Acquisition of trans-o-flex

Acquisition of trans-o-flex

Acquisition of trans-o-flex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

30-October-2006

Disclaimer<br />

This presentation contains forward-looking statements, based on the currently held<br />

beliefs and assumptions <strong>of</strong> the management <strong>of</strong> Austrian Post, which are expressed in<br />

good faith and, in their opinion, reasonable. These statements may be identified by<br />

words such as “expectation” or “target” and similar expressions, or by their context.<br />

Forward-looking statements involve known and unknown risks, uncertainties and other<br />

factors, which may cause the actual results, financial condition, performance, or<br />

achievements <strong>of</strong> Austrian Post, or results <strong>of</strong> the postal industry generally, to differ<br />

materially from the results, financial condition, performance or achievements expressed<br />

or implied by such forward-looking statements. Given these risks, uncertainties and<br />

other factors, recipients <strong>of</strong> this document are cautioned not to place undue reliance on<br />

these forward-looking statements. Austrian Post disclaims any obligation to update<br />

these forward-looking statements to reflect future events or developments.<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

2

Overview <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Strategic Aspects <strong>of</strong> Transaction<br />

Transaction Structure and Timeline<br />

Financial Impact<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

3

<strong>trans</strong>-o-<strong>flex</strong> is one <strong>of</strong> the leading specialized logistics<br />

service providers within the B2B segment in Germany<br />

Logistics network with 39 delivery centers covering the entire<br />

German market<br />

Attractive business model with combined freight (parcels and<br />

pallets) and recipient-oriented aggregation <strong>of</strong> shipments<br />

Successful niche focus on selective industries<br />

– Life Sciences<br />

– Consumer Electronics/Home Entertainment<br />

– Lifestyle/Cosmetics<br />

Leading market position in the Life Sciences industry<br />

Additional special services such as temperature-controlled<br />

delivery and <strong>trans</strong>portation <strong>of</strong> hazardous goods<br />

Lean corporate structure with high degree <strong>of</strong> outsourcing<br />

Long-lasting relationships with blue-chip customers<br />

Sales <strong>of</strong> approx. €460 million and EBITDA <strong>of</strong> approx. €27<br />

million in the twelve months up to and including June 2006<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

4

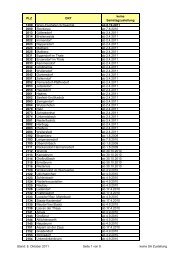

<strong>trans</strong>-o-<strong>flex</strong> operates a Germany-wide logistics<br />

network<br />

Clearly defined and highly <strong>flex</strong>ible network structure<br />

with multi-functional locations<br />

30 October 2006<br />

<strong>trans</strong>-o-<strong>flex</strong> network<br />

39 delivery centers (delivery)<br />

there<strong>of</strong><br />

19 „full-service centers“ (delivery, collection)<br />

there<strong>of</strong><br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

6 HUBs (delivery, collection, crossdock)<br />

• Center operations are fully outsourced to<br />

separate legal entities (Distribution-GmbHs)<br />

• <strong>trans</strong>-o-<strong>flex</strong> manages the customer<br />

relationships – particularly the key account<br />

management<br />

• Operations are executed by the centers through<br />

optimised processes with coordinated<br />

procedures<br />

• <strong>trans</strong>-o-<strong>flex</strong> is in full control <strong>of</strong> the business<br />

