Karnataka Agricultural Policy - Institute for Social and Economic ...

Karnataka Agricultural Policy - Institute for Social and Economic ...

Karnataka Agricultural Policy - Institute for Social and Economic ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Karnataka</strong> Agicultural <strong>Policy</strong> 2006<br />

Agriculture Insurance Scheme (NAIS). A special team of experts will review these recommendations<br />

to make them farmer friendly.<br />

The State government will consider extending the Crop Cutting Experiments (CCE) upto hobli<br />

level to increase the sample size so that reliability of CCE data will be enhanced.<br />

One of the essential insurance requirements is to cover of risk of prevented sowing due to early<br />

failure. This is difficult <strong>for</strong> implementation because of the experience. The area data is<br />

available only after lapse of one year; besides providing data on area sown, it is essential to link<br />

it with indemnity. No insurer appreciates this from the point of principle of insurance where<br />

risk is to be covered prior to the indication of occurrence of loss. This situation will be<br />

considered <strong>and</strong> a solution will be worked out.<br />

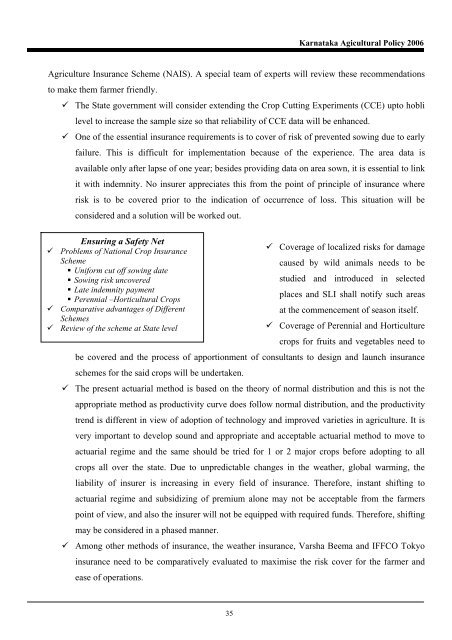

Ensuring a Safety Net<br />

Problems of National Crop Insurance<br />

Coverage of localized risks <strong>for</strong> damage<br />

Scheme<br />

caused by wild animals needs to be<br />

• Uni<strong>for</strong>m cut off sowing date<br />

• Sowing risk uncovered<br />

studied <strong>and</strong> introduced in selected<br />

• Late indemnity payment<br />

places <strong>and</strong> SLI shall notify such areas<br />

• Perennial –Horticultural Crops<br />

Comparative advantages of Different<br />

at the commencement of season itself.<br />

Schemes<br />

Review of the scheme at State level<br />

Coverage of Perennial <strong>and</strong> Horticulture<br />

crops <strong>for</strong> fruits <strong>and</strong> vegetables need to<br />

be covered <strong>and</strong> the process of apportionment of consultants to design <strong>and</strong> launch insurance<br />

schemes <strong>for</strong> the said crops will be undertaken.<br />

The present actuarial method is based on the theory of normal distribution <strong>and</strong> this is not the<br />

appropriate method as productivity curve does follow normal distribution, <strong>and</strong> the productivity<br />

trend is different in view of adoption of technology <strong>and</strong> improved varieties in agriculture. It is<br />

very important to develop sound <strong>and</strong> appropriate <strong>and</strong> acceptable actuarial method to move to<br />

actuarial regime <strong>and</strong> the same should be tried <strong>for</strong> 1 or 2 major crops be<strong>for</strong>e adopting to all<br />

crops all over the state. Due to unpredictable changes in the weather, global warming, the<br />

liability of insurer is increasing in every field of insurance. There<strong>for</strong>e, instant shifting to<br />

actuarial regime <strong>and</strong> subsidizing of premium alone may not be acceptable from the farmers<br />

point of view, <strong>and</strong> also the insurer will not be equipped with required funds. There<strong>for</strong>e, shifting<br />

may be considered in a phased manner.<br />

Among other methods of insurance, the weather insurance, Varsha Beema <strong>and</strong> IFFCO Tokyo<br />

insurance need to be comparatively evaluated to maximise the risk cover <strong>for</strong> the farmer <strong>and</strong><br />

ease of operations.<br />

35