Focus on Germany - Investor Relations - HypoVereinsbank

Focus on Germany - Investor Relations - HypoVereinsbank

Focus on Germany - Investor Relations - HypoVereinsbank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

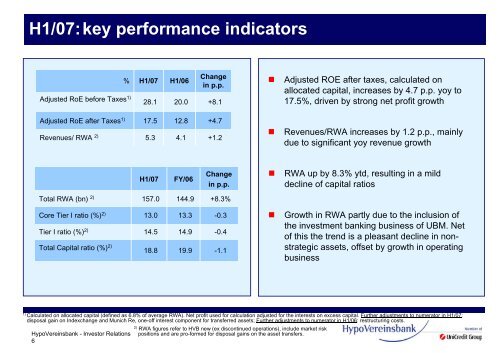

H1/07:key performance indicators<br />

Adjusted RoE before Taxes 1)<br />

Adjusted RoE after Taxes 1)<br />

Revenues/ RWA 2)<br />

Total RWA (bn) 2)<br />

Core Tier I ratio (%) 2)<br />

Tier I ratio (%) 2)<br />

Total Capital ratio (%) 2)<br />

%<br />

<strong>HypoVereinsbank</strong> - <strong>Investor</strong> Relati<strong>on</strong>s<br />

6<br />

H1/07<br />

28.1<br />

17.5<br />

5.3<br />

H1/07<br />

157.0<br />

13.0<br />

14.5<br />

18.8<br />

H1/06<br />

20.0<br />

12.8<br />

4.1<br />

FY/06<br />

144.9<br />

13.3<br />

14.9<br />

19.9<br />

Change<br />

in p.p.<br />

+8.1<br />

+4.7<br />

+1.2<br />

Change<br />

in p.p.<br />

+8.3%<br />

-0.3<br />

-0.4<br />

-1.1<br />

� Revenues/RWA increases by 1.2 p.p., mainly<br />

due to significant yoy revenue growth<br />

1) Calculated <strong>on</strong> allocated capital (defined as 6.8% of average RWA). Net profit used for calculati<strong>on</strong> adjusted for the interests <strong>on</strong> excess capital. Further adjustments to numerator in H1/07:<br />

disposal gain <strong>on</strong> Indexchange and Munich Re, <strong>on</strong>e-off interest comp<strong>on</strong>ent for transferred assets; Further adjustments to numerator in H1/06: restructuring costs.<br />

2) RWA figures refer to HVB new (ex disc<strong>on</strong>tinued operati<strong>on</strong>s), include market risk<br />

positi<strong>on</strong>s and are pro-formed for disposal gains <strong>on</strong> the asset transfers.<br />

� Adjusted ROE after taxes, calculated <strong>on</strong><br />

allocated capital, increases by 4.7 p.p. yoy to<br />

17.5%, driven by str<strong>on</strong>g net profit growth<br />

� RWA up by 8.3% ytd, resulting in a mild<br />

decline of capital ratios<br />

� Growth in RWA partly due to the inclusi<strong>on</strong> of<br />

the investment banking business of UBM. Net<br />

of this the trend is a pleasant decline in n<strong>on</strong>strategic<br />

assets, offset by growth in operating<br />

business