ALBA 2007 â 1 plc - Irish Stock Exchange

ALBA 2007 â 1 plc - Irish Stock Exchange

ALBA 2007 â 1 plc - Irish Stock Exchange

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

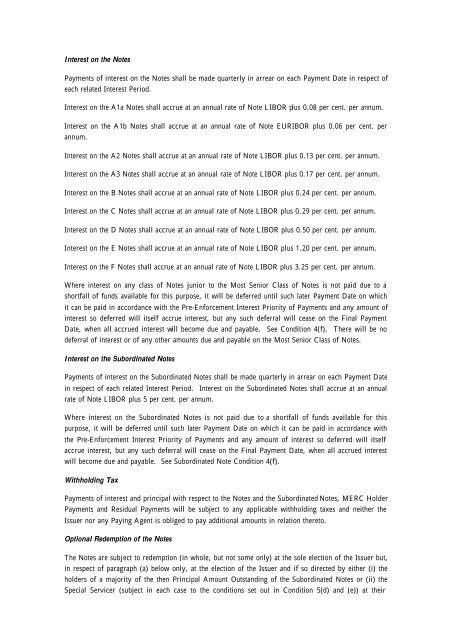

Interest on the Notes<br />

Payments of interest on the Notes shall be made quarterly in arrear on each Payment Date in respect of<br />

each related Interest Period.<br />

Interest on the A1a Notes shall accrue at an annual rate of Note LIBOR plus 0.08 per cent. per annum.<br />

Interest on the A1b Notes shall accrue at an annual rate of Note EURIBOR plus 0.06 per cent. per<br />

annum.<br />

Interest on the A2 Notes shall accrue at an annual rate of Note LIBOR plus 0.13 per cent. per annum.<br />

Interest on the A3 Notes shall accrue at an annual rate of Note LIBOR plus 0.17 per cent. per annum.<br />

Interest on the B Notes shall accrue at an annual rate of Note LIBOR plus 0.24 per cent. per annum.<br />

Interest on the C Notes shall accrue at an annual rate of Note LIBOR plus 0.29 per cent. per annum.<br />

Interest on the D Notes shall accrue at an annual rate of Note LIBOR plus 0.50 per cent. per annum.<br />

Interest on the E Notes shall accrue at an annual rate of Note LIBOR plus 1.20 per cent. per annum.<br />

Interest on the F Notes shall accrue at an annual rate of Note LIBOR plus 3.25 per cent. per annum.<br />

Where interest on any class of Notes junior to the Most Senior Class of Notes is not paid due to a<br />

shortfall of funds available for this purpose, it will be deferred until such later Payment Date on which<br />

it can be paid in accordance with the Pre-Enforcement Interest Priority of Payments and any amount of<br />

interest so deferred will itself accrue interest, but any such deferral will cease on the Final Payment<br />

Date, when all accrued interest will become due and payable. See Condition 4(f). There will be no<br />

deferral of interest or of any other amounts due and payable on the Most Senior Class of Notes.<br />

Interest on the Subordinated Notes<br />

Payments of interest on the Subordinated Notes shall be made quarterly in arrear on each Payment Date<br />

in respect of each related Interest Period. Interest on the Subordinated Notes shall accrue at an annual<br />

rate of Note LIBOR plus 5 per cent. per annum.<br />

Where interest on the Subordinated Notes is not paid due to a shortfall of funds available for this<br />

purpose, it will be deferred until such later Payment Date on which it can be paid in accordance with<br />

the Pre-Enforcement Interest Priority of Payments and any amount of interest so deferred will itself<br />

accrue interest, but any such deferral will cease on the Final Payment Date, when all accrued interest<br />

will become due and payable. See Subordinated Note Condition 4(f).<br />

Withholding Tax<br />

Payments of interest and principal with respect to the Notes and the Subordinated Notes, MERC Holder<br />

Payments and Residual Payments will be subject to any applicable withholding taxes and neither the<br />

Issuer nor any Paying Agent is obliged to pay additional amounts in relation thereto.<br />

Optional Redemption of the Notes<br />

The Notes are subject to redemption (in whole, but not some only) at the sole election of the Issuer but,<br />

in respect of paragraph (a) below only, at the election of the Issuer and if so directed by either (i) the<br />

holders of a majority of the then Principal Amount Outstanding of the Subordinated Notes or (ii) the<br />

Special Servicer (subject in each case to the conditions set out in Condition 5(d) and (e)) at their