Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

Annual Report 2012 - Haitian International Holdings Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

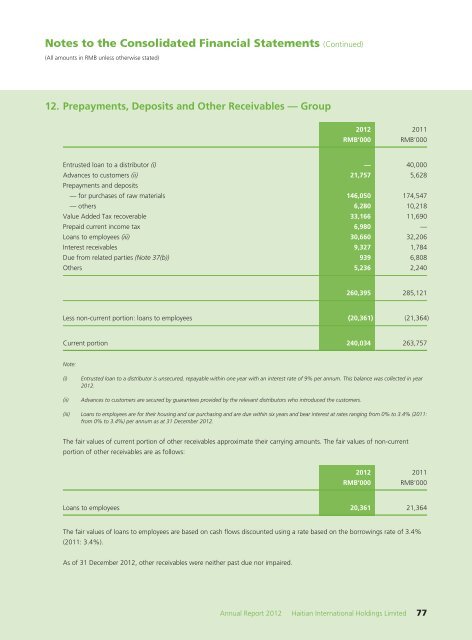

Notes to the Consolidated Financial Statements (Continued)<br />

(All amounts in RMB unless otherwise stated)<br />

12. Prepayments, Deposits and Other Receivables — Group<br />

<strong>2012</strong> 2011<br />

RMB’000<br />

RMB’000<br />

Entrusted loan to a distributor (i) — 40,000<br />

Advances to customers (ii) 21,757 5,628<br />

Prepayments and deposits<br />

— for purchases of raw materials 146,050 174,547<br />

— others 6,280 10,218<br />

Value Added Tax recoverable 33,166 11,690<br />

Prepaid current income tax 6,980 —<br />

Loans to employees (iii) 30,660 32,206<br />

Interest receivables 9,327 1,784<br />

Due from related parties (Note 37(b)) 939 6,808<br />

Others 5,236 2,240<br />

260,395 285,121<br />

Less non-current portion: loans to employees (20,361) (21,364)<br />

Current portion 240,034 263,757<br />

Note:<br />

(i)<br />

(ii)<br />

Entrusted loan to a distributor is unsecured, repayable within one year with an interest rate of 9% per annum. This balance was collected in year<br />

<strong>2012</strong>.<br />

Advances to customers are secured by guarantees provided by the relevant distributors who introduced the customers.<br />

(iii) Loans to employees are for their housing and car purchasing and are due within six years and bear interest at rates ranging from 0% to 3.4% (2011:<br />

from 0% to 3.4%) per annum as at 31 December <strong>2012</strong>.<br />

The fair values of current portion of other receivables approximate their carrying amounts. The fair values of non-current<br />

portion of other receivables are as follows:<br />

<strong>2012</strong> 2011<br />

RMB’000 RMB’000<br />

Loans to employees 20,361 21,364<br />

The fair values of loans to employees are based on cash flows discounted using a rate based on the borrowings rate of 3.4%<br />

(2011: 3.4%).<br />

As of 31 December <strong>2012</strong>, other receivables were neither past due nor impaired.<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> <strong>Haitian</strong> <strong>International</strong> <strong>Holdings</strong> Limited 77