Untitled - Irish Stock Exchange

Untitled - Irish Stock Exchange

Untitled - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

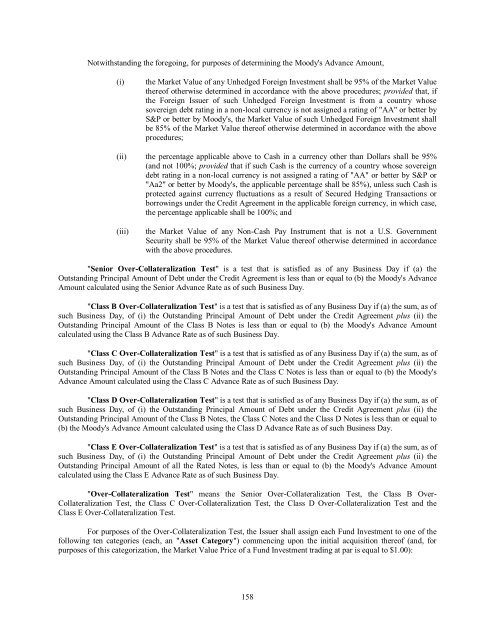

Notwithstanding the foregoing, for purposes of determining the Moody's Advance Amount,<br />

(i)<br />

the Market Value of any Unhedged Foreign Investment shall be 95% of the Market Value<br />

thereof otherwise determined in accordance with the above procedures; provided that, if<br />

the Foreign Issuer of such Unhedged Foreign Investment is from a country whose<br />

sovereign debt rating in a non-local currency is not assigned a rating of "AA" or better by<br />

S&P or better by Moody's, the Market Value of such Unhedged Foreign Investment shall<br />

be 85% of the Market Value thereof otherwise determined in accordance with the above<br />

procedures;<br />

(ii) the percentage applicable above to Cash in a currency other than Dollars shall be 95%<br />

(and not 100%; provided that if such Cash is the currency of a country whose sovereign<br />

debt rating in a non-local currency is not assigned a rating of "AA" or better by S&P or<br />

"Aa2" or better by Moody's, the applicable percentage shall be 85%), unless such Cash is<br />

protected against currency fluctuations as a result of Secured Hedging Transactions or<br />

borrowings under the Credit Agreement in the applicable foreign currency, in which case,<br />

the percentage applicable shall be 100%; and<br />

(iii)<br />

the Market Value of any Non-Cash Pay Instrument that is not a U.S. Government<br />

Security shall be 95% of the Market Value thereof otherwise determined in accordance<br />

with the above procedures.<br />

"Senior Over-Collateralization Test" is a test that is satisfied as of any Business Day if (a) the<br />

Outstanding Principal Amount of Debt under the Credit Agreement is less than or equal to (b) the Moody's Advance<br />

Amount calculated using the Senior Advance Rate as of such Business Day.<br />

"Class B Over-Collateralization Test" is a test that is satisfied as of any Business Day if (a) the sum, as of<br />

such Business Day, of (i) the Outstanding Principal Amount of Debt under the Credit Agreement plus (ii) the<br />

Outstanding Principal Amount of the Class B Notes is less than or equal to (b) the Moody's Advance Amount<br />

calculated using the Class B Advance Rate as of such Business Day.<br />

"Class C Over-Collateralization Test" is a test that is satisfied as of any Business Day if (a) the sum, as of<br />

such Business Day, of (i) the Outstanding Principal Amount of Debt under the Credit Agreement plus (ii) the<br />

Outstanding Principal Amount of the Class B Notes and the Class C Notes is less than or equal to (b) the Moody's<br />

Advance Amount calculated using the Class C Advance Rate as of such Business Day.<br />

"Class D Over-Collateralization Test" is a test that is satisfied as of any Business Day if (a) the sum, as of<br />

such Business Day, of (i) the Outstanding Principal Amount of Debt under the Credit Agreement plus (ii) the<br />

Outstanding Principal Amount of the Class B Notes, the Class C Notes and the Class D Notes is less than or equal to<br />

(b) the Moody's Advance Amount calculated using the Class D Advance Rate as of such Business Day.<br />

"Class E Over-Collateralization Test" is a test that is satisfied as of any Business Day if (a) the sum, as of<br />

such Business Day, of (i) the Outstanding Principal Amount of Debt under the Credit Agreement plus (ii) the<br />

Outstanding Principal Amount of all the Rated Notes, is less than or equal to (b) the Moody's Advance Amount<br />

calculated using the Class E Advance Rate as of such Business Day.<br />

"Over-Collateralization Test" means the Senior Over-Collateralization Test, the Class B Over-<br />

Collateralization Test, the Class C Over-Collateralization Test, the Class D Over-Collateralization Test and the<br />

Class E Over-Collateralization Test.<br />

For purposes of the Over-Collateralization Test, the Issuer shall assign each Fund Investment to one of the<br />

following ten categories (each, an "Asset Category") commencing upon the initial acquisition thereof (and, for<br />

purposes of this categorization, the Market Value Price of a Fund Investment trading at par is equal to $1.00):<br />

158