Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

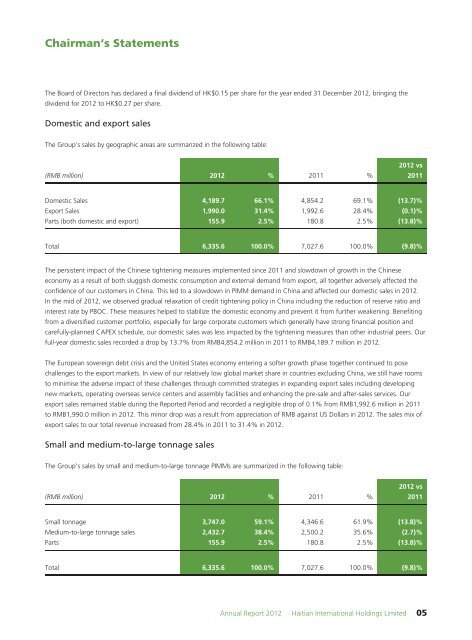

Chairman‘s Statements<br />

The Board of Directors has declared a final dividend of HK$0.15 per share for the year ended 31 December <strong>2012</strong>, bringing the<br />

dividend for <strong>2012</strong> to HK$0.27 per share.<br />

Domestic and export sales<br />

The Group’s sales by geographic areas are summarized in the following table:<br />

(RMB million) <strong>2012</strong> % 2011 %<br />

<strong>2012</strong> vs<br />

2011<br />

Domestic Sales 4,189.7 66.1% 4,854.2 69.1% (13.7)%<br />

Export Sales 1,990.0 31.4% 1,992.6 28.4% (0.1)%<br />

Parts (both domestic and export) 155.9 2.5% 180.8 2.5% (13.8)%<br />

Total 6,335.6 100.0% 7,027.6 100.0% (9.8)%<br />

The persistent impact of the Chinese tightening measures implemented since 2011 and slowdown of growth in the Chinese<br />

economy as a result of both sluggish domestic consumption and external demand from export, all together adversely affected the<br />

confidence of our customers in China. This led to a slowdown in PIMM demand in China and affected our domestic sales in <strong>2012</strong>.<br />

In the mid of <strong>2012</strong>, we observed gradual relaxation of credit tightening policy in China including the reduction of reserve ratio and<br />

interest rate by PBOC. These measures helped to stabilize the domestic economy and prevent it from further weakening. Benefiting<br />

from a diversified customer portfolio, especially for large corporate customers which generally have strong financial position and<br />

carefully-planned CAPEX schedule, our domestic sales was less impacted by the tightening measures than other industrial peers. Our<br />

full-year domestic sales recorded a drop by 13.7% from RMB4,854.2 million in 2011 to RMB4,189.7 million in <strong>2012</strong>.<br />

The European sovereign debt crisis and the United States economy entering a softer growth phase together continued to pose<br />

challenges to the export markets. In view of our relatively low global market share in countries excluding China, we still have rooms<br />

to minimise the adverse impact of these challenges through committed strategies in expanding export sales including developing<br />

new markets, operating overseas service centers and assembly facilities and enhancing the pre-sale and after-sales services. Our<br />

export sales remained stable during the <strong>Report</strong>ed Period and recorded a negligible drop of 0.1% from RMB1,992.6 million in 2011<br />

to RMB1,990.0 million in <strong>2012</strong>. This minor drop was a result from appreciation of RMB against US Dollars in <strong>2012</strong>. The sales mix of<br />

export sales to our total revenue increased from 28.4% in 2011 to 31.4% in <strong>2012</strong>.<br />

Small and medium-to-large tonnage sales<br />

The Group’s sales by small and medium-to-large tonnage PIMMs are summarized in the following table:<br />

(RMB million) <strong>2012</strong> % 2011 %<br />

<strong>2012</strong> vs<br />

2011<br />

Small tonnage 3,747.0 59.1% 4,346.6 61.9% (13.8)%<br />

Medium-to-large tonnage sales 2,432.7 38.4% 2,500.2 35.6% (2.7)%<br />

Parts 155.9 2.5% 180.8 2.5% (13.8)%<br />

Total 6,335.6 100.0% 7,027.6 100.0% (9.8)%<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> <strong>Haitian</strong> <strong>International</strong> <strong>Holdings</strong> Limited 05