.6 million). The claims expenditure included in benefits rose<br />

to € 853.7 million (PY: € 810.2 million) in the net account, notably as a result of increased<br />

reserving. With premium income rising and claims expenses up, the net loss ratio stood<br />

at 68.0 % (PY: 66.3 %), thus remaining at a very good level. This is the result of the<br />

ongoing measures taken to stabilize underwriting results.<br />

<strong>Gothaer</strong> <strong>Allgemeine</strong> <strong>Group</strong> <strong>Annual</strong> <strong>Report</strong> 2011 13