Untitled - Irish Stock Exchange

Untitled - Irish Stock Exchange

Untitled - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

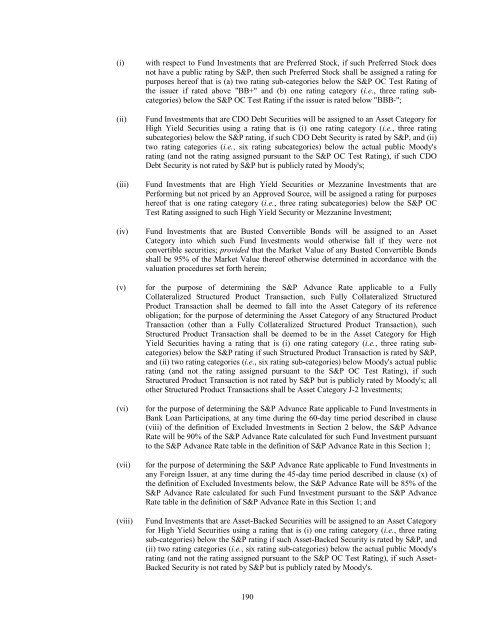

(i)<br />

(ii)<br />

(iii)<br />

(iv)<br />

with respect to Fund Investments that are Preferred <strong>Stock</strong>, if such Preferred <strong>Stock</strong> does<br />

not have a public rating by S&P, then such Preferred <strong>Stock</strong> shall be assigned a rating for<br />

purposes hereof that is (a) two rating sub-categories below the S&P OC Test Rating of<br />

the issuer if rated above "BB+" and (b) one rating category (i.e., three rating subcategories)<br />

below the S&P OC Test Rating if the issuer is rated below "BBB-";<br />

Fund Investments that are CDO Debt Securities will be assigned to an Asset Category for<br />

High Yield Securities using a rating that is (i) one rating category (i.e., three rating<br />

subcategories) below the S&P rating, if such CDO Debt Security is rated by S&P, and (ii)<br />

two rating categories (i.e., six rating subcategories) below the actual public Moody's<br />

rating (and not the rating assigned pursuant to the S&P OC Test Rating), if such CDO<br />

Debt Security is not rated by S&P but is publicly rated by Moody's;<br />

Fund Investments that are High Yield Securities or Mezzanine Investments that are<br />

Performing but not priced by an Approved Source, will be assigned a rating for purposes<br />

hereof that is one rating category (i.e., three rating subcategories) below the S&P OC<br />

Test Rating assigned to such High Yield Security or Mezzanine Investment;<br />

Fund Investments that are Busted Convertible Bonds will be assigned to an Asset<br />

Category into which such Fund Investments would otherwise fall if they were not<br />

convertible securities; provided that the Market Value of any Busted Convertible Bonds<br />

shall be 95% of the Market Value thereof otherwise determined in accordance with the<br />

valuation procedures set forth herein;<br />

(v) for the purpose of determining the S&P Advance Rate applicable to a Fully<br />

Collateralized Structured Product Transaction, such Fully Collateralized Structured<br />

Product Transaction shall be deemed to fall into the Asset Category of its reference<br />

obligation; for the purpose of determining the Asset Category of any Structured Product<br />

Transaction (other than a Fully Collateralized Structured Product Transaction), such<br />

Structured Product Transaction shall be deemed to be in the Asset Category for High<br />

Yield Securities having a rating that is (i) one rating category (i.e., three rating subcategories)<br />

below the S&P rating if such Structured Product Transaction is rated by S&P,<br />

and (ii) two rating categories (i.e., six rating sub-categories) below Moody's actual public<br />

rating (and not the rating assigned pursuant to the S&P OC Test Rating), if such<br />

Structured Product Transaction is not rated by S&P but is publicly rated by Moody's; all<br />

other Structured Product Transactions shall be Asset Category J-2 Investments;<br />

(vi)<br />

(vii)<br />

(viii)<br />

for the purpose of determining the S&P Advance Rate applicable to Fund Investments in<br />

Bank Loan Participations, at any time during the 60-day time period described in clause<br />

(viii) of the definition of Excluded Investments in Section 2 below, the S&P Advance<br />

Rate will be 90% of the S&P Advance Rate calculated for such Fund Investment pursuant<br />

to the S&P Advance Rate table in the definition of S&P Advance Rate in this Section 1;<br />

for the purpose of determining the S&P Advance Rate applicable to Fund Investments in<br />

any Foreign Issuer, at any time during the 45-day time period described in clause (x) of<br />

the definition of Excluded Investments below, the S&P Advance Rate will be 85% of the<br />

S&P Advance Rate calculated for such Fund Investment pursuant to the S&P Advance<br />

Rate table in the definition of S&P Advance Rate in this Section 1; and<br />

Fund Investments that are Asset-Backed Securities will be assigned to an Asset Category<br />

for High Yield Securities using a rating that is (i) one rating category (i.e., three rating<br />

sub-categories) below the S&P rating if such Asset-Backed Security is rated by S&P, and<br />

(ii) two rating categories (i.e., six rating sub-categories) below the actual public Moody's<br />

rating (and not the rating assigned pursuant to the S&P OC Test Rating), if such Asset-<br />

Backed Security is not rated by S&P but is publicly rated by Moody's.<br />

190