CHAPTER 75:01 - Inland Revenue Division

CHAPTER 75:01 - Inland Revenue Division

CHAPTER 75:01 - Inland Revenue Division

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Corporation Tax Act Mac 1<br />

Vol. 1<br />

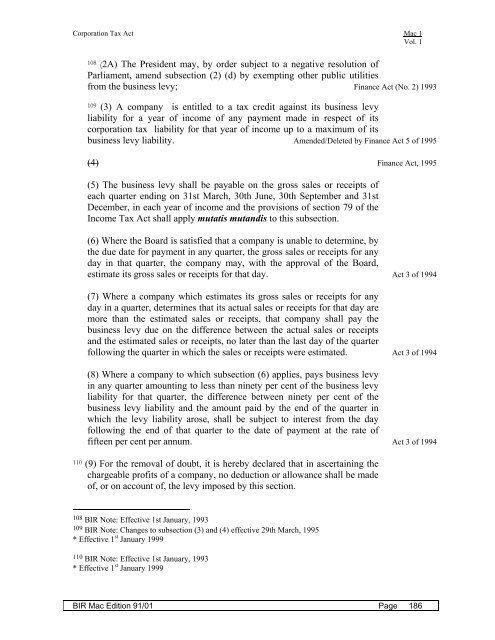

108 (2A) The President may, by order subject to a negative resolution of<br />

Parliament, amend subsection (2) (d) by exempting other public utilities<br />

from the business levy; Finance Act (No. 2) 1993<br />

109 (3) A company is entitled to a tax credit against its business levy<br />

liability for a year of income of any payment made in respect of its<br />

corporation tax liability for that year of income up to a maximum of its<br />

business levy liability. Amended/Deleted by Finance Act 5 of 1995<br />

(4) Finance Act, 1995<br />

(5) The business levy shall be payable on the gross sales or receipts of<br />

each quarter ending on 31st March, 30th June, 30th September and 31st<br />

December, in each year of income and the provisions of section 79 of the<br />

Income Tax Act shall apply mutatis mutandis to this subsection.<br />

(6) Where the Board is satisfied that a company is unable to determine, by<br />

the due date for payment in any quarter, the gross sales or receipts for any<br />

day in that quarter, the company may, with the approval of the Board,<br />

estimate its gross sales or receipts for that day. Act 3 of 1994<br />

(7) Where a company which estimates its gross sales or receipts for any<br />

day in a quarter, determines that its actual sales or receipts for that day are<br />

more than the estimated sales or receipts, that company shall pay the<br />

business levy due on the difference between the actual sales or receipts<br />

and the estimated sales or receipts, no later than the last day of the quarter<br />

following the quarter in which the sales or receipts were estimated. Act 3 of 1994<br />

(8) Where a company to which subsection (6) applies, pays business levy<br />

in any quarter amounting to less than ninety per cent of the business levy<br />

liability for that quarter, the difference between ninety per cent of the<br />

business levy liability and the amount paid by the end of the quarter in<br />

which the levy liability arose, shall be subject to interest from the day<br />

following the end of that quarter to the date of payment at the rate of<br />

fifteen per cent per annum. Act 3 of 1994<br />

110 (9) For the removal of doubt, it is hereby declared that in ascertaining the<br />

chargeable profits of a company, no deduction or allowance shall be made<br />

of, or on account of, the levy imposed by this section.<br />

108 BIR Note: Effective 1st January, 1993<br />

109 BIR Note: Changes to subsection (3) and (4) effective 29th March, 1995<br />

* Effective 1 st January 1999<br />

110 BIR Note: Effective 1st January, 1993<br />

* Effective 1 st January 1999<br />

BIR Mac Edition 91/<strong>01</strong> Page 186