Sustainable Development Impacts of Investment Incentives: A Case ...

Sustainable Development Impacts of Investment Incentives: A Case ...

Sustainable Development Impacts of Investment Incentives: A Case ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

trade knowledge network<br />

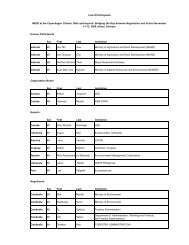

Annex 1: List <strong>of</strong> regulations on investment incentives<br />

No. Regulation Concerning Contents<br />

1. Act No. 1/1967 Foreign <strong>Investment</strong> <strong>Incentives</strong><br />

Exemption and tax reduction on corporate pr<strong>of</strong>its for a period not longer than five years<br />

Tax on dividends out <strong>of</strong> company pr<strong>of</strong>its paid to shareholders for pr<strong>of</strong>its accrued within a<br />

period not exceeding five years<br />

Lower corporate tax on pr<strong>of</strong>its that are re-invested in Indonesia<br />

Import duty at the time <strong>of</strong> importing fixed equipment such as machinery, tools, and work<br />

utensils required in facilitating company operations<br />

Excise tax on FDI<br />

FDI negative list<br />

Areas that are <strong>of</strong> strategic importance to the state/nation, and affect the well being <strong>of</strong> the<br />

public :<br />

• Harbours<br />

• Generation, transmission, and distribution <strong>of</strong> electricity for the public<br />

• Telecommunication<br />

• Water transportation<br />

• Air transportation<br />

• Drinking water services<br />

• Public railway transportation<br />

• Nuclear energy generation<br />

• Mass media<br />

• Areas that are <strong>of</strong> strategic importance to national defence:<br />

• Production <strong>of</strong> arms and ammunition<br />

• Dynamite<br />

• Explosives<br />

• War weaponry<br />

2. Act No. 11/1970 Amendment and addition (1) Tax <strong>Incentives</strong> given to FDI companies:<br />

made to Act No. 1/1967 • Excise tax on capital /investment<br />

on FDI • Excise tax and tax on sales<br />

• Excise on changing ownership<br />

• Corporate tax<br />

• Tax on dividends<br />

(2). For new legal entities undertaking investment in government priority areas/sectors or<br />

production in areas declared by government to be <strong>of</strong> priority, the Ministry <strong>of</strong> Finance is<br />

authorized to exempt the company from tax commitments for a period <strong>of</strong> two years <strong>of</strong><br />

the commencement <strong>of</strong> company operations (can be extended).<br />

(3). Besides tax incentives, the government can issue regulations for additional incentives to<br />

FDI companies that are deemed pivotal for the country’s economic development.<br />

3. Ministry <strong>of</strong> Exemption/reduction <strong>of</strong> Exempted or reduced import duty and sales tax on imports made by an FDI or domestic<br />

Finance Decree import duty and tax on investment company with an operational permit for:<br />

No. Kep-289/MK/ imports • Company machinery and equipment<br />

IV/4/1971 • Spare parts<br />

• Raw materials and supporting materials<br />

• Transportation equipment, tools and construction materials<br />

Exemption is applicable if:<br />

• The goods/materials are not produced in the country<br />

• The goods/materials have been included in capital expenditure plan<br />

• The cost <strong>of</strong> importing the goods is not drawn from country’s foreign currency.<br />

4. Presidential Restricting/limiting the Restricts the use <strong>of</strong> foreign manpower in FDI and domestic direct investment.<br />

Decree use <strong>of</strong> foreign manpower The company employing foreign manpower is obliged to conduct training and education<br />

No. 23/1974<br />

programs for Indonesian employees who are supposed to replace the expatriates.<br />

5. Act No. 7/1983 Income tax Retracts exemption <strong>of</strong> excise tax on company fixed goods such as machinery, worker<br />

equipment, and tools /aircraft to facilitate company operations.<br />

Restores imposition <strong>of</strong> excise tax on FDI.<br />

Retracts tax incentives and other levies that are applicable.<br />

6. Government Requirements for owning A company that is established within the framework <strong>of</strong> a FDI is, in principle, a joint venture<br />

Regulation shares in FDI companies in which the Indonesian partners must hold not less than 20 per cent <strong>of</strong> the total value <strong>of</strong><br />

No. 17/1992<br />

the company at the time <strong>of</strong> establishment, and can be raised to become 51 per cent in a<br />

period <strong>of</strong> 20 years from when the company commenced its production on a commercial<br />

basis (as noted in its operational permit/license).<br />

<strong>Sustainable</strong> <strong>Development</strong> <strong>Impacts</strong> <strong>of</strong> <strong>Investment</strong> <strong>Incentives</strong>: A <strong>Case</strong> Study <strong>of</strong> the Chemical Industry in Indonesia<br />

29