Corporate Plan 2009-2012: Part B.pdf (2.99MB) - Hastings Council

Corporate Plan 2009-2012: Part B.pdf (2.99MB) - Hastings Council

Corporate Plan 2009-2012: Part B.pdf (2.99MB) - Hastings Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

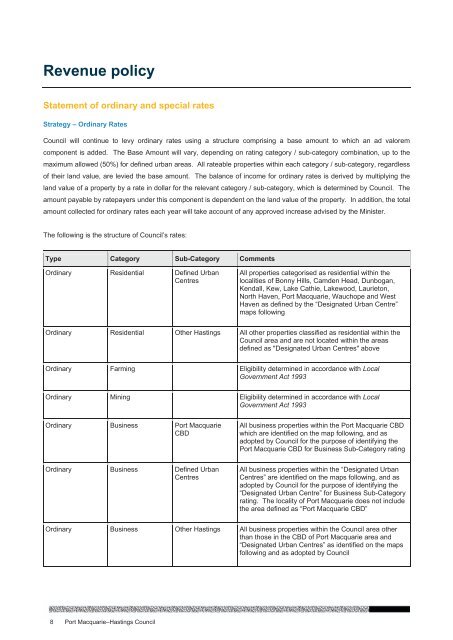

Revenue policy<br />

Statement of ordinary and special rates<br />

Strategy – Ordinary Rates<br />

<strong>Council</strong> will continue to levy ordinary rates using a structure comprising a base amount to which an ad valorem<br />

component is added. The Base Amount will vary, depending on rating category / sub-category combination, up to the<br />

maximum allowed (50%) for defined urban areas. All rateable properties within each category / sub-category, regardless<br />

of their land value, are levied the base amount. The balance of income for ordinary rates is derived by multiplying the<br />

land value of a property by a rate in dollar for the relevant category / sub-category, which is determined by <strong>Council</strong>. The<br />

amount payable by ratepayers under this component is dependent on the land value of the property. In addition, the total<br />

amount collected for ordinary rates each year will take account of any approved increase advised by the Minister.<br />

The following is the structure of <strong>Council</strong>’s rates:<br />

Type Category Sub-Category Comments<br />

Ordinary Residential Defined Urban<br />

Centres<br />

All properties categorised as residential within the<br />

localities of Bonny Hills, Camden Head, Dunbogan,<br />

Kendall, Kew, Lake Cathie, Lakewood, Laurieton,<br />

North Haven, Port Macquarie, Wauchope and West<br />

Haven as defined by the “Designated Urban Centre”<br />

maps following<br />

Ordinary Residential Other <strong>Hastings</strong> All other properties classified as residential within the<br />

<strong>Council</strong> area and are not located within the areas<br />

defined as "Designated Urban Centres" above<br />

Ordinary Farming Eligibility determined in accordance with Local<br />

Government Act 1993<br />

Ordinary Mining Eligibility determined in accordance with Local<br />

Government Act 1993<br />

Ordinary Business Port Macquarie<br />

CBD<br />

All business properties within the Port Macquarie CBD<br />

which are identified on the map following, and as<br />

adopted by <strong>Council</strong> for the purpose of identifying the<br />

Port Macquarie CBD for Business Sub-Category rating<br />

Ordinary Business Defined Urban<br />

Centres<br />

All business properties within the “Designated Urban<br />

Centres” are identified on the maps following, and as<br />

adopted by <strong>Council</strong> for the purpose of identifying the<br />

“Designated Urban Centre” for Business Sub-Category<br />

rating. The locality of Port Macquarie does not include<br />

the area defined as “Port Macquarie CBD”<br />

Ordinary Business Other <strong>Hastings</strong> All business properties within the <strong>Council</strong> area other<br />

than those in the CBD of Port Macquarie area and<br />

“Designated Urban Centres” as identified on the maps<br />

following and as adopted by <strong>Council</strong><br />

8 Port Macquarie–<strong>Hastings</strong> <strong>Council</strong>