through IT, quality-audit, etc.<br />

► Delivery centers work under own<br />

responsibilities which results in<br />

increased efficiency and pr<strong>of</strong>itability<br />

Dortmund<br />

Duisburg<br />

Kerpen<br />

Meinerzhagen<br />

Köln<br />

Koblenz<br />

St. Ingbert<br />

Osnabrück<br />

Münster<br />

Wiesbaden<br />

Offenburg<br />

Bremen<br />

Herford<br />

Gießen<br />

Frankfurt<br />

Weinheim<br />

Donaueschingen<br />

Neumünster<br />

Kassel<br />

Bruchsal<br />

Stuttgart<br />

Hamburg<br />

Hannover<br />

Braunschweig<br />

Würzburg<br />

Ulm<br />

Augsburg<br />

Kaufbeuren<br />

Magdeburg<br />

Erfurt<br />

Jena<br />

Bayreuth<br />

Nürnberg<br />

Rostock<br />

Leipzig<br />

München<br />

Straubing<br />

Rosenheim<br />

Berlin<br />

Dresden<br />

5

Unique competitive positioning <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

<strong>trans</strong>-o-<strong>flex</strong> <strong>of</strong>fers individual solutions in its core segments and thereby differentiates<br />

itself from its competitors. Recently acquired thermomed supplements <strong>trans</strong>-o-<strong>flex</strong>’<br />

special services<br />

30 October 2006<br />

Specialists<br />

Generalists<br />

Courier Express<br />

Parcel<br />

Weight per shipment:<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

UPS /<br />

UNIDATA<br />

FedEx<br />

DPD<br />

GLS<br />

DHL<br />

TNT<br />

<strong>trans</strong>med<br />

<strong>trans</strong>-o-<strong>flex</strong><br />

thermomed<br />

Dachser<br />

Hellmann<br />

Courier Services Others<br />

40 kg<br />

System<br />

Alliance<br />

IDS<br />

Freight<br />

Forwarder<br />

6

<strong>trans</strong>-o-<strong>flex</strong> has a successful industry niche focus<br />

Strong focus on Life Sciences, Consumer Electronics/Home Entertainment and<br />

Lifestyle/Cosmetics<br />

30 October 2006<br />

Life Sciences<br />

• Pharma<br />

• Dental<br />

• Radio pharmaceuticals<br />

• Diagnostics<br />

• Laboratory<br />

Consumer Electronics /<br />

Home Entertainment<br />

• Computer hardware<br />

• S<strong>of</strong>tware<br />

• Picture and sound storage<br />

mediums<br />

• Consumer electronics<br />

• Office and information technology<br />

Note: Sales split by national and international network in 2005<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

55%<br />

23%<br />

9%<br />

13%<br />

Lifestyle / Cosmetics<br />

• Pharmacy cosmetics<br />

• Perfumes<br />

• Skin care<br />

• Hair care products<br />

Other<br />

• Automotive<br />

• Print / publisher<br />

• Food<br />

• Chemical products<br />

• Gardening tools<br />

• Textiles<br />

• Tobacco<br />

7

Blue-chip customer base<br />

<strong>trans</strong>-o-<strong>flex</strong> has long-lasting relationships with blue-chip customers<br />

30 October 2006<br />

Life Sciences<br />

Sales by business area (2005)<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Consumer Electronics/<br />

Home Entertainment<br />

Other<br />

Life Style/<br />

Cosmetics<br />

55% 23% 13% 9%<br />

8

Overview <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Strategic Aspects <strong>of</strong> Transaction<br />

Transaction Structure and Timeline<br />

Financial Impact<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

9

Strategic aspects <strong>of</strong> <strong>trans</strong>action<br />

One <strong>of</strong> the leading logistics service providers for B2B express<br />

delivery in Germany<br />

Significant “know-how” in handling combined freight and one <strong>of</strong> the<br />

leading service provider for all companies whose products have<br />

special handling and requirements such as the pharma industry<br />

Strong market position in Germany, Austria’s most important trading<br />

partner and the largest logistics market in Europe<br />

Expanding European network EURODIS in Western Europe as well<br />

as CEE<br />

Focus on attractive industries such as Life Sciences, Consumer<br />

Electronics/Home Entertainment and Lifestyle/Cosmetics<br />

Special services such as temperature-controlled storage and<br />

<strong>trans</strong>portation <strong>of</strong> hazardous goods<br />

<strong>trans</strong>-o-<strong>flex</strong> acts as a system architect and process developer in an<br />

