Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

Gold Derivatives: Gold Derivatives: - World Gold Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

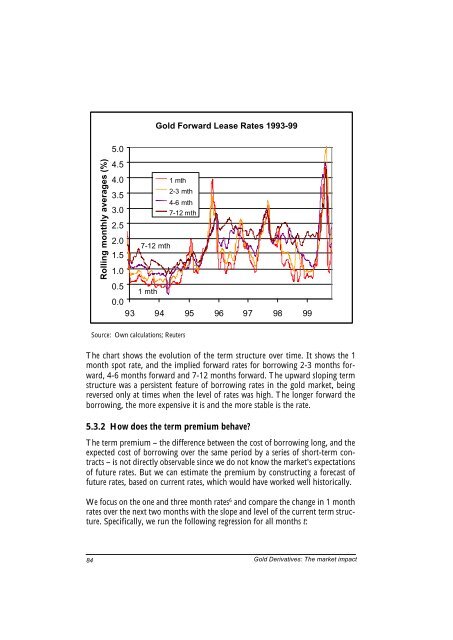

<strong>Gold</strong> Forward Lease Rates 1993-99<br />

5.0<br />

Rolling monthly averages (%)<br />

4.5<br />

4.0<br />

1 mth<br />

3.5<br />

2-3 mth<br />

4-6 mth<br />

3.0<br />

7-12 mth<br />

2.5<br />

2.0<br />

7-12 mth<br />

1.5<br />

1.0<br />

0.5<br />

1 mth<br />

0.0<br />

93 94 95 96 97 98 99<br />

Source: Own calculations; Reuters<br />

The chart shows the evolution of the term structure over time. It shows the 1<br />

month spot rate, and the implied forward rates for borrowing 2-3 months forward,<br />

4-6 months forward and 7-12 months forward. The upward sloping term<br />

structure was a persistent feature of borrowing rates in the gold market, being<br />

reversed only at times when the level of rates was high. The longer forward the<br />

borrowing, the more expensive it is and the more stable is the rate.<br />

5.3.2 How does the term premium behave?<br />

The term premium – the difference between the cost of borrowing long, and the<br />

expected cost of borrowing over the same period by a series of short-term contracts<br />

– is not directly observable since we do not know the market's expectations<br />

of future rates. But we can estimate the premium by constructing a forecast of<br />

future rates, based on current rates, which would have worked well historically.<br />

We focus on the one and three month rates 6 and compare the change in 1 month<br />

rates over the next two months with the slope and level of the current term structure.<br />

Specifically, we run the following regression for all months t:<br />

84<br />

<strong>Gold</strong> <strong>Derivatives</strong>: The market impact