View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

deals of the year<br />

case study<br />

Axiata Group’s US$158.06 million<br />

yuan-denominated Sukuk Wakalah<br />

Cross Border Deal of the Year<br />

Telecommunications company Axiata Group priced a<br />

CNY1 billion (US$158.06 million) Sukuk Wakalah on the<br />

11 th September 2012, in a deal touted as the world’s largest<br />

yuan-denominated <strong>Islamic</strong> bond offering to date.<br />

The sale is the first from Axiata’s multi-currency Sukuk program<br />

worth up to US$1.5 billion set up in July 2012.<br />

Structure and pricing<br />

The notes are backed by airtime vouchers, entitling<br />

Sukukholders to a specified number of airtime minutes for onnet<br />

calls on the mobile telecommunications network of Axiata’s<br />

subsidiaries, which comprise units in Bangladesh, Cambodia,<br />

India, Indonesia, Malaysia, Singapore and Sri Lanka. Axiata<br />

said that the Sukuk are the first yuan-denominated notes<br />

utilizing 100% airtime vouchers as underlying assets.<br />

Pricing for the sale closed intra-day, at a profit rate of 3.75%.<br />

Initial price guidance for the notes was at the 4% area, before<br />

it was revised to 3.75-3.85%. The transaction’s final orderbook<br />

of CNY3.5 billion (US$553.63 million) was seven times the<br />

Sukuk’s initial issuance size of CNY500 million (US$79.15<br />

million), allowing Axiata to upsize the offering to CNY1 billion.<br />

Proceeds from the<br />

issuance will pare down<br />

the group’s more<br />

expensive debt facilities<br />

James Maclaurin, the chief financial officer of Axiata, said: “The<br />

ability to raise yuan-denominated funds demonstrates Axiata’s<br />

ability to diversify away from other, more traditional currencies<br />

such as the US dollar and achieve cost-efficient funding. The<br />

proceeds from the issuance will pare down the group’s more<br />

expensive debt facilities and is also in line with our balance<br />

sheet optimization initiatives.”<br />

The Sukuk was listed and quoted on Bursa Malaysia and on the<br />

Singapore Exchange on the 19 th September.<br />

Axiata noted that the issuance is the group’s second benchmark<br />

Sukuk sale for 2012, following a RM5 billion (US$1.64 billion)<br />

offering from its Malaysian subsidiary, Celcom Transmission,<br />

in August 2012. “Both Sukuk issuances are in line with the<br />

Axiata Group’s ongoing group-wide initiative to optimize its<br />

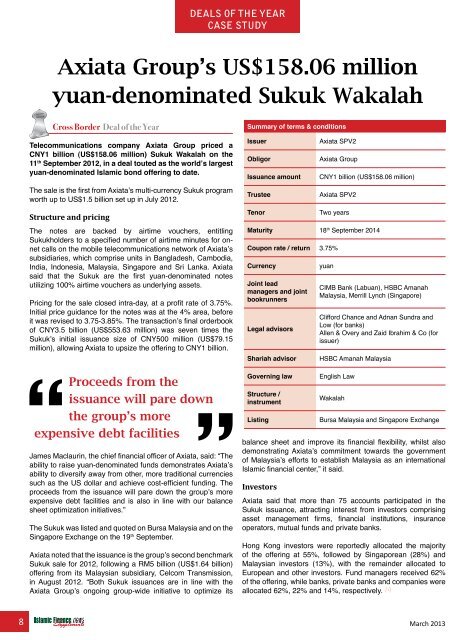

Summary of terms & conditions<br />

Issuer<br />

Obligor<br />

Issuance amount<br />

Trustee<br />

Tenor<br />

balance sheet and improve its financial flexibility, whilst also<br />

demonstrating Axiata’s commitment towards the government<br />

of Malaysia’s efforts to establish Malaysia as an international<br />

<strong>Islamic</strong> financial center,” it said.<br />

Investors<br />

Axiata SPV2<br />

Axiata Group<br />

CNY1 billion (US$158.06 million)<br />

Axiata SPV2<br />

Two years<br />

Maturity 18 th September 2014<br />

Coupon rate / return 3.75%<br />

Currency<br />

Joint lead<br />

managers and joint<br />

bookrunners<br />

Legal advisors<br />

Shariah advisor<br />

Governing law<br />

Structure /<br />

instrument<br />

Listing<br />

yuan<br />

CIMB Bank (Labuan), HSBC Amanah<br />

Malaysia, Merrill Lynch (Singapore)<br />

Clifford Chance and Adnan Sundra and<br />

Low (for banks)<br />

Allen & Overy and Zaid Ibrahim & Co (for<br />

issuer)<br />

HSBC Amanah Malaysia<br />

English Law<br />

Wakalah<br />

Bursa Malaysia and Singapore Exchange<br />

Axiata said that more than 75 accounts participated in the<br />

Sukuk issuance, attracting interest from investors comprising<br />

asset management firms, financial institutions, insurance<br />

operators, mutual funds and private banks.<br />

Hong Kong investors were reportedly allocated the majority<br />

of the offering at 55%, followed by Singaporean (28%) and<br />

Malaysian investors (13%), with the remainder allocated to<br />

European and other investors. Fund managers received 62%<br />

of the offering, while banks, private banks and companies were<br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

allocated 62%, 22% and 14%, respectively.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

8 March 2013<br />

www.REDmoneyBooks.com