Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

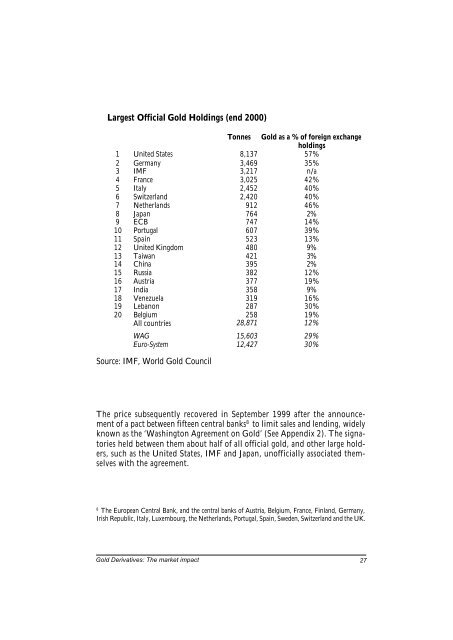

Largest Official <strong>Gold</strong> Holdings (end 2000)<br />

Tonnes <strong>Gold</strong> as a % of foreign exchange<br />

holdings<br />

1 United States 8,137 57%<br />

2 Germany 3,469 35%<br />

3 IMF 3,217 n/a<br />

4 France 3,025 42%<br />

5 Italy 2,452 40%<br />

6 Switzerland 2,420 40%<br />

7 Netherlands 912 46%<br />

8 Japan 764 2%<br />

9 ECB 747 14%<br />

10 Portugal 607 39%<br />

11 Spain 523 13%<br />

12 United Kingdom 480 9%<br />

13 Taiwan 421 3%<br />

14 China 395 2%<br />

15 Russia 382 12%<br />

16 Austria 377 19%<br />

17 India 358 9%<br />

18 Venezuela 319 16%<br />

19 Lebanon 287 30%<br />

20 Belgium 258 19%<br />

All countries 28,871 12%<br />

WAG 15,603 29%<br />

Euro-System 12,427 30%<br />

Source: IMF, <strong>World</strong> <strong>Gold</strong> <strong>Council</strong><br />

The price subsequently recovered in September 1999 after the announcement<br />

of a pact between fifteen central banks 8 to limit sales and lending, widely<br />

known as the ‘Washington Agreement on <strong>Gold</strong>’ (See Appendix 2). The signatories<br />

held between them about half of all official gold, and other large holders,<br />

such as the United States, IMF and Japan, unofficially associated themselves<br />

with the agreement.<br />

8<br />

The European Central Bank, and the central banks of Austria, Belgium, France, Finland, Germany,<br />

Irish Republic, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden, Switzerland and the UK.<br />

<strong>Gold</strong> <strong>Derivatives</strong>: The market impact 27