View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

country report<br />

kuwait<br />

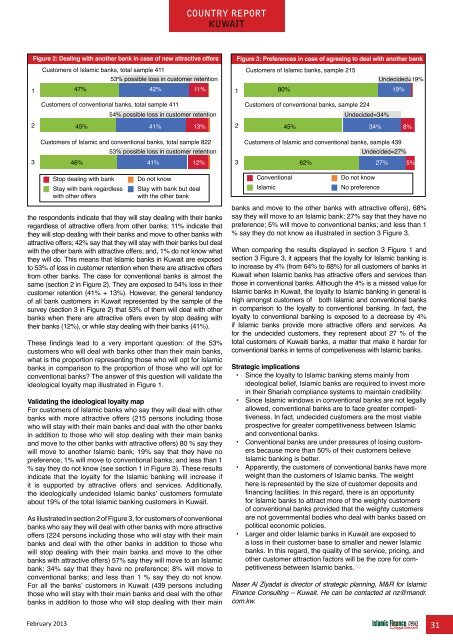

Figure 2: Dealing with another bank in case of new attractive offers<br />

Customers of <strong>Islamic</strong> banks, total sample 411<br />

53% possible loss in customer retention<br />

1<br />

47% 42% 11%<br />

Figure 3: Preferences in case of agreeing to deal with another bank<br />

Customers of <strong>Islamic</strong> banks, sample 215<br />

Undecided=19%<br />

1<br />

80% 19%<br />

Customers of conventional banks, total sample 411<br />

54% possible loss in customer retention<br />

Customers of conventional banks, sample 224<br />

Undecided=34%<br />

2<br />

45% 41% 13%<br />

2<br />

45% 34% 8%<br />

Customers of <strong>Islamic</strong> and conventional banks, total sample 822<br />

53% possible loss in customer retention<br />

Customers of <strong>Islamic</strong> and conventional banks, sample 439<br />

Undecided=27%<br />

3<br />

46% 41% 12%<br />

3<br />

62% 27% 5%<br />

Stop dealing with bank<br />

Stay with bank regardless<br />

with other offers<br />

Do not know<br />

Stay with bank but deal<br />

with the other bank<br />

the respondents indicate that they will stay dealing with their banks<br />

regardless of attractive offers from other banks; 11% indicate that<br />

they will stop dealing with their banks and move to other banks with<br />

attractive offers; 42% say that they will stay with their banks but deal<br />

with the other bank with attractive offers; and, 1% do not know what<br />

they will do. This means that <strong>Islamic</strong> banks in Kuwait are exposed<br />

to 53% of loss in customer retention when there are attractive offers<br />

from other banks. The case for conventional banks is almost the<br />

same (section 2 in Figure 2). They are exposed to 54% loss in their<br />

customer retention (41% + 13%). However, the general tendency<br />

of all bank customers in Kuwait represented by the sample of the<br />

survey (section 3 in Figure 2) that 53% of them will deal with other<br />

banks when there are attractive offers even by stop dealing with<br />

their banks (12%), or while stay dealing with their banks (41%).<br />

These findings lead to a very important question: of the 53%<br />

customers who will deal with banks other than their main banks,<br />

what is the proportion representing those who will opt for <strong>Islamic</strong><br />

banks in comparison to the proportion of those who will opt for<br />

conventional banks? The answer of this question will validate the<br />

ideological loyalty map illustrated in Figure 1.<br />

Validating the ideological loyalty map<br />

For customers of <strong>Islamic</strong> banks who say they will deal with other<br />

banks with more attractive offers (215 persons including those<br />

who will stay with their main banks and deal with the other banks<br />

in addition to those who will stop dealing with their main banks<br />

and move to the other banks with attractive offers) 80 % say they<br />

will move to another <strong>Islamic</strong> bank; 19% say that they have no<br />

preference; 1% will move to conventional banks; and less than 1<br />

% say they do not know (see section 1 in Figure 3). These results<br />

indicate that the loyalty for the <strong>Islamic</strong> banking will increase if<br />

it is supported by attractive offers and services. Additionally,<br />

the ideologically undecided <strong>Islamic</strong> banks’ customers formulate<br />

about 19% of the total <strong>Islamic</strong> banking customers in Kuwait.<br />

