2013 Sprint Benefits Guide

2013 Sprint Benefits Guide

2013 Sprint Benefits Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

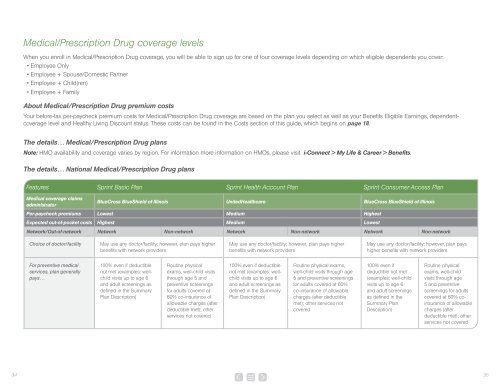

Medical/Prescription Drug coverage levels<br />

When you enroll in Medical/Prescription Drug coverage, you will be able to sign up for one of four coverage levels depending on which eligible dependents you cover:<br />

• Employee Only<br />

• Employee + Spouse/Domestic Partner<br />

• Employee + Child(ren)<br />

• Employee + Family<br />

About Medical/Prescription Drug premium costs<br />

Your before-tax per-paycheck premium costs for Medical/Prescription Drug coverage are based on the plan you select as well as your <strong>Benefits</strong> Eligible Earnings, dependentcoverage<br />

level and Healthy Living Discount status. These costs can be found in the Costs section of this guide, which begins on page 18.<br />

The details… Medical/Prescription Drug plans<br />

Note: HMO availability and coverage varies by region. For information more information on HMOs, please visit i-Connect > My Life & Career > <strong>Benefits</strong>.<br />

The details… National Medical/Prescription Drug plans<br />

Features <strong>Sprint</strong> Basic Plan <strong>Sprint</strong> Health Account Plan <strong>Sprint</strong> Consumer Access Plan<br />

Medical coverage claims<br />

administrator<br />

BlueCross BlueShield of Illinois UnitedHealthcare BlueCross BlueShield of Illinois<br />

Per-paycheck premiums Lowest Medium Highest<br />

Expected out-of-pocket costs Highest Medium Lowest<br />

Network/Out-of-network Network Non-network Network Non-network Network Non-network<br />

Choice of doctor/facility<br />

May use any doctor/facility; however, plan pays higher<br />

benefits with network providers<br />

May use any doctor/facility; however, plan pays higher<br />

benefits with network providers<br />

May use any doctor/facility; however, plan pays<br />

higher benefits with network providers<br />

For preventive medical<br />

services, plan generally<br />

pays…<br />

100% even if deductible<br />

not met (examples: wellchild<br />

visits up to age 6<br />

and adult screenings as<br />

defined in the Summary<br />

Plan Description)<br />

Routine physical<br />

exams, well-child visits<br />

through age 5 and<br />

preventive screenings<br />

for adults covered at<br />

60% co-insurance of<br />

allowable charges (after<br />

deductible met); other<br />

services not covered<br />

100% even if deductible<br />

not met (examples: wellchild<br />

visits up to age 6<br />

and adult screenings as<br />

defined in the Summary<br />

Plan Description)<br />

Routine physical exams,<br />

well-child visits through age<br />

5 and preventive screenings<br />

for adults covered at 60%<br />

co-insurance of allowable<br />

charges (after deductible<br />

met); other services not<br />

covered<br />

100% even if<br />

deductible not met<br />

(examples: well-child<br />

visits up to age 6<br />

and adult screenings<br />

as defined in the<br />

Summary Plan<br />

Description)<br />

Routine physical<br />

exams, well-child<br />

visits through age<br />

5 and preventive<br />

screenings for adults<br />

covered at 60% coinsurance<br />

of allowable<br />

charges (after<br />

deductible met); other<br />

services not covered<br />

34<br />

35