Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

85<br />

Financial <strong>statements</strong><br />

Notes to the consolidated <strong>financial</strong> <strong>statements</strong><br />

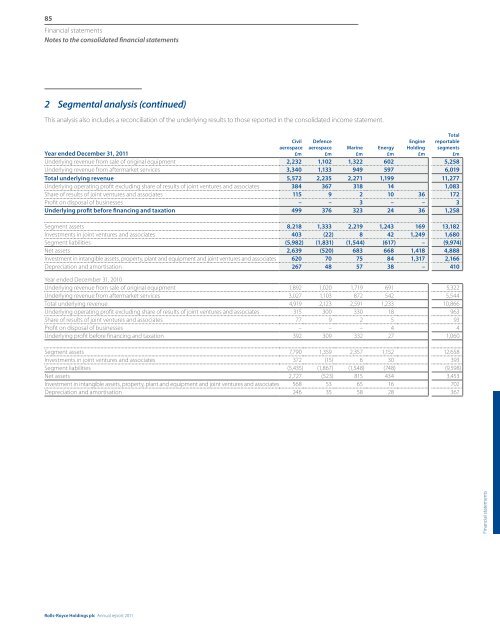

2 Segmental analysis (continued)<br />

This analysis also includes a reconciliation of the underlying results to those reported in the consolidated income statement.<br />

Civil<br />

aerospace<br />

£m<br />

Defence<br />

aerospace<br />

£m<br />

Marine<br />

£m<br />

Energy<br />

£m<br />

Engine<br />

Holding<br />

£m<br />

Total<br />

reportable<br />

segments<br />

£m<br />

Year ended December 31, 2011<br />

Underlying revenue from sale of original equipment 2,232 1,102 1,322 602 5,258<br />

Underlying revenue from aftermarket services 3,340 1,133 949 597 6,019<br />

Total underlying revenue 5,572 2,235 2,271 1,199 11,277<br />

Underlying operating profit excluding share of results of joint ventures and associates 384 367 318 14 1,083<br />

Share of results of joint ventures and associates 115 9 2 10 36 172<br />

Profit on disposal of businesses – – 3 – – 3<br />

Underlying profit before financing and taxation 499 376 323 24 36 1,258<br />

Segment assets 8,218 1,333 2,219 1,243 169 13,182<br />

Investments in joint ventures and associates 403 (22) 8 42 1,249 1,680<br />

Segment liabilities (5,982) (1,831) (1,544) (617) – (9,974)<br />

Net assets 2,639 (520) 683 668 1,418 4,888<br />

Investment in intangible assets, property, plant and equipment and joint ventures and associates 620 70 75 84 1,317 2,166<br />

Depreciation and amortisation 267 48 57 38 – 410<br />

Year ended December 31, 2010<br />

Underlying revenue from sale of original equipment 1,892 1,020 1,719 691 5,322<br />

Underlying revenue from aftermarket services 3,027 1,103 872 542 5,544<br />

Total underlying revenue 4,919 2,123 2,591 1,233 10,866<br />

Underlying operating profit excluding share of results of joint ventures and associates 315 300 330 18 963<br />

Share of results of joint ventures and associates 77 9 2 5 93<br />

Profit on disposal of businesses – – – 4 4<br />

Underlying profit before financing and taxation 392 309 332 27 1,060<br />

Segment assets 7,790 1,359 2,357 1,152 12,658<br />

Investments in joint ventures and associates 372 (15) 6 30 393<br />

Segment liabilities (5,435) (1,867) (1,548) (748) (9,598)<br />

Net assets 2,727 (523) 815 434 3,453<br />

Investment in intangible assets, property, plant and equipment and joint ventures and associates 568 53 65 16 702<br />

Depreciation and amortisation 246 35 58 28 367<br />

Financial <strong>statements</strong><br />

<strong>Rolls</strong>-<strong>Royce</strong> Holdings plc Annual report 2011