Annual Report 2012 - HKExnews

Annual Report 2012 - HKExnews

Annual Report 2012 - HKExnews

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements (Continued)<br />

3 Financial Risk Management (Continued)<br />

3.1 Financial risk factors (Continued)<br />

(c)<br />

Liquidity risk<br />

The Group’s policy is to regularly monitor current and expected liquidity requirements and its compliance with<br />

debt covenants, to ensure that it maintains sufficient reserves of cash and adequate committed lines of funding<br />

from banks and other financial institutions to meet its liquidity requirements in the short and longer term.<br />

Management believes there is no liquidity risk as the Group has sufficient committed facilities to fund its<br />

operations.<br />

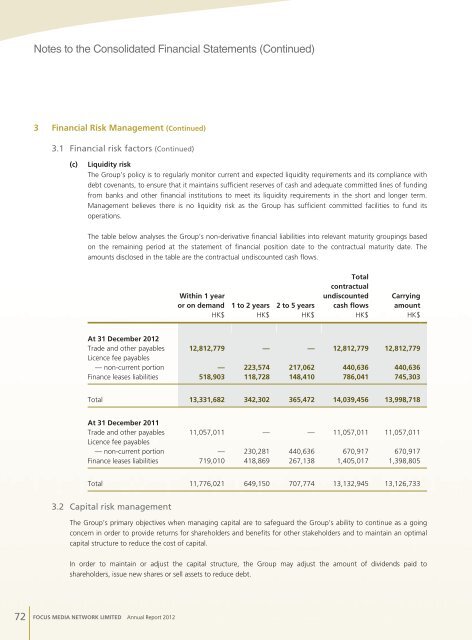

The table below analyses the Group’s non-derivative financial liabilities into relevant maturity groupings based<br />

on the remaining period at the statement of financial position date to the contractual maturity date. The<br />

amounts disclosed in the table are the contractual undiscounted cash flows.<br />

Within 1 year<br />

or on demand 1 to 2 years 2 to 5 years<br />

Total<br />

contractual<br />

undiscounted<br />

cash flows<br />

Carrying<br />

amount<br />

HK$ HK$ HK$ HK$ HK$<br />

At 31 December <strong>2012</strong><br />

Trade and other payables 12,812,779 — — 12,812,779 12,812,779<br />

Licence fee payables<br />

— non-current portion — 223,574 217,062 440,636 440,636<br />

Finance leases liabilities 518,903 118,728 148,410 786,041 745,303<br />

Total 13,331,682 342,302 365,472 14,039,456 13,998,718<br />

At 31 December 2011<br />

Trade and other payables 11,057,011 — — 11,057,011 11,057,011<br />

Licence fee payables<br />

— non-current portion — 230,281 440,636 670,917 670,917<br />

Finance leases liabilities 719,010 418,869 267,138 1,405,017 1,398,805<br />

Total 11,776,021 649,150 707,774 13,132,945 13,126,733<br />

3.2 Capital risk management<br />

The Group’s primary objectives when managing capital are to safeguard the Group’s ability to continue as a going<br />

concern in order to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal<br />

capital structure to reduce the cost of capital.<br />

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to<br />

shareholders, issue new shares or sell assets to reduce debt.<br />

72<br />

FOCUS MEDIA NETWORK LIMITED <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>