Annual Report 2011-2012 - HCL Infosystems

Annual Report 2011-2012 - HCL Infosystems

Annual Report 2011-2012 - HCL Infosystems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT <strong>2011</strong>-12<br />

Personnel Costs<br />

Personnel costs increased marginally from ` 487 crores in FY <strong>2011</strong> to ` 489 crores in FY <strong>2012</strong>.<br />

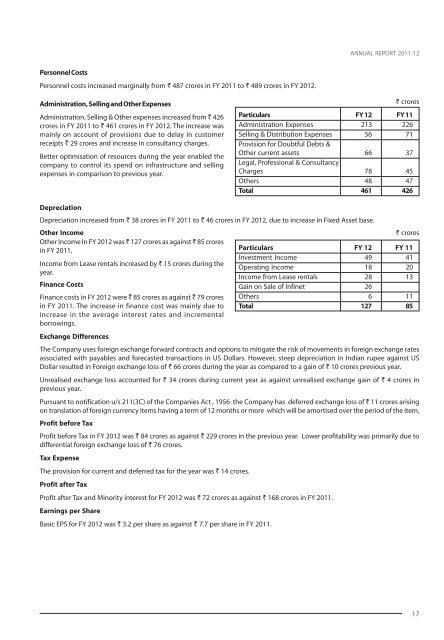

Administration, Selling and Other Expenses<br />

Administration, Selling & Other expenses increased from ` 426<br />

crores in FY <strong>2011</strong> to ` 461 crores in FY <strong>2012</strong>. The increase was<br />

mainly on account of provisions due to delay in customer<br />

receipts ` 29 crores and increase in consultancy charges.<br />

Better optimisation of resources during the year enabled the<br />

company to control its spend on infrastructure and selling<br />

expenses in comparison to previous year.<br />

` crores<br />

Particulars FY 12 FY 11<br />

Administration Expenses 213 226<br />

Selling & Distribution Expenses 56 71<br />

Provision for Doubtful Debts &<br />

Other current assets 66 37<br />

Legal, Professional & Consultancy<br />

Charges 78 45<br />

Others 48 47<br />

Total 461 426<br />

Depreciation<br />

Depreciation increased from ` 38 crores in FY <strong>2011</strong> to ` 46 crores in FY <strong>2012</strong>, due to increase in Fixed Asset base.<br />

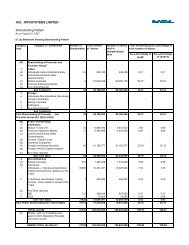

Other Income<br />

Other Income In FY <strong>2012</strong> was ` 127 crores as against ` 85 crores<br />

in FY <strong>2011</strong>.<br />

Income from Lease rentals increased by ` 15 crores during the<br />

year.<br />

Finance Costs<br />

Finance costs in FY <strong>2012</strong> were ` 85 crores as against ` 79 crores<br />

in FY <strong>2011</strong>. The increase in finance cost was mainly due to<br />

increase in the average interest rates and incremental<br />

borrowings.<br />

Exchange Differences<br />

` crores<br />

Particulars FY 12 FY 11<br />

Investment Income 49 41<br />

Operating Income 18 20<br />

Income from Lease rentals 28 13<br />

Gain on Sale of Infinet 26<br />

Others 6 11<br />

Total 127 85<br />

The Company uses foreign exchange forward contracts and options to mitigate the risk of movements in foreign exchange rates<br />

associated with payables and forecasted transactions in US Dollars. However, steep depreciation in Indian rupee against US<br />

Dollar resulted in Foreign exchange loss of ` 66 crores during the year as compared to a gain of ` 10 crores previous year.<br />

Unrealised exchange loss accounted for ` 34 crores during current year as against unrealised exchange gain of ` 4 crores in<br />

previous year.<br />

Pursuant to notification u/s 211(3C) of the Companies Act , 1956 the Company has deferred exchange loss of ` 11 crores arising<br />

on translation of foreign currency items having a term of 12 months or more which will be amortised over the period of the item.<br />

Profit before Tax<br />

Profit before Tax in FY <strong>2012</strong> was ` 84 crores as against ` 229 crores in the previous year. Lower profitability was primarily due to<br />

differential foreign exchange loss of ` 76 crores.<br />

Tax Expense<br />

The provision for current and deferred tax for the year was ` 14 crores.<br />

Profit after Tax<br />

Profit after Tax and Minority interest for FY <strong>2012</strong> was ` 72 crores as against ` 168 crores in FY <strong>2011</strong>.<br />

Earnings per Share<br />

Basic EPS for FY <strong>2012</strong> was ` 3.2 per share as against ` 7.7 per share in FY <strong>2011</strong>.<br />

17