Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

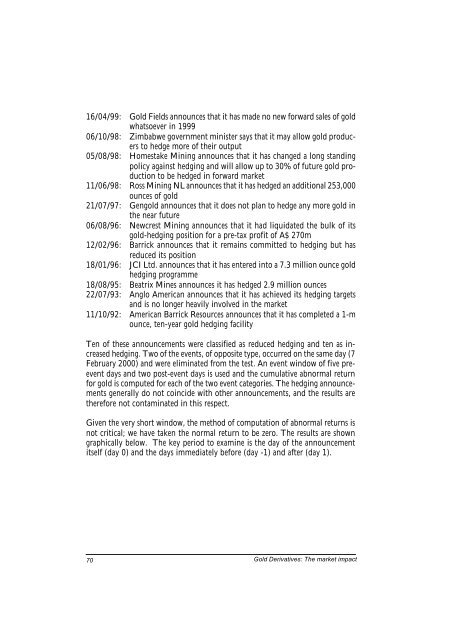

16/04/99: <strong>Gold</strong> Fields announces that it has made no new forward sales of gold<br />

whatsoever in 1999<br />

06/10/98: Zimbabwe government minister says that it may allow gold producers<br />

to hedge more of their output<br />

05/08/98: Homestake Mining announces that it has changed a long standing<br />

policy against hedging and will allow up to 30% of future gold production<br />

to be hedged in forward market<br />

11/06/98: Ross Mining NL announces that it has hedged an additional 253,000<br />

ounces of gold<br />

21/07/97: Gengold announces that it does not plan to hedge any more gold in<br />

the near future<br />

06/08/96: Newcrest Mining announces that it had liquidated the bulk of its<br />

gold-hedging position for a pre-tax profit of A$ 270m<br />

12/02/96: Barrick announces that it remains committed to hedging but has<br />

reduced its position<br />

18/01/96: JCI Ltd. announces that it has entered into a 7.3 million ounce gold<br />

hedging programme<br />

18/08/95: Beatrix Mines announces it has hedged 2.9 million ounces<br />

22/07/93: Anglo American announces that it has achieved its hedging targets<br />

and is no longer heavily involved in the market<br />

11/10/92: American Barrick Resources announces that it has completed a 1-m<br />

ounce, ten-year gold hedging facility<br />

Ten of these announcements were classified as reduced hedging and ten as increased<br />

hedging. Two of the events, of opposite type, occurred on the same day (7<br />

February 2000) and were eliminated from the test. An event window of five preevent<br />

days and two post-event days is used and the cumulative abnormal return<br />

for gold is computed for each of the two event categories. The hedging announcements<br />

generally do not coincide with other announcements, and the results are<br />

therefore not contaminated in this respect.<br />

Given the very short window, the method of computation of abnormal returns is<br />

not critical; we have taken the normal return to be zero. The results are shown<br />

graphically below. The key period to examine is the day of the announcement<br />

itself (day 0) and the days immediately before (day -1) and after (day 1).<br />

70<br />

<strong>Gold</strong> <strong>Derivatives</strong>: The market impact