2013 Sprint Benefits Guide

2013 Sprint Benefits Guide

2013 Sprint Benefits Guide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• Supplemental AD&D coverage: Paid for by employee. Must first elect<br />

maximum level of Basic AD&D coverage. Available in amounts of 1x, 2x,<br />

3x, 4x, 5x, 6x, 7x and 8x <strong>Benefits</strong> Eligible Earnings. Can cover employee or<br />

employee + family.<br />

You may also elect to receive only $10,000 in AD&D coverage (paid for by <strong>Sprint</strong>)<br />

or waive AD&D coverage entirely.<br />

Deciding on Life Insurance and Accidental Death & Dismemberment<br />

Insurance<br />

When thinking about Life and Accidental Death & Dismemberment Insurance<br />

(AD&D, covered in more detail in the next section), consider:<br />

• Do I have other life insurance?<br />

• Do I have children or other dependents who depend on my income?<br />

• Does my spouse/domestic partner have life insurance?<br />

• Would my surviving spouse/domestic partner or children be able to enjoy the<br />

same lifestyle we have today if I die?<br />

• What other sources of income are available to my beneficiaries?<br />

• Are my children covered by any other life insurance policies?<br />

• In case of an accident causing major injury or death, do I have other forms of<br />

insurance?<br />

Already enrolled in <strong>Sprint</strong> AD&D coverage for <strong>2013</strong>?<br />

Because of the way AD&D coverage is being re-structured in <strong>2013</strong>,<br />

if you are enrolled in this benefit through <strong>Sprint</strong> for <strong>2013</strong>, it is strongly<br />

recommended that you actively make an election for your desired<br />

coverage level for <strong>2013</strong>. If you are currently enrolled in <strong>2013</strong> AD&D<br />

coverage of 1x <strong>Benefits</strong> Eligible Earnings (BEE) or higher and you do not<br />

actively enroll in a different level (or waive coverage) for <strong>2013</strong>, you will<br />

be automatically enrolled in Supplemental coverage at the same level<br />

of coverage plus the highest level of Basic coverage for which you are<br />

eligible. This will effectively raise the total coverage in <strong>2013</strong>.<br />

Example 1: For <strong>2013</strong>, Joe is enrolled in employee-only AD&D<br />

coverage in the amount of 4x his BEE. If he does not make a different<br />

election during Annual Enrollment, his <strong>2013</strong> AD&D coverage will be<br />

Basic employee-only coverage of 1x BEE ($50,000 maximum) plus<br />

Supplemental employee-only coverage of 4x BEE.<br />

Example 2: For <strong>2013</strong>, Regina is enrolled in employee + family AD&D<br />

coverage in the amount of 2x her BEE. If she does not make a different<br />

election during Annual Enrolment, her <strong>2013</strong> AD&D coverage will be<br />

Basic employee-only coverage of 1x BEE ($50,000 maximum) plus<br />

Supplemental employee + family coverage of 2x BEE<br />

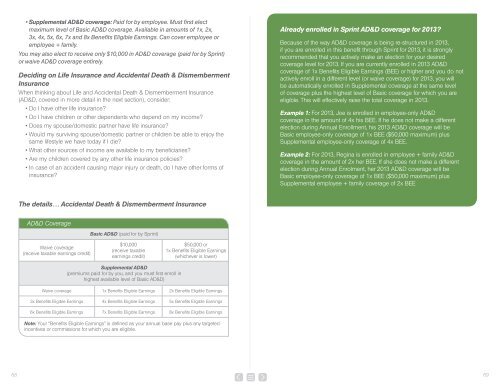

The details… Accidental Death & Dismemberment Insurance<br />

AD&D Coverage<br />

Basic AD&D (paid for by <strong>Sprint</strong>)<br />

Waive coverage<br />

(receive taxable earnings credit)<br />

$10,000<br />

(receive taxable<br />

earnings credit)<br />

$50,000 or<br />

1x <strong>Benefits</strong> Eligible Earnings<br />

(whichever is lower)<br />

Supplemental AD&D<br />

(premiums paid for by you, and you must first enroll in<br />

highest available level of Basic AD&D)<br />

Waive coverage 1x <strong>Benefits</strong> Eligible Earnings 2x <strong>Benefits</strong> Eligible Earnings<br />

3x <strong>Benefits</strong> Eligible Earnings 4x <strong>Benefits</strong> Eligible Earnings 5x <strong>Benefits</strong> Eligible Earnings<br />

6x <strong>Benefits</strong> Eligible Earnings 7x <strong>Benefits</strong> Eligible Earnings 8x <strong>Benefits</strong> Eligible Earnings<br />

Note: Your “<strong>Benefits</strong> Eligible Earnings” is defined as your annual base pay plus any targeted<br />

incentives or commissions for which you are eligible.<br />

68<br />

69