Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

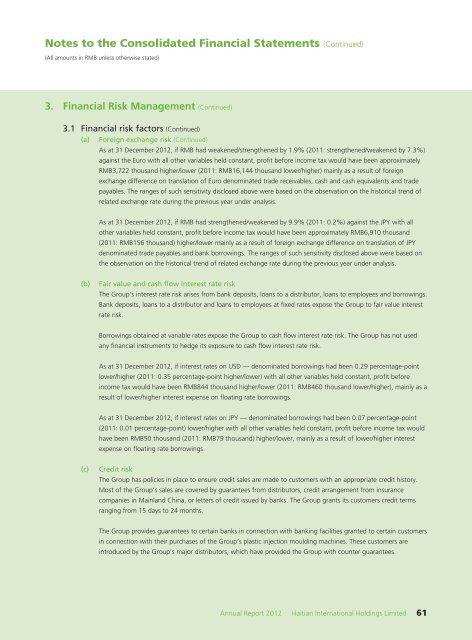

Notes to the Consolidated Financial Statements (Continued)<br />

(All amounts in RMB unless otherwise stated)<br />

3. Financial Risk Management (Continued)<br />

3.1 Financial risk factors (Continued)<br />

(a) Foreign exchange risk (Continued)<br />

As at 31 December <strong>2012</strong>, if RMB had weakened/strengthened by 1.9% (2011: strengthened/weakened by 7.3%)<br />

against the Euro with all other variables held constant, profit before income tax would have been approximately<br />

RMB3,722 thousand higher/lower (2011: RMB16,144 thousand lower/higher) mainly as a result of foreign<br />

exchange difference on translation of Euro denominated trade receivables, cash and cash equivalents and trade<br />

payables. The ranges of such sensitivity disclosed above were based on the observation on the historical trend of<br />

related exchange rate during the previous year under analysis.<br />

As at 31 December <strong>2012</strong>, if RMB had strengthened/weakened by 9.9% (2011: 0.2%) against the JPY with all<br />

other variables held constant, profit before income tax would have been approximately RMB6,910 thousand<br />

(2011: RMB156 thousand) higher/lower mainly as a result of foreign exchange difference on translation of JPY<br />

denominated trade payables and bank borrowings. The ranges of such sensitivity disclosed above were based on<br />

the observation on the historical trend of related exchange rate during the previous year under analysis.<br />

(b)<br />

Fair value and cash flow interest rate risk<br />

The Group’s interest rate risk arises from bank deposits, loans to a distributor, loans to employees and borrowings.<br />

Bank deposits, loans to a distributor and loans to employees at fixed rates expose the Group to fair value interest<br />

rate risk.<br />

Borrowings obtained at variable rates expose the Group to cash flow interest rate risk. The Group has not used<br />

any financial instruments to hedge its exposure to cash flow interest rate risk.<br />

As at 31 December <strong>2012</strong>, if interest rates on USD — denominated borrowings had been 0.29 percentage-point<br />

lower/higher (2011: 0.35 percentage-point higher/lower) with all other variables held constant, profit before<br />

income tax would have been RMB844 thousand higher/lower (2011: RMB460 thousand lower/higher), mainly as a<br />

result of lower/higher interest expense on floating rate borrowings.<br />

As at 31 December <strong>2012</strong>, if interest rates on JPY — denominated borrowings had been 0.07 percentage-point<br />

(2011: 0.01 percentage-point) lower/higher with all other variables held constant, profit before income tax would<br />

have been RMB50 thousand (2011: RMB79 thousand) higher/lower, mainly as a result of lower/higher interest<br />

expense on floating rate borrowings.<br />

(c)<br />

Credit risk<br />

The Group has policies in place to ensure credit sales are made to customers with an appropriate credit history.<br />

Most of the Group’s sales are covered by guarantees from distributors, credit arrangement from insurance<br />

companies in Mainland China, or letters of credit issued by banks. The Group grants its customers credit terms<br />

ranging from 15 days to 24 months.<br />

The Group provides guarantees to certain banks in connection with banking facilities granted to certain customers<br />

in connection with their purchases of the Group’s plastic injection moulding machines. These customers are<br />

introduced by the Group’s major distributors, which have provided the Group with counter guarantees.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> <strong>Haitian</strong> <strong>International</strong> <strong>Holdings</strong> Limited 61