View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

View PDF Edition - Islamic Finance News

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

sector report<br />

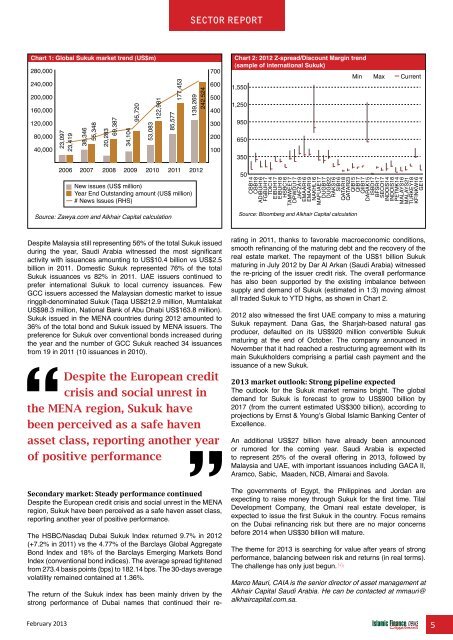

Chart 1: Global Sukuk market trend (US$m)<br />

280,000<br />

240,000<br />

200,000<br />

160,000<br />

120,000<br />

80,000<br />

40,000<br />

23,097<br />

23,419<br />

38,346<br />

55,348<br />

20,283<br />

69,387<br />

34,104<br />

95,720<br />

53,083<br />

122,981<br />

85,577<br />

177,453<br />

139,269<br />

242,524<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Chart 2: 2012 Z-spread/Discount Margin trend<br />

(sample of international Sukuk)<br />

Min Max Current<br />

1,550<br />

1,250<br />

950<br />

650<br />

350<br />

2006 2007 2008 2009 2010 2011 2012<br />

New issues (US$ million)<br />

Year End Outstanding amount (US$ million)<br />

# <strong>News</strong> Issues (RHS)<br />

Source: Zawya.com and Alkhair Capital calculation<br />

50<br />

CBB14<br />

CBB18<br />

ADIBUH16<br />

FGBUH17<br />

TDIC14<br />

EIBUH17<br />

EIBUH18<br />

HSBC16<br />

TAMWEE17<br />

DPWDU17<br />

JAFZA19<br />

EMAAR16<br />

EMAAR19<br />

NAKHL16<br />

MAFUAE17<br />

DUGB17<br />

DUGB22<br />

RAKS16<br />

SIB16<br />

QATAR18<br />

QATAR23<br />

QIB15<br />

QIB17<br />

QIIB17<br />

DARAK15<br />

ISBD17<br />

BFSR17<br />

SECO17<br />

INDOIS14<br />

INDOIS18<br />

PETMK14<br />

MALAYS16<br />

MALAYS21<br />

TURKEY18<br />

KFINKW16<br />

GE14<br />

Source: Bloomberg and Alkhair Capital calculation<br />

Despite Malaysia still representing 56% of the total Sukuk issued<br />

during the year, Saudi Arabia witnessed the most significant<br />

activity with issuances amounting to US$10.4 billion vs US$2.5<br />

billion in 2011. Domestic Sukuk represented 76% of the total<br />

Sukuk issuances vs 82% in 2011. UAE issuers continued to<br />

prefer international Sukuk to local currency issuances. Few<br />

GCC issuers accessed the Malaysian domestic market to issue<br />

ringgit-denominated Sukuk (Taqa US$212.9 million, Mumtalakat<br />

US$98.3 million, National Bank of Abu Dhabi US$163.8 million).<br />

Sukuk issued in the MENA countries during 2012 amounted to<br />

36% of the total bond and Sukuk issued by MENA issuers. The<br />

preference for Sukuk over conventional bonds increased during<br />

the year and the number of GCC Sukuk reached 34 issuances<br />

from 19 in 2011 (10 issuances in 2010).<br />

Despite the European credit<br />

crisis and social unrest in<br />

the MENA region, Sukuk have<br />

been perceived as a safe haven<br />

asset class, reporting another year<br />

of positive performance<br />

Secondary market: Steady performance continued<br />

Despite the European credit crisis and social unrest in the MENA<br />

region, Sukuk have been perceived as a safe haven asset class,<br />

reporting another year of positive performance.<br />

The HSBC/Nasdaq Dubai Sukuk Index returned 9.7% in 2012<br />

(+7.2% in 2011) vs the 4.77% of the Barclays Global Aggregate<br />

Bond Index and 18% of the Barclays Emerging Markets Bond<br />

Index (conventional bond indices). The average spread tightened<br />

from 273.4 basis points (bps) to 182.14 bps. The 30-days average<br />

volatility remained contained at 1.36%.<br />

The return of the Sukuk index has been mainly driven by the<br />

strong performance of Dubai names that continued their rerating<br />

in 2011, thanks to favorable macroeconomic conditions,<br />

smooth refinancing of the maturing debt and the recovery of the<br />

real estate market. The repayment of the US$1 billion Sukuk<br />

maturing in July 2012 by Dar Al Arkan (Saudi Arabia) witnessed<br />

the re-pricing of the issuer credit risk. The overall performance<br />

has also been supported by the existing imbalance between<br />

supply and demand of Sukuk (estimated in 1:3) moving almost<br />

all traded Sukuk to YTD highs, as shown in Chart 2.<br />

2012 also witnessed the first UAE company to miss a maturing<br />

Sukuk repayment. Dana Gas, the Sharjah-based natural gas<br />

producer, defaulted on its US$920 million convertible Sukuk<br />

maturing at the end of October. The company announced in<br />

November that it had reached a restructuring agreement with its<br />

main Sukukholders comprising a partial cash payment and the<br />

issuance of a new Sukuk.<br />

2013 market outlook: Strong pipeline expected<br />

The outlook for the Sukuk market remains bright. The global<br />

demand for Sukuk is forecast to grow to US$900 billion by<br />

2017 (from the current estimated US$300 billion), according to<br />

projections by Ernst & Young’s Global <strong>Islamic</strong> Banking Center of<br />

Excellence.<br />

An additional US$27 billion have already been announced<br />

or rumored for the coming year. Saudi Arabia is expected<br />

to represent 25% of the overall offering in 2013, followed by<br />

Malaysia and UAE, with important issuances including GACA II,<br />

Aramco, Sabic, Maaden, NCB, Almarai and Savola.<br />

The governments of Egypt, the Philippines and Jordan are<br />

expecting to raise money through Sukuk for the first time. Tilal<br />

Development Company, the Omani real estate developer, is<br />

expected to issue the first Sukuk in the country. Focus remains<br />

on the Dubai refinancing risk but there are no major concerns<br />

before 2014 when US$30 billion will mature.<br />

The theme for 2013 is searching for value after years of strong<br />

performance, balancing between risk and returns (in real terms).<br />

consulting www.<strong>Islamic</strong><strong>Finance</strong>Consulting.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Events.com<br />

The challenge has only just begun.<br />

www.<strong>Islamic</strong><strong>Finance</strong><strong>News</strong>.com<br />

www.<strong>Islamic</strong><strong>Finance</strong>Training.com<br />

www.MIFforum.com<br />

www.MIFmonthly.com<br />

www.MIFtraining.com<br />

www.REDmoneyBooks.com<br />

Marco Mauri, CAIA is the senior director of asset management at<br />

Alkhair Capital Saudi Arabia. He can be contacted at mmauri@<br />

alkhaircapital.com.sa.<br />

February 2013 5