Annual Report 2012-13 - India Infoline Finance Limited

Annual Report 2012-13 - India Infoline Finance Limited

Annual Report 2012-13 - India Infoline Finance Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

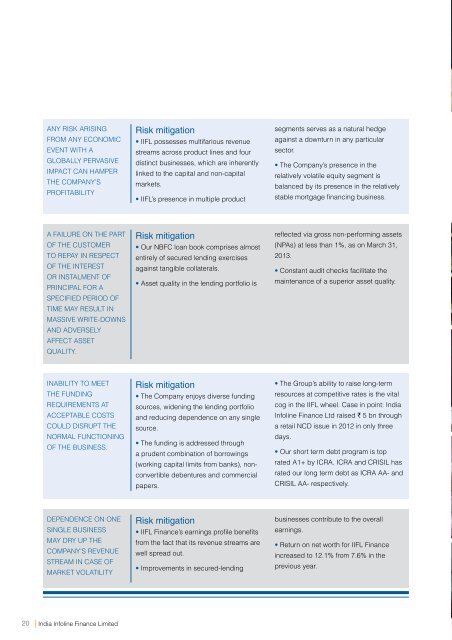

ANY RISK ARISING<br />

FROM ANY ECONOMIC<br />

EVENT WITH A<br />

GLOBALLY PERVASIVE<br />

IMPACT CAN HAMPER<br />

THE COMPANY’S<br />

PROFITABILITY<br />

Risk mitigation<br />

IIFL possesses multifarious revenue<br />

streams across product lines and four<br />

distinct businesses, which are inherently<br />

linked to the capital and non-capital<br />

markets.<br />

IIFL’s presence in multiple product<br />

segments serves as a natural hedge<br />

against a downturn in any particular<br />

sector.<br />

The Company’s presence in the<br />

relatively volatile equity segment is<br />

balanced by its presence in the relatively<br />

<br />

A FAILURE ON THE PART<br />

OF THE CUSTOMER<br />

TO REPAY IN RESPECT<br />

OF THE INTEREST<br />

OR INSTALMENT OF<br />

PRINCIPAL FOR A<br />

SPECIFIED PERIOD OF<br />

TIME MAY RESULT IN<br />

MASSIVE WRITE-DOWNS<br />

AND ADVERSELY<br />

AFFECT ASSET<br />

QUALITY.<br />

Risk mitigation<br />

Our NBFC loan book comprises almost<br />

entirely of secured lending exercises<br />

against tangible collaterals.<br />

Asset quality in the lending portfolio is<br />

<br />

(NPAs) at less than 1%, as on March 31,<br />

20<strong>13</strong>.<br />

Constant audit checks facilitate the<br />

maintenance of a superior asset quality.<br />

INABILITY TO MEET<br />

THE FUNDING<br />

REQUIREMENTS AT<br />

ACCEPTABLE COSTS<br />

COULD DISRUPT THE<br />

NORMAL FUNCTIONING<br />

OF THE BUSINESS.<br />

Risk mitigation<br />

The Company enjoys diverse funding<br />

sources, widening the lending portfolio<br />

and reducing dependence on any single<br />

source.<br />

The funding is addressed through<br />

a prudent combination of borrowings<br />

(working capital limits from banks), nonconvertible<br />

debentures and commercial<br />

papers.<br />

The Group’s ability to raise long-term<br />

resources at competitive rates is the vital<br />

cog in the IIFL wheel. Case in point: <strong>India</strong><br />

<strong>Infoline</strong> <strong>Finance</strong> Ltd raised ` 5 bn through<br />

a retail NCD issue in <strong>2012</strong> in only three<br />

days.<br />

Our short term debt program is top<br />

rated A1+ by ICRA. ICRA and CRISIL has<br />

rated our long term debt as ICRA AA- and<br />

CRISIL AA- respectively.<br />

DEPENDENCE ON ONE<br />

SINGLE BUSINESS<br />

MAY DRY UP THE<br />

COMPANY’S REVENUE<br />

STREAM IN CASE OF<br />

MARKET VOLATILITY<br />

Risk mitigation<br />

<br />

from the fact that its revenue streams are<br />

well spread out.<br />

Improvements in secured-lending<br />

businesses contribute to the overall<br />

earnings.<br />

Return on net worth for IIFL <strong>Finance</strong><br />

increased to 12.1% from 7.6% in the<br />

previous year.<br />

20<br />

| <strong>India</strong> <strong>Infoline</strong> <strong>Finance</strong> <strong>Limited</strong>