View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

deals of the year<br />

case study<br />

Sabana REIT pushes <strong>Islamic</strong> asset<br />

management in Singapore<br />

Equity & Real Estate Deal of the Year<br />

Sabana REIT, the world’s largest listed Shariah compliant<br />

REIT, saw a spectacular year in 2012: reporting an 11.4%<br />

year-on-year rise in distribution per unit (DPU) with a<br />

portfolio that has grown 22.6% over the last two years<br />

to reach SG$1.1 billion (US$894.51 million). In the fourth<br />

quarter of 2012 it saw a net revaluation gain of around<br />

SG$25.3 million (US$20.56 million), and with an occupancy<br />

rate of 99.9%, its portfolio is performing strongly.<br />

The trust currently holds a portfolio of 21 properties with an<br />

occupancy rate of 99.9%, and in October 2012 completed a<br />

further acquisition with the purchase of 23 Serangoon North<br />

Avenue 5 for SG$61 million (US$49.59 million). The acquisition<br />

was partially funded through its SG$80 million (US$65.7 million)<br />

convertible Sukuk Murabahah issued in September, which<br />

represented a step forward in the REIT’s goal of diversifying its<br />

funding sources.<br />

Bobby Tay, the chief strategy officer at Sabana REIT, confirmed<br />

that the group has every intention of continuing accessing the<br />

<strong>Islamic</strong> capital market. “The Sukuk was fully subscribed on the<br />

very first day of launch. We are open to new Sukuk launches<br />

but have to time it with our acquisition and market conditions.”<br />

Sabana REIT has also benefited from a trend towards dividend<br />

stocks, as investors struggling to counter low interest rates<br />

move away from growth equities towards the comfort of a<br />

steady income stream. Sabana REIT returned 39% in 2012,<br />

making it one of the top 20 dividend-paying stocks in Singapore.<br />

However, as market conditions tighten the investment trust<br />

is looking to diversify and consolidate in order to maintain its<br />

growth. Tay commented that: “We are still carefully reviewing<br />

some new properties but for 2013, we will be focusing more on<br />

managing our own IPO assets.”<br />

He warns that although the REIT expects to see continued<br />

growth in 2013, its strategy will depend on market conditions<br />

and is likely to remain cautious: “We do hope to grow 10-20%<br />

annually on asset size, but will be prudent on the cost and<br />

quality of the assets. We are dependent on how the financial<br />

markets perform should we want to raise equity or debt.”<br />

The <strong>Islamic</strong> finance sector in Singapore has been slow to take<br />

off, and interest has remained limited. However, Tharman<br />

Shanmugaratnam, the Singaporean finance minister (and<br />

deputy prime minister), expressed his intention of encouraging<br />

the development of <strong>Islamic</strong> finance and highlighted the growing<br />

levels of collaboration between Singapore corporates and<br />

Malaysian banks to structure Singapore dollar-denominated<br />

Sukuk programs.<br />

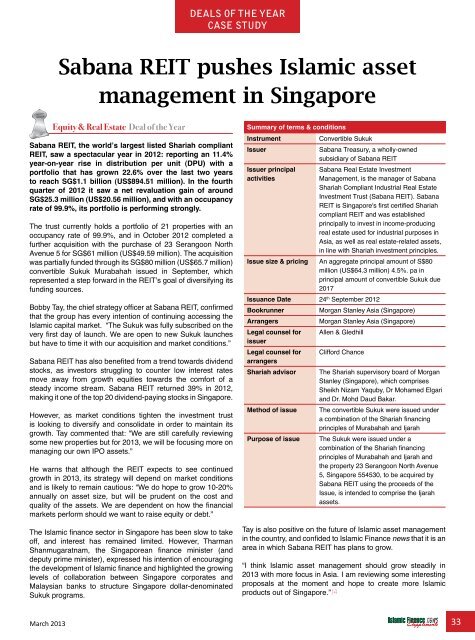

Summary of terms & conditions<br />

Instrument<br />

Convertible Sukuk<br />

Issuer<br />

Sabana Treasury, a wholly-owned<br />

subsidiary of Sabana REIT<br />

Issuer principal<br />

activities<br />

Tay is also positive on the future of <strong>Islamic</strong> asset management<br />

in the country, and confided to <strong>Islamic</strong> <strong>Finance</strong> news that it is an<br />

area in which Sabana REIT has plans to grow.<br />

“I think <strong>Islamic</strong> asset management should grow steadily in<br />

2013 with more focus in Asia. I am reviewing some interesting<br />

proposals at the moment and hope to create more <strong>Islamic</strong><br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

products out of Singapore.”<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

Sabana Real Estate Investment<br />

Management, is the manager of Sabana<br />

Shariah Compliant Industrial Real Estate<br />

Investment Trust (Sabana REIT). Sabana<br />

REIT is Singapore's first certified Shariah<br />

compliant REIT and was established<br />

principally to invest in income-producing<br />

real estate used for industrial purposes in<br />

Asia, as well as real estate-related assets,<br />

in line with Shariah investment principles.<br />

Issue size & pricing An aggregate principal amount of S$80<br />

million (US$64.3 million) 4.5%. pa in<br />

principal amount of convertible Sukuk due<br />

2017<br />

Issuance Date 24 th September 2012<br />

Bookrunner<br />

Morgan Stanley Asia (Singapore)<br />

Arrangers<br />

Morgan Stanley Asia (Singapore)<br />

Legal counsel for Allen & Gledhill<br />

issuer<br />

Legal counsel for Clifford Chance<br />

arrangers<br />

Shariah advisor The Shariah supervisory board of Morgan<br />

Stanley (Singapore), which comprises<br />

Sheikh Nizam Yaquby, Dr Mohamed Elgari<br />

and Dr. Mohd Daud Bakar.<br />

Method of issue The convertible Sukuk were issued under<br />

a combination of the Shariah financing<br />

principles of Murabahah and Ijarah<br />

Purpose of issue The Sukuk were issued under a<br />

combination of the Shariah financing<br />

principles of Murabahah and Ijarah and<br />

the property 23 Serangoon North Avenue<br />

5, Singapore 554530, to be acquired by<br />

Sabana REIT using the proceeds of the<br />

Issue, is intended to comprise the Ijarah<br />

assets.<br />

www.REDmoneyBooks.com<br />

March 2013 33<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com