View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

country report<br />

Indonesia<br />

end of the year as shown in the case of BMI and BRI Syariah<br />

where they experienced a decline in March 2012 from December<br />

2011.<br />

Preview of the Indonesian <strong>Islamic</strong> banking industry in<br />

2013<br />

Looking at the development in 2012, it is important to reflect<br />

on the sustainability of the high growth regime of Indonesian<br />

<strong>Islamic</strong> banking sector. The case of BMI and BRI Syariah, which<br />

experienced decline in the first quarter of 2012, showed that<br />

pushing for growth only towards the end of the year will not mean<br />

anything if it cannot be maintained in the following year.<br />

Here, the bank’s management should have a more steady &<br />

sustainable approach in fostering growth. Rapid asset growth<br />

not accompanied by proper risk management could also create<br />

financing risk in the medium and long term, especially for bigger<br />

sized banks. 2012 could be a good lesson for the secondtier<br />

banks to learn from the experience of the first-tier banks,<br />

which is to strengthen the foundation for the growth itself. This<br />

includes developing people, crafting meaningful values & vision,<br />

enhancing products and services, and upgrading information<br />

technology. They need to look beyond just the numbers and<br />

have bigger objectives, and let the numbers come on their own<br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

sustainably.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

www.REDmoneyBooks.com<br />

Farouk is the CEO of Alwyni International Capital (AIC) and the<br />

Chairman of Center for <strong>Islamic</strong> Studies in <strong>Finance</strong>, Economics,<br />

and Development (CISFED). He can be contacted at falwyni@<br />

alwyni.com.<br />

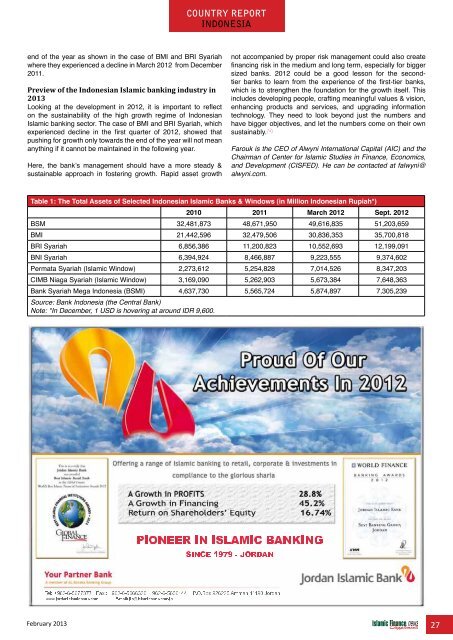

Table 1: The Total Assets of Selected Indonesian <strong>Islamic</strong> Banks & Windows (in Million Indonesian Rupiah*)<br />

2010 2011 March 2012 Sept. 2012<br />

BSM 32,481,873 48,671,950 49,616,835 51,203,659<br />

BMI 21,442,596 32,479,506 30,836,353 35,700,818<br />

BRI Syariah 6,856,386 11,200,823 10,552,693 12,199,091<br />

BNI Syariah 6,394,924 8,466,887 9,223,555 9,374,602<br />

Permata Syariah (<strong>Islamic</strong> Window) 2,273,612 5,254,828 7,014,526 8,347,203<br />

CIMB Niaga Syariah (<strong>Islamic</strong> Window) 3,169,090 5,262,903 5,673,384 7,648,363<br />

Bank Syariah Mega Indonesia (BSMI) 4,637,730 5,565,724 5,874,897 7,305,239<br />

Source: Bank Indonesia (the Central Bank)<br />

Note: *In December, 1 USD is hovering at around IDR 9,600.<br />

February 2013 27