Annual Report 2012-13 - India Infoline Finance Limited

Annual Report 2012-13 - India Infoline Finance Limited

Annual Report 2012-13 - India Infoline Finance Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

This is what we<br />

achieved in <strong>2012</strong>-<strong>13</strong><br />

Performance<br />

Performance<br />

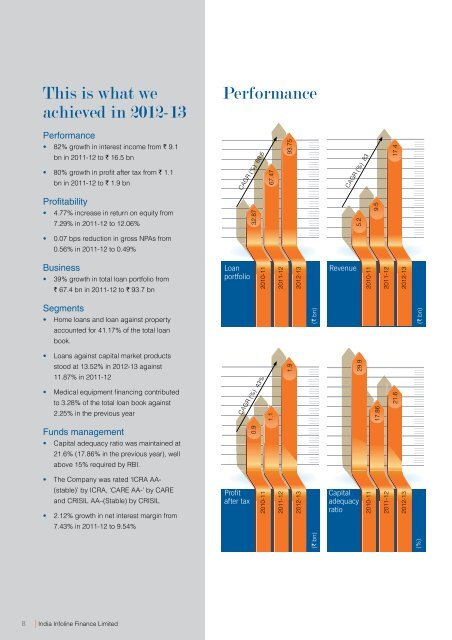

82% growth in interest income from ` 9.1<br />

bn in 2011-12 to ` 16.5 bn<br />

` 1.1<br />

bn in 2011-12 to ` 1.9 bn<br />

CAGR (%) 68.5<br />

67.47<br />

93.75<br />

CAGR (%) 83<br />

17.4<br />

<br />

4.77% increase in return on equity from<br />

7.29% in 2011-12 to 12.06%<br />

32.87<br />

5.2<br />

9.5<br />

<br />

0.07 bps reduction in gross NPAs from<br />

0.56% in 2011-12 to 0.49%<br />

Business<br />

39% growth in total loan portfolio from<br />

` 67.4 bn in 2011-12 to ` 93.7 bn<br />

Loan<br />

portfolio<br />

2010-11<br />

2011-12<br />

<strong>2012</strong>-<strong>13</strong><br />

Revenue<br />

2010-11<br />

2011-12<br />

<strong>2012</strong>-<strong>13</strong><br />

Segments<br />

Home loans and loan against property<br />

accounted for 41.17% of the total loan<br />

book.<br />

(` bn)<br />

(` bn)<br />

CAGR (%) 43%<br />

Profit<br />

after tax<br />

(` bn)<br />

<br />

Loans against capital market products<br />

<br />

stood at <strong>13</strong>.52% in <strong>2012</strong>-<strong>13</strong> against<br />

11.87% in 2011-12<br />

<br />

to 3.28% of the total loan book against<br />

2.25% in the previous year<br />

1.1<br />

1.9<br />

29.9<br />

17.86<br />

21.6<br />

Funds management<br />

Capital adequacy ratio was maintained at<br />

21.6% (17.86% in the previous year), well<br />

above 15% required by RBI.<br />

0.9<br />

<br />

2010-11<br />

2011-12<br />

<strong>2012</strong>-<strong>13</strong><br />

Capital<br />

adequacy<br />

ratio<br />

(%)<br />

The Company was rated ‘ICRA AA-<br />

<br />

(stable)’ by ICRA, ‘CARE AA-’ by CARE<br />

and CRISIL AA–(Stable) by CRISIL<br />

2.12% growth in net interest margin from<br />

2010-11<br />

2011-12<br />

<strong>2012</strong>-<strong>13</strong><br />

7.43% in 2011-12 to 9.54%<br />

8<br />

| <strong>India</strong> <strong>Infoline</strong> <strong>Finance</strong> <strong>Limited</strong>