Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

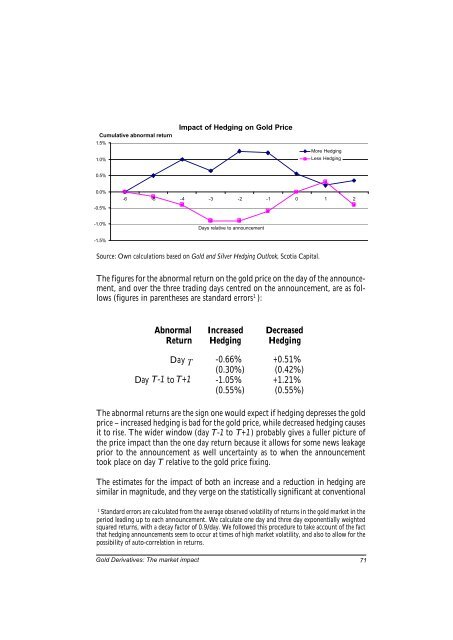

Cumulative abnormal return<br />

1.5%<br />

1.0%<br />

Impact of Hedging on <strong>Gold</strong> Price<br />

More Hedging<br />

Less Hedging<br />

0.5%<br />

0.0%<br />

-0.5%<br />

-6 -5 -4 -3 -2 -1 0 1 2<br />

-1.0%<br />

Days relative to announcement<br />

-1.5%<br />

Source: Own calculations based on <strong>Gold</strong> and Silver Hedging Outlook, Scotia Capital.<br />

The figures for the abnormal return on the gold price on the day of the announcement,<br />

and over the three trading days centred on the announcement, are as follows<br />

(figures in parentheses are standard errors 1 ):<br />

Abnormal<br />

Return<br />

Increased<br />

Hedging<br />

Decreased<br />

Hedging<br />

Day T -0.66%<br />

(0.30%)<br />

Day T-1 to T+1 -1.05%<br />

(0.55%)<br />

+0.51%<br />

(0.42%)<br />

+1.21%<br />

(0.55%)<br />

The abnormal returns are the sign one would expect if hedging depresses the gold<br />

price – increased hedging is bad for the gold price, while decreased hedging causes<br />

it to rise. The wider window (day T-1 to T+1) probably gives a fuller picture of<br />

the price impact than the one day return because it allows for some news leakage<br />

prior to the announcement as well uncertainty as to when the announcement<br />

took place on day T relative to the gold price fixing.<br />

The estimates for the impact of both an increase and a reduction in hedging are<br />

similar in magnitude, and they verge on the statistically significant at conventional<br />

1<br />

Standard errors are calculated from the average observed volatility of returns in the gold market in the<br />

period leading up to each announcement. We calculate one day and three day exponentially weighted<br />

squared returns, with a decay factor of 0.9/day. We followed this procedure to take account of the fact<br />

that hedging announcements seem to occur at times of high market volatility, and also to allow for the<br />

possibility of auto-correlation in returns.<br />

<strong>Gold</strong> <strong>Derivatives</strong>: The market impact 71