optimised process with blue-chip customers<br />

30 October 2006<br />

Strengths<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

=<br />

1.<br />

2.<br />

3.<br />

Benefits<br />

Strengthen positioning <strong>of</strong><br />

Parcel & Logistics Division<br />

in existing home markets<br />

and B2B growth<br />

Accelerate international<br />

expansion<br />

Enter attractive<br />

niche markets<br />

10

<strong>trans</strong>-o-<strong>flex</strong> will further strengthen Austrian Post’s<br />

Parcel & Logistics Division<br />

Letter<br />

Mail<br />

Direct mail<br />

Newspapers<br />

and periodicals<br />

July 2005 to June 2006 Sales: 1<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Parcel & Logistics<br />

Parcels<br />

Express deliveries<br />

Branch Network<br />

Postal services<br />

Financial and insurance<br />

products<br />

Retail products<br />

Post: €1,303m Post: €222m Post: €197m<br />

+<br />

(1) Austrian Post external sales based on IFRS (incl. Others/Consolidation); <strong>trans</strong>-o-<strong>flex</strong> total sales based on German GAAP (management reporting).<br />

Pro-forma Group 1<br />

Sales Split<br />

Branch Network<br />

9%<br />

Parcel &<br />

Logistics<br />

31%<br />

Mail<br />

60%<br />

Post: €1,727m<br />

<strong>trans</strong>-o-<strong>flex</strong>: €460m Pro-forma: €2,187m<br />

11

Attractive business model characterized by combined<br />

freight and recipient-oriented consolidation <strong>of</strong> shipments<br />

Parcel<br />

Parcel<br />

Companies:<br />

DHL<br />

UPS<br />

DPD<br />

GLS<br />

TNT<br />

…<br />

Strong USP with respect to competitors<br />

30 October 2006<br />

Temperature-controlled<br />

„Easy-pickup“<br />

Combined<br />

Combined<br />

freight<br />

freight<br />

Flexible<br />

Flexible<br />

shipment<br />

shipment<br />

definition<br />

definition<br />

B2B<br />

B2B<br />

with<br />

with<br />

segment<br />

segment<br />

focus<br />

focus<br />

Recipient<br />

orientation<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Hazardous goods &<br />

radio pharmaceuticals<br />

Groupage<br />

Freight<br />

Forwarders:<br />

Dachser<br />

Schenker<br />

DHL Solutions/<br />

Danzas<br />

IDS<br />

System<br />

Alliance<br />

…<br />

<strong>trans</strong>-o-<strong>flex</strong> as supplier <strong>of</strong> combined<br />

freight in Germany<br />

– Combined servicing <strong>of</strong> parcel (to 30 kg)<br />

and part-load (from 30 kg up to several<br />

pallets)<br />

High penetration <strong>of</strong> pharma market<br />

enables the consolidation <strong>of</strong> deliveries<br />

at the recipient<br />

– Consolidation <strong>of</strong> shipments at the recipient<br />

which results in higher stop factor<br />

compensates for potential cost<br />

disadvantage<br />

12

The <strong>trans</strong>action enlarges Austrian Post’s economic<br />

footprint<br />

Austrian Post will operate in a combined market with a total population <strong>of</strong> approx. 110m<br />

people<br />

30 October 2006<br />

Germany<br />

Leading market position<br />

in combined freight and<br />

B2B express delivery for<br />

Life Sciences<br />

Austria<br />

#1 in letter mail<br />

#1 in addressed direct mailings<br />

#1 in unaddressed direct mailings<br />

#1 in X2C parcels<br />

#1 in Media Post<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

#2 in parcels<br />

#2 in unaddressed direct mail<br />

Slovakia<br />

Hungary<br />

#1 in unaddressed direct mail<br />

Croatia<br />

#2 in parcels<br />

#1 unaddressed direct mailings<br />

13

<strong>trans</strong>-o-<strong>flex</strong> is establishing the European network<br />

