View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

deals of the year<br />

results<br />

Size<br />

Issuer<br />

Joint Arrangers<br />

Legal Counsel for the Issuer<br />

Legal Counsel for the Banks<br />

Joint Arranger & Joint Bookrunner<br />

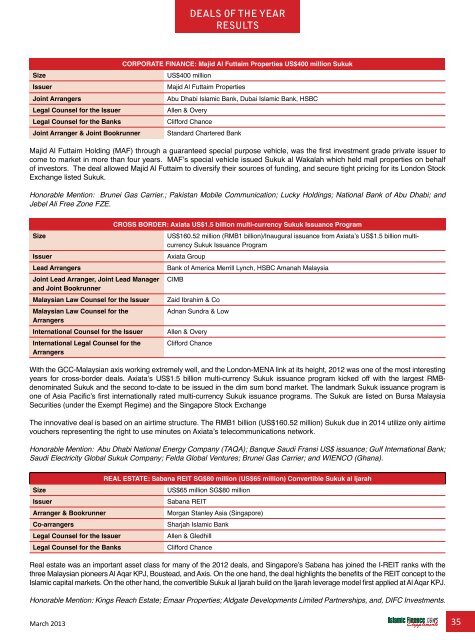

Corporate <strong>Finance</strong>: Majid Al Futtaim Properties US$400 million Sukuk<br />

US$400 million<br />

Majid Al Futtaim Properties<br />

Abu Dhabi <strong>Islamic</strong> Bank, Dubai <strong>Islamic</strong> Bank, HSBC<br />

Allen & Overy<br />

Clifford Chance<br />

Standard Chartered Bank<br />

Majid Al Futtaim Holding (MAF) through a guaranteed special purpose vehicle, was the first investment grade private issuer to<br />

come to market in more than four years. MAF’s special vehicle issued Sukuk al Wakalah which held mall properties on behalf<br />

of investors. The deal allowed Majid Al Futtaim to diversify their sources of funding, and secure tight pricing for its London Stock<br />

Exchange listed Sukuk.<br />

Honorable Mention: Brunei Gas Carrier.; Pakistan Mobile Communication; Lucky Holdings; National Bank of Abu Dhabi; and<br />

Jebel Ali Free Zone FZE.<br />

Cross Border: Axiata US$1.5 billion multi-currency Sukuk Issuance Program<br />

Size<br />

US$160.52 million (RMB1 billion)/Inaugural issuance from Axiata’s US$1.5 billion multicurrency<br />

Sukuk Issuance Program<br />

Issuer<br />

Axiata Group<br />

Lead Arrangers<br />

Bank of America Merrill Lynch, HSBC Amanah Malaysia<br />

Joint Lead Arranger, Joint Lead Manager CIMB<br />

and Joint Bookrunner<br />

Malaysian Law Counsel for the Issuer Zaid Ibrahim & Co<br />

Malaysian Law Counsel for the<br />

Adnan Sundra & Low<br />

Arrangers<br />

International Counsel for the Issuer Allen & Overy<br />

International Legal Counsel for the Clifford Chance<br />

Arrangers<br />

With the GCC-Malaysian axis working extremely well, and the London-MENA link at its height, 2012 was one of the most interesting<br />

years for cross-border deals. Axiata’s US$1.5 billion multi-currency Sukuk issuance program kicked off with the largest RMBdenominated<br />

Sukuk and the second to-date to be issued in the dim sum bond market. The landmark Sukuk issuance program is<br />

one of Asia Pacific’s first internationally rated multi-currency Sukuk issuance programs. The Sukuk are listed on Bursa Malaysia<br />

Securities (under the Exempt Regime) and the Singapore Stock Exchange<br />

The innovative deal is based on an airtime structure. The RMB1 billion (US$160.52 million) Sukuk due in 2014 utilize only airtime<br />

vouchers representing the right to use minutes on Axiata’s telecommunications network.<br />

Honorable Mention: Abu Dhabi National Energy Company (TAQA); Banque Saudi Fransi US$ issuance; Gulf International Bank;<br />

Saudi Electricity Global Sukuk Company; Felda Global Ventures; Brunei Gas Carrier; and WIENCO (Ghana).<br />

Real Estate: Sabana REIT SG$80 million (US$65 million) Convertible Sukuk al Ijarah<br />

Size<br />

US$65 million SG$80 million<br />

Issuer<br />

Sabana REIT<br />

Arranger & Bookrunner<br />

Morgan Stanley Asia (Singapore)<br />

Co-arrangers<br />

Sharjah <strong>Islamic</strong> Bank<br />

Legal Counsel for the Issuer<br />

Allen & Gledhill<br />

Legal Counsel for the Banks<br />

Clifford Chance<br />

Real estate was an important asset class for many of the 2012 deals, and Singapore’s Sabana has joined the I-REIT ranks with the<br />

three Malaysian pioneers Al Aqar KPJ, Boustead, and Axis. On the one hand, the deal highlights the benefits of the REIT concept to the<br />

<strong>Islamic</strong> capital markets. On the other hand, the convertible Sukuk al Ijarah build on the Ijarah leverage model first applied at Al Aqar KPJ.<br />

Honorable Mention: Kings Reach Estate; Emaar Properties; Aldgate Developments Limited Partnerships, and, DIFC Investments.<br />

March 2013 35