View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

deals of the year<br />

case study<br />

Supporting Egypt through difficult times<br />

Sovereign Deal of the Year<br />

The International <strong>Islamic</strong> Trade <strong>Finance</strong> Corporation<br />

(ITFC) fosters socio-economic development, setting new<br />

benchmarks in ethical trade financing and developing<br />

innovative Shariah compliant solutions. In addition,<br />

ITFC supports the development of markets and trading<br />

capacities of its member countries of the Organization of<br />

<strong>Islamic</strong> Cooperation (OIC) in order to promote IDB Group’s<br />

strategic developmental objectives.<br />

Operating to world-class standards, ITFC’s mission is clear<br />

from its mandate to be a catalyst for the development of trade<br />

among OIC member countries and with the rest of the world.<br />

ITFC aspires to be a recognized provider of trade solutions for<br />

the OIC member countries’ needs in order to fulfill its brand<br />

promise of “Advancing Trade & Improving Lives”.<br />

Pumping energy into the Egyptian economy<br />

The US$2.2 billion financing program signed between ITFC and<br />

the Government of Egypt came at a critical time for Egypt and<br />

helped the government in reducing the pressure on the foreign<br />

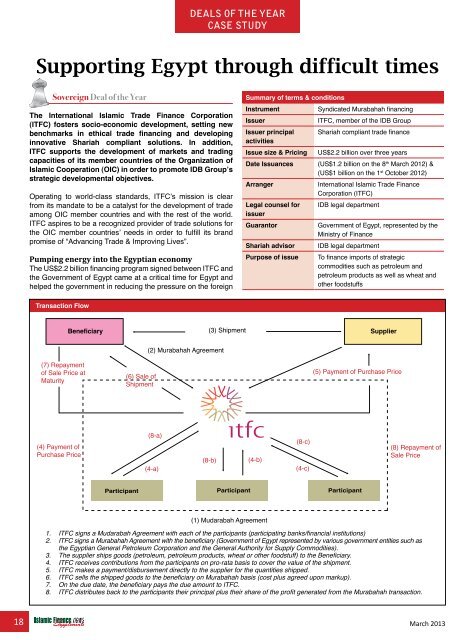

Summary of terms & conditions<br />

Instrument<br />

Syndicated Murabahah financing<br />

Issuer<br />

ITFC, member of the IDB Group<br />

Issuer principal Shariah compliant trade finance<br />

activities<br />

Issue size & Pricing US$2.2 billion over three years<br />

Date Issuances (US$1.2 billion on the 8 th March 2012) &<br />

(US$1 billion on the 1 st October 2012)<br />

Arranger<br />

International <strong>Islamic</strong> Trade <strong>Finance</strong><br />

Corporation (ITFC)<br />

Legal counsel for IDB legal department<br />

issuer<br />

Guarantor<br />

Government of Egypt, represented by the<br />

Ministry of <strong>Finance</strong><br />

Shariah advisor IDB legal department<br />

Purpose of issue To finance imports of strategic<br />

commodities such as petroleum and<br />

petroleum products as well as wheat and<br />

other foodstuffs<br />

Transaction Flow<br />

Beneficiary (3) Shipment Supplier<br />

(2) Murabahah Agreement<br />

(7) Repayment<br />

of Sale Price at<br />

Maturity<br />

(6) Sale of<br />

Shipment<br />

(5) Payment of Purchase Price<br />

(4) Payment of<br />

Purchase Price<br />

(8-a)<br />

(4-a)<br />

(8-b)<br />

(4-b)<br />

(8-c)<br />

(4-c)<br />

(8) Repayment of<br />

Sale Price<br />

Participant Participant Participant<br />

(1) Mudarabah Agreement<br />

1. ITFC signs a Mudarabah Agreement with each of the participants (participating banks/financial institutions)<br />

2. ITFC signs a Murabahah Agreement with the beneficiary (Government of Egypt represented by various government entities such as<br />

the Egyptian General Petroleum Corporation and the General Authority for Supply Commodities).<br />

3. The supplier ships goods (petroleum, petroleum products, wheat or other foodstuff) to the Beneficiary.<br />

4. ITFC receives contributions from the participants on pro-rata basis to cover the value of the shipment.<br />

5. ITFC makes a payment/disbursement directly to the supplier for the quantities shipped.<br />

6. ITFC sells the shipped goods to the beneficiary on Murabahah basis (cost plus agreed upon markup).<br />

7. On the due date, the beneficiary pays the due amount to ITFC.<br />

8. ITFC distributes back to the participants their principal plus their share of the profit generated from the Murabahah transaction.<br />

18 March 2013