EURODIS<br />

EURODIS is a European network <strong>of</strong> independent<br />

logistics companies which jointly provide distribution<br />

services within Europe<br />

EURODIS was founded by <strong>trans</strong>-o-<strong>flex</strong><br />

The main tasks <strong>of</strong> EURODIS are clearing, track and<br />

trace, managing European tenders, customer<br />

relationships, IT and marketing<br />

EURODIS <strong>of</strong>fers a comprehensive pick-up and<br />

delivery <strong>of</strong> shipments in Europe on a daily basis<br />

Austrian Post intends to further strengthen the<br />

successful establishment <strong>of</strong> EURODIS<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

14

Overview <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Strategic Aspects <strong>of</strong> Transaction<br />

Transaction Structure and Timeline<br />

Financial Impact<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

15

Transaction structure<br />

Enterprise Value <strong>of</strong> €225m as <strong>of</strong> 30-June-2006 (purchase price equals<br />

enterprise value less net financial debt)<br />

Two-step <strong>trans</strong>action:<br />

– 1 st Tranche: 74.9% stake acquired with closing expected in Dec-2006<br />

– 2 nd Tranche: Option to acquire remaining 25.1% at the latest in 2009<br />

Transaction subject to approval by the relevant antitrust authority<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

16

Expected timeline for the <strong>trans</strong>action<br />

Until Dec-2006 In Dec-2006 2008/2009<br />

30 October 2006<br />

Announcement <strong>of</strong> the<br />

<strong>trans</strong>action (30-Oct-2006)<br />

Application for approval by<br />

antitrust authorities<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Closing:<br />

Transfer <strong>of</strong> 74.9%<br />

stake<br />

Payment <strong>of</strong> purchase<br />

price (74.9%)<br />

Consolidation <strong>of</strong><br />

<strong>trans</strong>-o-<strong>flex</strong><br />

Potential Execution <strong>of</strong><br />

options:<br />

Put option for seller<br />

in June 2008<br />

Call option for<br />

Austrian Post in May<br />

2009<br />

17

Overview <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

Strategic Aspects <strong>of</strong> Transaction<br />

Transaction Structure and Timeline<br />

Financial Impact<br />

30 October 2006<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

18

Positive financial impact<br />

July 2005 to June 2006 1<br />

Sales<br />

EBITDA<br />

(1) Austrian Post figures based on IFRS; <strong>trans</strong>-o-<strong>flex</strong> figures based on German GAAP (management reporting).<br />

30 October 2006<br />

Margin<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

1,727<br />

239<br />

460<br />

27<br />

Pro-forma<br />

2,187<br />

13.8% 5.9%<br />

12.2%<br />

Austrian Post does not expect any changes to its stated dividend policy as a consequence <strong>of</strong> the<br />

<strong>trans</strong>action.<br />

267<br />

19

<strong>trans</strong>-o-<strong>flex</strong> matches all <strong>of</strong> Austrian Post’s stringent<br />

acquisition criteria<br />

Strategic<br />

Business<br />

Financial<br />

30 October 2006<br />

Geographic expansion in European countries with a focus on neighbouring<br />

CEE markets or<br />

Functional expansion into related service areas to expand existing postal<br />

services platform<br />

Private company<br />

Top market position<br />

Existing know-how about markets and customers – management remains<br />

Customers, service and IT standards to be integrated within 12 months<br />

Last mile service all over the country<br />

ROIC post-tax <strong>of</strong> more than 7%, which is above Austrian Post’s internal<br />

hurdle rate for cost <strong>of</strong> capital<br />

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

20

<strong>Acquisition</strong> <strong>of</strong> <strong>trans</strong>-o-<strong>flex</strong><br />

30-October-2006