Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

Consolidated financial statements - Rolls-Royce

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

113<br />

Financial <strong>statements</strong><br />

Notes to the consolidated <strong>financial</strong> <strong>statements</strong><br />

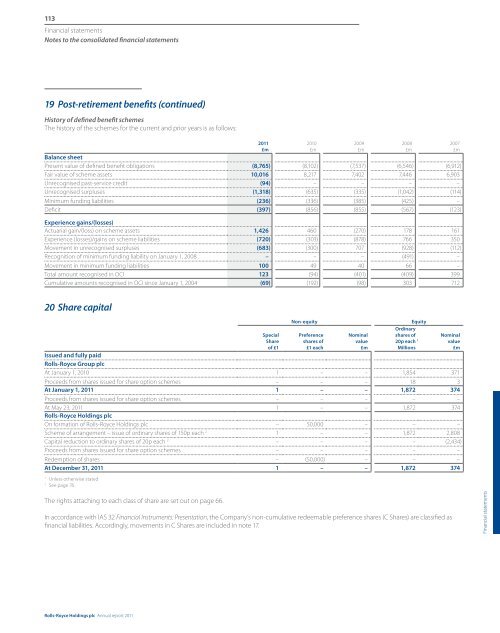

19 Post-retirement benefits (continued)<br />

History of defined benefit schemes<br />

The history of the schemes for the current and prior years is as follows:<br />

Balance sheet<br />

Present value of defined benefit obligations (8,765) (8,102) (7,537) (6,546) (6,912)<br />

Fair value of scheme assets 10,016 8,217 7,402 7,446 6,903<br />

Unrecognised past-service credit (94) – – – –<br />

Unrecognised surpluses (1,318) (635) (335) (1,042) (114)<br />

Minimum funding liabilities (236) (336) (385) (425) –<br />

Deficit (397) (856) (855) (567) (123)<br />

Experience gains/(losses)<br />

Actuarial gain/(loss) on scheme assets 1,426 460 (270) 178 161<br />

Experience (losses)/gains on scheme liabilities (720) (303) (878) 766 350<br />

Movement in unrecognised surpluses (683) (300) 707 (928) (112)<br />

Recognition of minimum funding liability on January 1, 2008 – – – (491) –<br />

Movement in minimum funding liabilities 100 49 40 66 –<br />

Total amount recognised in OCI 123 (94) (401) (409) 399<br />

Cumulative amounts recognised in OCI since January 1, 2004 (69) (192) (98) 303 712<br />

2011<br />

£m<br />

2010<br />

£m<br />

2009<br />

£m<br />

2008<br />

£m<br />

2007<br />

£m<br />

20 Share capital<br />

Non-equity<br />

Equity<br />

Special<br />

Share<br />

of £1<br />

Preference<br />

shares of<br />

£1 each<br />

Nominal<br />

value<br />

£m<br />

Ordinary<br />

shares of<br />

20p each 1<br />

Millions<br />

Nominal<br />

value<br />

£m<br />

Issued and fully paid<br />

<strong>Rolls</strong>-<strong>Royce</strong> Group plc<br />

At January 1, 2010 1 – – 1,854 371<br />

Proceeds from shares issued for share option schemes – – – 18 3<br />

At January 1, 2011 1 – – 1,872 374<br />

Proceeds from shares issued for share option schemes – – – – –<br />

At May 23, 2011 1 – – 1,872 374<br />

<strong>Rolls</strong>-<strong>Royce</strong> Holdings plc<br />

On formation of <strong>Rolls</strong>-<strong>Royce</strong> Holdings plc – 50,000 – – –<br />

Scheme of arrangement – issue of ordinary shares of 150p each 2 1 – – 1,872 2,808<br />

Capital reduction to ordinary shares of 20p each 2 – – – – (2,434)<br />

Proceeds from shares issued for share option schemes – – – – –<br />

Redemption of shares – (50,000) – – –<br />

At December 31, 2011 1 – – 1,872 374<br />

1<br />

Unless otherwise stated<br />

2<br />

See page 76<br />

The rights attaching to each class of share are set out on page 66.<br />

In accordance with IAS 32 Financial Instruments: Presentation, the Company’s non-cumulative redeemable preference shares (C Shares) are classified as<br />

<strong>financial</strong> liabilities. Accordingly, movements in C Shares are included in note 17.<br />

Financial <strong>statements</strong><br />

<strong>Rolls</strong>-<strong>Royce</strong> Holdings plc Annual report 2011