Scope - Clearstream

Scope - Clearstream

Scope - Clearstream

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET PRACTICE BOOK<br />

18<br />

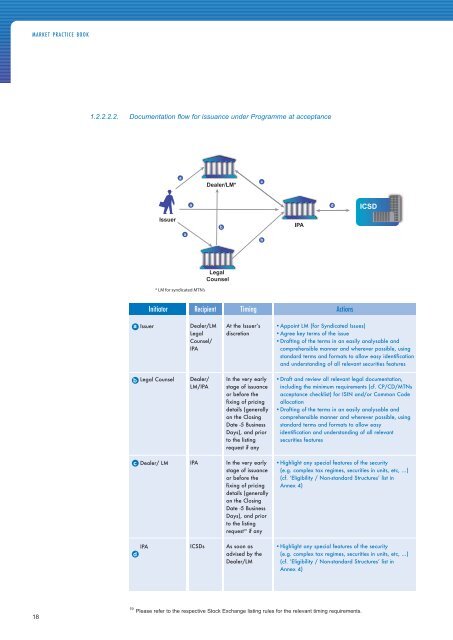

1.2.2.2.2.<br />

Documentation flow for issuance under Programme at acceptance<br />

a Issuer<br />

Issuer<br />

b Legal Counsel<br />

c Dealer/ LM<br />

IPA<br />

d<br />

a<br />

* LM for syndicated MTN’s<br />

a<br />

a<br />

Dealer/LM*<br />

b<br />

LLegal l<br />

Counsel<br />

Initiator Recipient Timing<br />

Dealer/LM<br />

Legal<br />

Counsel/<br />

IPA<br />

Dealer/<br />

LM/IPA<br />

IPA<br />

ICSDs<br />

At the Issuer’s<br />

discretion<br />

c<br />

b<br />

In the very early<br />

stage of issuance<br />

or before the<br />

fixing of pricing<br />

details (generally<br />

on the Closing<br />

Date -5 Business<br />

Days), and prior<br />

to the listing<br />

request if any<br />

In the very early<br />

stage of issuance<br />

or before the<br />

fixing of pricing<br />

details (generally<br />

on the Closing<br />

Date -5 Business<br />

Days), and prior<br />

to the listing<br />

request 19 if any<br />

As soon as<br />

advised by the<br />

Dealer/LM<br />

IPA<br />

d<br />

Actions<br />

ICSD SD<br />

•Appoint LM (for Syndicated Issues)<br />

•Agree key terms of the issue<br />

•Drafting of the terms in an easily analysable and<br />

comprehensible manner and wherever possible, using<br />

standard terms and formats to allow easy identification<br />

and understanding of all relevant securities features<br />

•Draft and review all relevant legal documentation,<br />

including the minimum requirements (cf. CP/CD/MTNs<br />

acceptance checklist) for ISIN and/or Common Code<br />

allocation<br />

•Drafting of the terms in an easily analysable and<br />

comprehensible manner and wherever possible, using<br />

standard terms and formats to allow easy<br />

identification and understanding of all relevant<br />

securities features<br />

•Highlight any special features of the security<br />

(e.g. complex tax regimes, securities in units, etc, …)<br />

(cf. ‘Eligibility / Non-standard Structures’ list in<br />

Annex 4)<br />

•Highlight any special features of the security<br />

(e.g. complex tax regimes, securities in units, etc, …)<br />

(cf. ‘Eligibility / Non-standard Structures’ list in<br />

Annex 4)<br />

19 Please refer to the respective Stock Exchange listing rules for the relevant timing requirements.