Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

81<br />

Financial <strong>statements</strong><br />

Notes to the consolidated <strong>financial</strong> <strong>statements</strong><br />

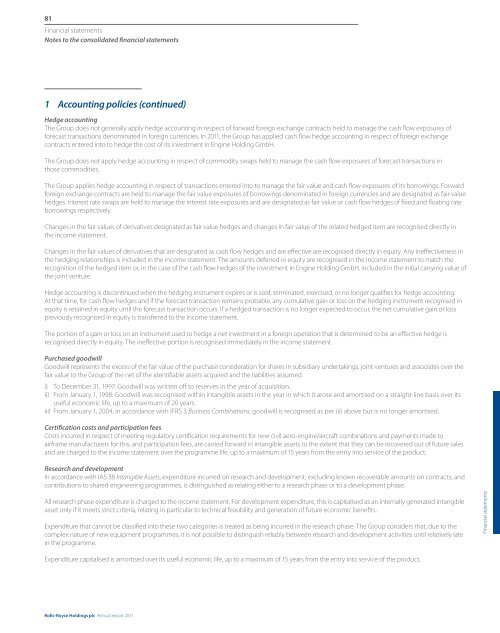

1 Accounting policies (continued)<br />

Hedge accounting<br />

The Group does not generally apply hedge accounting in respect of forward foreign exchange contracts held to manage the cash flow exposures of<br />

forecast transactions denominated in foreign currencies. In 2011, the Group has applied cash flow hedge accounting in respect of foreign exchange<br />

contracts entered into to hedge the cost of its investment in Engine Holding GmbH.<br />

The Group does not apply hedge accounting in respect of commodity swaps held to manage the cash flow exposures of forecast transactions in<br />

those commodities.<br />

The Group applies hedge accounting in respect of transactions entered into to manage the fair value and cash flow exposures of its borrowings. Forward<br />

foreign exchange contracts are held to manage the fair value exposures of borrowings denominated in foreign currencies and are designated as fair value<br />

hedges. Interest rate swaps are held to manage the interest rate exposures and are designated as fair value or cash flow hedges of fixed and floating rate<br />

borrowings respectively.<br />

Changes in the fair values of derivatives designated as fair value hedges and changes in fair value of the related hedged item are recognised directly in<br />

the income statement.<br />

Changes in the fair values of derivatives that are designated as cash flow hedges and are effective are recognised directly in equity. Any ineffectiveness in<br />

the hedging relationships is included in the income statement. The amounts deferred in equity are recognised in the income statement to match the<br />

recognition of the hedged item or, in the case of the cash flow hedges of the investment in Engine Holding GmbH, included in the initial carrying value of<br />

the joint venture.<br />

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, exercised, or no longer qualifies for hedge accounting.<br />

At that time, for cash flow hedges and if the forecast transaction remains probable, any cumulative gain or loss on the hedging instrument recognised in<br />

equity is retained in equity until the forecast transaction occurs. If a hedged transaction is no longer expected to occur, the net cumulative gain or loss<br />

previously recognised in equity is transferred to the income statement.<br />

The portion of a gain or loss on an instrument used to hedge a net investment in a foreign operation that is determined to be an effective hedge is<br />

recognised directly in equity. The ineffective portion is recognised immediately in the income statement.<br />

Purchased goodwill<br />

Goodwill represents the excess of the fair value of the purchase consideration for shares in subsidiary undertakings, joint ventures and associates over the<br />

fair value to the Group of the net of the identifiable assets acquired and the liabilities assumed.<br />

i) To December 31, 1997: Goodwill was written off to reserves in the year of acquisition.<br />

ii) From January 1, 1998: Goodwill was recognised within intangible assets in the year in which it arose and amortised on a straight-line basis over its<br />

useful economic life, up to a maximum of 20 years.<br />

iii) From January 1, 2004, in accordance with IFRS 3 Business Combinations, goodwill is recognised as per (ii) above but is no longer amortised.<br />

Certification costs and participation fees<br />

Costs incurred in respect of meeting regulatory certification requirements for new civil aero-engine/aircraft combinations and payments made to<br />

airframe manufacturers for this, and participation fees, are carried forward in intangible assets to the extent that they can be recovered out of future sales<br />

and are charged to the income statement over the programme life, up to a maximum of 15 years from the entry into service of the product.<br />

Research and development<br />

In accordance with IAS 38 Intangible Assets, expenditure incurred on research and development, excluding known recoverable amounts on contracts, and<br />

contributions to shared engineering programmes, is distinguished as relating either to a research phase or to a development phase.<br />

All research phase expenditure is charged to the income statement. For development expenditure, this is capitalised as an internally generated intangible<br />

asset only if it meets strict criteria, relating in particular to technical feasibility and generation of future economic benefits.<br />

Expenditure that cannot be classified into these two categories is treated as being incurred in the research phase. The Group considers that, due to the<br />

complex nature of new equipment programmes, it is not possible to distinguish reliably between research and development activities until relatively late<br />

in the programme.<br />

Financial <strong>statements</strong><br />

Expenditure capitalised is amortised over its useful economic life, up to a maximum of 15 years from the entry into service of the product.<br />

<strong>Rolls</strong>-<strong>Royce</strong> Holdings plc Annual report 2011