View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

country report<br />

UK<br />

UK: A tough year for <strong>Islamic</strong> finance<br />

By Mohammed Amin<br />

The UK has led non-Muslim majority countries in the<br />

establishment of <strong>Islamic</strong> financial institutions and changes<br />

to tax law and regulatory policies to facilitate <strong>Islamic</strong> finance.<br />

Since the global financial crisis struck in 2008, with a recession<br />

in the UK and falling real estate values in the Gulf, the UK <strong>Islamic</strong><br />

finance industry has struggled. The UK’s first standalone Takaful<br />

operator closed due to having insufficient capital, and no new<br />

<strong>Islamic</strong> bank has been opened since June 2008.<br />

2012: A review<br />

For the UK as a whole, and for the UK <strong>Islamic</strong> finance industry,<br />

2012 has been another tough year. From late 2011, the UK<br />

economy fell back into recession before emerging in the third<br />

quarter. Despite the boost to morale from the Queen’s Diamond<br />

Jubilee and a very successful Olympic Games, the ‘feelgood’<br />

factor has been scarce in the UK.<br />

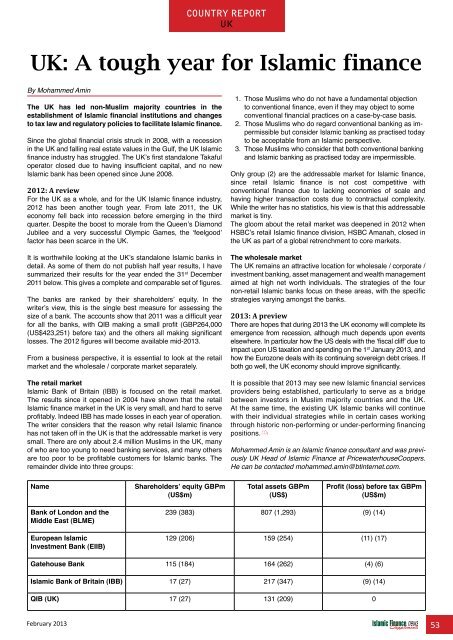

It is worthwhile looking at the UK’s standalone <strong>Islamic</strong> banks in<br />

detail. As some of them do not publish half year results, I have<br />

summarized their results for the year ended the 31 st December<br />

2011 below. This gives a complete and comparable set of figures.<br />

The banks are ranked by their shareholders’ equity. In the<br />

writer’s view, this is the single best measure for assessing the<br />

size of a bank. The accounts show that 2011 was a difficult year<br />

for all the banks, with QIB making a small profit (GBP264,000<br />

(US$423,251) before tax) and the others all making significant<br />

losses. The 2012 figures will become available mid-2013.<br />

From a business perspective, it is essential to look at the retail<br />

market and the wholesale / corporate market separately.<br />

The retail market<br />

<strong>Islamic</strong> Bank of Britain (IBB) is focused on the retail market.<br />

The results since it opened in 2004 have shown that the retail<br />

<strong>Islamic</strong> finance market in the UK is very small, and hard to serve<br />

profitably. Indeed IBB has made losses in each year of operation.<br />

The writer considers that the reason why retail <strong>Islamic</strong> finance<br />

has not taken off in the UK is that the addressable market is very<br />

small. There are only about 2.4 million Muslims in the UK, many<br />

of who are too young to need banking services, and many others<br />

are too poor to be profitable customers for <strong>Islamic</strong> banks. The<br />

remainder divide into three groups:<br />

1. Those Muslims who do not have a fundamental objection<br />

to conventional finance, even if they may object to some<br />

conventional financial practices on a case-by-case basis.<br />

2. Those Muslims who do regard conventional banking as impermissible<br />

but consider <strong>Islamic</strong> banking as practised today<br />

to be acceptable from an <strong>Islamic</strong> perspective.<br />

3. Those Muslims who consider that both conventional banking<br />

and <strong>Islamic</strong> banking as practised today are impermissible.<br />

Only group (2) are the addressable market for <strong>Islamic</strong> finance,<br />

since retail <strong>Islamic</strong> finance is not cost competitive with<br />

conventional finance due to lacking economies of scale and<br />

having higher transaction costs due to contractual complexity.<br />

While the writer has no statistics, his view is that this addressable<br />

market is tiny.<br />

The gloom about the retail market was deepened in 2012 when<br />

HSBC’s retail <strong>Islamic</strong> finance division, HSBC Amanah, closed in<br />

the UK as part of a global retrenchment to core markets.<br />

The wholesale market<br />

The UK remains an attractive location for wholesale / corporate /<br />

investment banking, asset management and wealth management<br />

aimed at high net worth individuals. The strategies of the four<br />

non-retail <strong>Islamic</strong> banks focus on these areas, with the specific<br />

strategies varying amongst the banks.<br />

2013: A preview<br />

There are hopes that during 2013 the UK economy will complete its<br />

emergence from recession, although much depends upon events<br />

elsewhere. In particular how the US deals with the ‘fiscal cliff’ due to<br />

impact upon US taxation and spending on the 1 st January 2013, and<br />

how the Eurozone deals with its continuing sovereign debt crises. If<br />

both go well, the UK economy should improve significantly.<br />

It is possible that 2013 may see new <strong>Islamic</strong> financial services<br />

providers being established, particularly to serve as a bridge<br />

between investors in Muslim majority countries and the UK.<br />

At the same time, the existing UK <strong>Islamic</strong> banks will continue<br />

with their individual strategies while in certain cases working<br />

through historic non-performing or under-performing financing<br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

positions.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

www.REDmoneyBooks.com<br />

Mohammed Amin is an <strong>Islamic</strong> finance consultant and was previously<br />

UK Head of <strong>Islamic</strong> <strong>Finance</strong> at PricewaterhouseCoopers.<br />

He can be contacted mohammed.amin@btinternet.com.<br />

Name<br />

Shareholders’ equity GBPm<br />

(US$m)<br />

Total assets GBPm<br />

(US$)<br />

Profit (loss) before tax GBPm<br />

(US$m)<br />

Bank of London and the<br />

Middle East (BLME)<br />

European <strong>Islamic</strong><br />

Investment Bank (EIIB)<br />

239 (383) 807 (1,293) (9) (14)<br />

129 (206) 159 (254) (11) (17)<br />

Gatehouse Bank 115 (184) 164 (262) (4) (6)<br />

<strong>Islamic</strong> Bank of Britain (IBB) 17 (27) 217 (347) (9) (14)<br />

QIB (UK) 17 (27) 131 (209) 0<br />

February 2013 53