FirstCaribbean International Bank Limited

FirstCaribbean International Bank Limited

FirstCaribbean International Bank Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis<br />

Taxes were lower than the prior year by $15 million or<br />

54% due to a lower proportion of income earned in<br />

taxable jurisdictions.<br />

Review of Consolidated Statement of<br />

Total Comprehensive Income<br />

$millions, as at October 31 2010 2009<br />

Net income for the year 157 175<br />

Other comprehensive income:<br />

Net (losses)/gains on availablefor-sale<br />

investment securities (14) 113<br />

Exchange differences on<br />

translation of foreign operations 3 (14)<br />

Other comprehensive income (11) 99<br />

Total comprehensive income 146 274<br />

Total comprehensive income declined by $128 million or<br />

47% due to the following:<br />

- decline in net income for the year by $18 million as<br />

explained above; and<br />

- decline in other comprehensive income by $110<br />

million due to the realisation of the 2009 availablefor-sale<br />

securities gains on sale in 2010 through<br />

the statement of income. These decreases were<br />

partially offset by increases in exchange differences<br />

on translation of foreign operations mainly Jamaica<br />

where the Jamaican dollar appreciated.<br />

The <strong>Bank</strong> conducts business in two jurisdictions (Jamaica<br />

and Trinidad) that have functional currencies that float<br />

against the United States (U.S.) dollar. The Jamaican<br />

dollar appreciated slightly by 3.0% year on year, while the<br />

Trinidad dollar remained relatively stable. This resulted in<br />

a gain of $3 million in the current year compared with a<br />

loss of $14 million in the prior year when the currency<br />

was devaluing.<br />

Liabilities & shareholders’ equity<br />

Deposits<br />

Individuals 3,494 3,613<br />

Business & Government 4,357 4,876<br />

<strong>Bank</strong>s 62 141<br />

Other 30 28<br />

7,943 8,658<br />

Other borrowings 45 38<br />

Debt issued 31 125<br />

Other liabilities 174 163<br />

Minority interest 30 28<br />

Shareholder’s equity 1,543 1,491<br />

9,766 10,503<br />

Assets<br />

Total assets declined year on year by $737 million or<br />

7% mainly due to the slowdown in loan demand, as<br />

well as, the reduction in cash and deposits with banks<br />

attributable to the net repayment of deposit liabilities.<br />

Liabilities<br />

Client liquidity needs resulted in a decline in deposits<br />

by $715 million or 8%. Fixed deposits accounted for<br />

approximately 70% of this decline.<br />

The <strong>Bank</strong> redeemed its Cayman issued debt in full<br />

during the year which accounted for the reduction of $94<br />

million compared to 2009.<br />

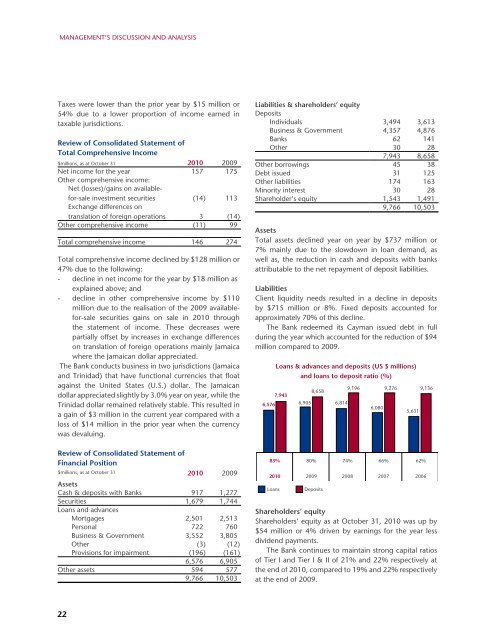

Loans & advances and deposits (US $ millions)<br />

and loans to deposit ratio (%)<br />

Review of Consolidated Statement of<br />

Financial Position<br />

$millions, as at October 31 2010 2009<br />

Assets<br />

Cash & deposits with <strong>Bank</strong>s 917 1,277<br />

Securities 1,679 1,744<br />

Loans and advances<br />

Mortgages 2,501 2,513<br />

Personal 722 760<br />

Business & Government 3,552 3,805<br />

Other (3) (12)<br />

Provisions for impairment (196) (161)<br />

6,576 6,905<br />

Other assets 594 577<br />

9,766 10,503<br />

Shareholders’ equity<br />

Shareholders’ equity as at October 31, 2010 was up by<br />

$54 million or 4% driven by earnings for the year less<br />

dividend payments.<br />

The <strong>Bank</strong> continues to maintain strong capital ratios<br />

of Tier I and Tier I & II of 21% and 22% respectively at<br />

the end of 2010, compared to 19% and 22% respectively<br />

at the end of 2009.<br />

22