As illustrated in section 2 of Figure 3, for customers of conventional<br />

banks who say they will deal with other banks with more attractive<br />

offers (224 persons including those who will stay with their main<br />

banks and deal with the other banks in addition to those who<br />

will stop dealing with their main banks and move to the other<br />

banks with attractive offers) 57% say they will move to an <strong>Islamic</strong><br />

bank; 34% say that they have no preference; 8% will move to<br />

conventional banks; and less than 1 % say they do not know.<br />

For all the banks’ customers in Kuwait (439 persons including<br />

those who will stay with their main banks and deal with the other<br />

banks in addition to those who will stop dealing with their main<br />

Conventional<br />

<strong>Islamic</strong><br />

banks and move to the other banks with attractive offers), 68%<br />

say they will move to an <strong>Islamic</strong> bank; 27% say that they have no<br />

preference; 5% will move to conventional banks; and less than 1<br />

% say they do not know as illustrated in section 3 Figure 3.<br />

When comparing the results displayed in section 3 Figure 1 and<br />

section 3 Figure 3, it appears that the loyalty for <strong>Islamic</strong> banking is<br />

to increase by 4% (from 64% to 68%) for all customers of banks in<br />

Kuwait when <strong>Islamic</strong> banks has attractive offers and services than<br />

those in conventional banks. Although the 4% is a missed value for<br />

<strong>Islamic</strong> banks in Kuwait, the loyalty to <strong>Islamic</strong> banking in general is<br />

high amongst customers of both <strong>Islamic</strong> and conventional banks<br />

in comparison to the loyalty to conventional banking. In fact, the<br />

loyalty to conventional banking is exposed to a decrease by 4%<br />

if <strong>Islamic</strong> banks provide more attractive offers and services. As<br />

for the undecided customers, they represent about 27 % of the<br />

total customers of Kuwaiti banks, a matter that make it harder for<br />

conventional banks in terms of competiveness with <strong>Islamic</strong> banks.<br />

Strategic implications<br />

• Since the loyalty to <strong>Islamic</strong> banking stems mainly from<br />

ideological belief, <strong>Islamic</strong> banks are required to invest more<br />

in their Shariah compliance systems to maintain credibility.<br />

• Since <strong>Islamic</strong> windows in conventional banks are not legally<br />

allowed, conventional banks are to face greater competitiveness.<br />

In fact, undecided customers are the most viable<br />

prospective for greater competitiveness between <strong>Islamic</strong><br />

and conventional banks.<br />

• Conventional banks are under pressures of losing customers<br />

because more than 50% of their customers believe<br />

<strong>Islamic</strong> banking is better.<br />

• Apparently, the customers of conventional banks have more<br />

weight than the customers of <strong>Islamic</strong> banks. The weight<br />

here is represented by the size of customer deposits and<br />

financing facilities. In this regard, there is an opportunity<br />

for <strong>Islamic</strong> banks to attract more of the weighty customers<br />

of conventional banks provided that the weighty customers<br />

are not governmental bodies who deal with banks based on<br />

political economic policies.<br />

• Larger and older <strong>Islamic</strong> banks in Kuwait are exposed to<br />

a loss in their customer base to smaller and newer <strong>Islamic</strong><br />

banks. In this regard, the quality of the service, pricing, and<br />

other customer attraction factors will be the core for competitiveness<br />

between <strong>Islamic</strong><br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

banks.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

www.REDmoneyBooks.com<br />

Do not know<br />

No preference<br />

Naser Al Ziyadat is director of strategic planning, M&R for <strong>Islamic</strong><br />

<strong>Finance</strong> Consulting – Kuwait. He can be contacted at nz@mandr.<br />

com.kw.<br />

February 2013 31