NO BORDER

NO BORDER

NO BORDER

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

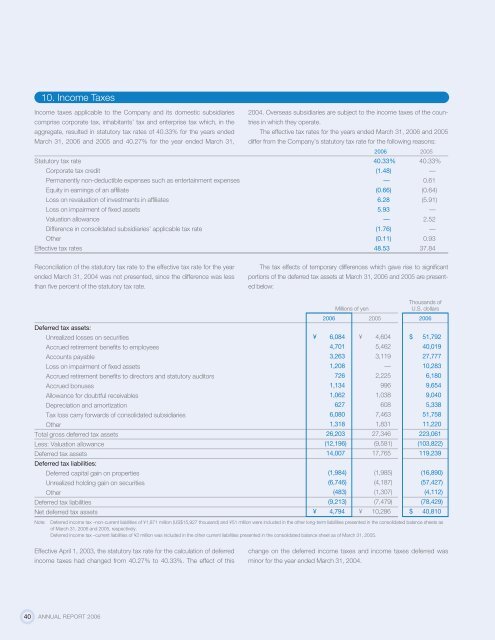

10. Income Taxes<br />

Income taxes applicable to the Company and its domestic subsidiaries 2004. Overseas subsidiaries are subject to the income taxes of the countries<br />

comprise corporate tax, inhabitants’ tax and enterprise tax which, in the<br />

in which they operate.<br />

aggregate, resulted in statutory tax rates of 40.33% for the years ended The effective tax rates for the years ended March 31, 2006 and 2005<br />

March 31, 2006 and 2005 and 40.27% for the year ended March 31, differ from the Company’s statutory tax rate for the following reasons:<br />

2006 2005<br />

Statutory tax rate 40.33% 40.33%<br />

Corporate tax credit (1.48) —<br />

Permanently non-deductible expenses such as entertainment expenses — 0.61<br />

Equity in earnings of an affiliate (0.66) (0.64)<br />

Loss on revaluation of investments in affiliates 6.28 (5.91)<br />

Loss on impairment of fixed assets 5.93 —<br />

Valuation allowance — 2.52<br />

Difference in consolidated subsidiaries’ applicable tax rate (1.76) —<br />

Other (0.11) 0.93<br />

Effective tax rates 48.53 37.84<br />

Reconciliation of the statutory tax rate to the effective tax rate for the year<br />

ended March 31, 2004 was not presented, since the difference was less<br />

than five percent of the statutory tax rate.<br />

The tax effects of temporary differences which gave rise to significant<br />

portions of the deferred tax assets at March 31, 2006 and 2005 are presented<br />

below:<br />

Deferred tax assets:<br />

Unrealized losses on securities<br />

Accrued retirement benefits to employees<br />

Accounts payable<br />

Loss on impairment of fixed assets<br />

Accrued retirement benefits to directors and statutory auditors<br />

Accrued bonuses<br />

Allowance for doubtful receivables<br />

Depreciation and amortization<br />

Tax loss carry forwards of consolidated subsidiaries<br />

Other<br />

Total gross deferred tax assets<br />

Less: Valuation allowance<br />

Deferred tax assets<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2006 2005 2006<br />

¥ 6,084<br />

4,701<br />

3,263<br />

1,208<br />

726<br />

1,134<br />

1,062<br />

627<br />

6,080<br />

1,318<br />

26,203<br />

(12,196)<br />

14,007<br />

¥ 4,604<br />

5,462<br />

3,119<br />

—<br />

2,225<br />

996<br />

1,038<br />

608<br />

7,463<br />

1,831<br />

27,346<br />

(9,581)<br />

17,765<br />

$ 51,792<br />

40,019<br />

27,777<br />

10,283<br />

6,180<br />

9,654<br />

9,040<br />

5,338<br />

51,758<br />

11,220<br />

223,061<br />

(103,822)<br />

119,239<br />

Deferred tax liabilities:<br />

Deferred capital gain on properties<br />

Unrealized holding gain on securities<br />

Other<br />

Deferred tax liabilities<br />

Net deferred tax assets<br />

¥<br />

(1,984)<br />

(6,746)<br />

(483)<br />

(9,213)<br />

4,794 ¥<br />

(1,985)<br />

(4,187)<br />

(1,307)<br />

(7,479)<br />

10,286 $<br />

(16,890)<br />

(57,427)<br />

(4,112)<br />

(78,429)<br />

40,810<br />

Note: Deferred income tax –non-current liabilities of ¥1,871 million (US$15,927 thousand) and ¥51 million were included in the other long-term liabilities presented in the consolidated balance sheets as<br />

of March 31, 2006 and 2005, respectively.<br />

Deferred income tax –current liabilities of ¥2 million was included in the other current liabilities presented in the consolidated balance sheet as of March 31, 2005.<br />

Effective April 1, 2003, the statutory tax rate for the calculation of deferred<br />

income taxes had changed from 40.27% to 40.33%. The effect of this<br />

change on the deferred income taxes and income taxes deferred was<br />

minor for the year ended March 31, 2004.<br />

40 ANNUAL REPORT 2006