Slides - IEA

Slides - IEA

Slides - IEA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

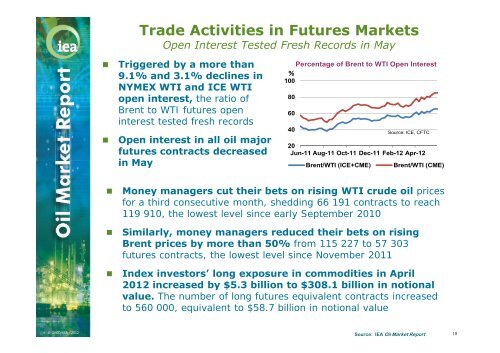

Trade Activities in Futures Markets<br />

Open Interest Tested Fresh Records in May<br />

• Triggered by a more than<br />

9.1% and 3.1% declines in<br />

NYMEX WTI and ICE WTI<br />

open interest, the ratio of<br />

Brent to WTI futures open<br />

interest tested fresh records<br />

• Open interest in all oil major<br />

futures contracts decreased<br />

in May<br />

Percentage of Brent to WTI Open Interest<br />

%<br />

100<br />

80<br />

60<br />

40<br />

Source: ICE, CFTC<br />

20<br />

Jun-11 Aug-11 Oct-11 Dec-11 Feb-12 Apr-12<br />

Brent/WTI (ICE+CME) Brent/WTI (CME)<br />

• Money managers cut their bets on rising WTI crude oil prices<br />

for a third consecutive month, shedding 66 191 contracts to reach<br />

119 910, the lowest level since early September 2010<br />

• Similarly, money managers reduced their bets on rising<br />

Brent prices by more than 50% from 115 227 to 57 303<br />

futures contracts, the lowest level since November 2011<br />

• Index investors’ long exposure in commodities in April<br />

2012 increased by $5.3 billion to $308.1 billion in notional<br />

value. The number of long futures equivalent contracts increased<br />

to 560 000, equivalent to $58.7 billion in notional value<br />

© OECD/<strong>IEA</strong> - 2012<br />

Source: <strong>IEA</strong> Oil Market Report<br />

18