Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

60.00<br />

The Real Price of <strong>Gold</strong> 1900-2000<br />

in 1900 $<br />

50.00<br />

40.00<br />

30.00<br />

20.00<br />

10.00<br />

0.00<br />

1900<br />

1907<br />

1914<br />

1921<br />

1928<br />

1935<br />

1942<br />

1949<br />

1956<br />

1963<br />

1970<br />

1977<br />

1984<br />

1991<br />

1998<br />

Source: Bannock Consulting, <strong>World</strong> <strong>Gold</strong> <strong>Council</strong><br />

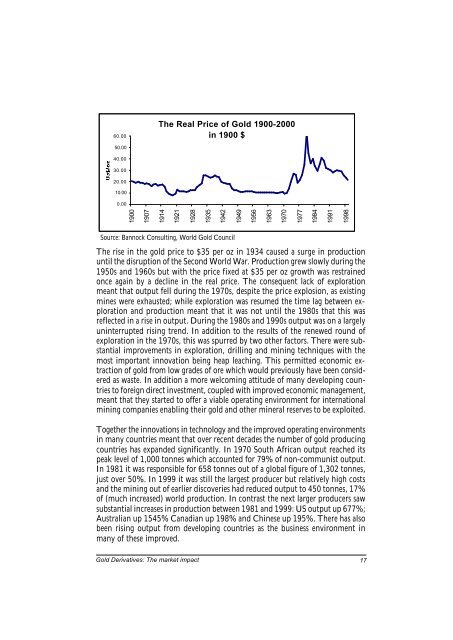

The rise in the gold price to $35 per oz in 1934 caused a surge in production<br />

until the disruption of the Second <strong>World</strong> War. Production grew slowly during the<br />

1950s and 1960s but with the price fixed at $35 per oz growth was restrained<br />

once again by a decline in the real price. The consequent lack of exploration<br />

meant that output fell during the 1970s, despite the price explosion, as existing<br />

mines were exhausted; while exploration was resumed the time lag between exploration<br />

and production meant that it was not until the 1980s that this was<br />

reflected in a rise in output. During the 1980s and 1990s output was on a largely<br />

uninterrupted rising trend. In addition to the results of the renewed round of<br />

exploration in the 1970s, this was spurred by two other factors. There were substantial<br />

improvements in exploration, drilling and mining techniques with the<br />

most important innovation being heap leaching. This permitted economic extraction<br />

of gold from low grades of ore which would previously have been considered<br />

as waste. In addition a more welcoming attitude of many developing countries<br />

to foreign direct investment, coupled with improved economic management,<br />

meant that they started to offer a viable operating environment for international<br />

mining companies enabling their gold and other mineral reserves to be exploited.<br />

Together the innovations in technology and the improved operating environments<br />

in many countries meant that over recent decades the number of gold producing<br />

countries has expanded significantly. In 1970 South African output reached its<br />

peak level of 1,000 tonnes which accounted for 79% of non-communist output.<br />

In 1981 it was responsible for 658 tonnes out of a global figure of 1,302 tonnes,<br />

just over 50%. In 1999 it was still the largest producer but relatively high costs<br />

and the mining out of earlier discoveries had reduced output to 450 tonnes, 17%<br />

of (much increased) world production. In contrast the next larger producers saw<br />

substantial increases in production between 1981 and 1999: US output up 677%;<br />

Australian up 1545% Canadian up 198% and Chinese up 195%. There has also<br />

been rising output from developing countries as the business environment in<br />

many of these improved.<br />

<strong>Gold</strong> <strong>Derivatives</strong>: The market impact 17