Sustainable Development Impacts of Investment Incentives: A Case ...

Sustainable Development Impacts of Investment Incentives: A Case ...

Sustainable Development Impacts of Investment Incentives: A Case ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

trade knowledge network<br />

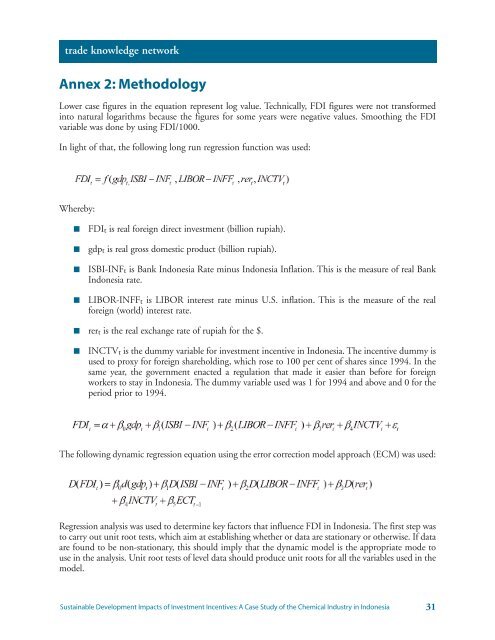

Annex 2: Methodology<br />

Lower case figures in the equation represent log value. Technically, FDI figures were not transformed<br />

into natural logarithms because the figures for some years were negative values. Smoothing the FDI<br />

variable was done by using FDI/1000.<br />

In light <strong>of</strong> that, the following long run regression function was used:<br />

Whereby:<br />

■<br />

■<br />

■<br />

■<br />

FDIt is real foreign direct investment (billion rupiah).<br />

gdpt is real gross domestic product (billion rupiah).<br />

ISBI-INFt is Bank Indonesia Rate minus Indonesia Inflation. This is the measure <strong>of</strong> real Bank<br />

Indonesia rate.<br />

LIBOR-INFFt is LIBOR interest rate minus U.S. inflation. This is the measure <strong>of</strong> the real<br />

foreign (world) interest rate.<br />

■ rert is the real exchange rate <strong>of</strong> rupiah for the $.<br />

■<br />

INCTVt is the dummy variable for investment incentive in Indonesia. The incentive dummy is<br />

used to proxy for foreign shareholding, which rose to 100 per cent <strong>of</strong> shares since 1994. In the<br />

same year, the government enacted a regulation that made it easier than before for foreign<br />

workers to stay in Indonesia. The dummy variable used was 1 for 1994 and above and 0 for the<br />

period prior to 1994.<br />

The following dynamic regression equation using the error correction model approach (ECM) was used:<br />

Regression analysis was used to determine key factors that influence FDI in Indonesia. The first step was<br />

to carry out unit root tests, which aim at establishing whether or data are stationary or otherwise. If data<br />

are found to be non-stationary, this should imply that the dynamic model is the appropriate mode to<br />

use in the analysis. Unit root tests <strong>of</strong> level data should produce unit roots for all the variables used in the<br />

model.<br />

<strong>Sustainable</strong> <strong>Development</strong> <strong>Impacts</strong> <strong>of</strong> <strong>Investment</strong> <strong>Incentives</strong>: A <strong>Case</strong> Study <strong>of</strong> the Chemical Industry in Indonesia<br />

31