FirstCaribbean International Bank Limited

FirstCaribbean International Bank Limited

FirstCaribbean International Bank Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

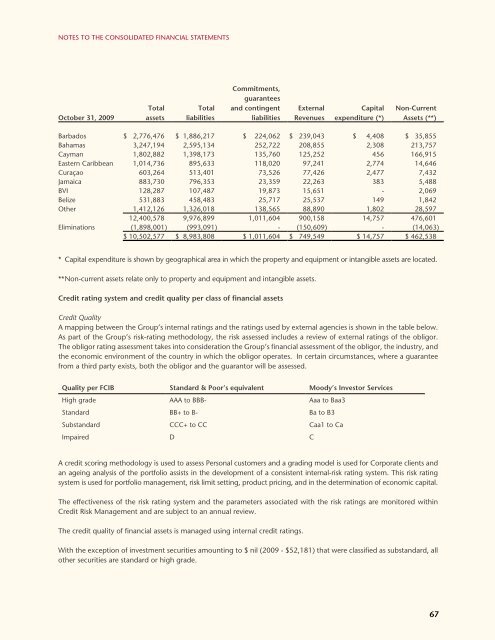

Notes To The Consolidated Financial Statements<br />

October 31, 2009<br />

Total<br />

assets<br />

Total<br />

liabilities<br />

Commitments,<br />

guarantees<br />

and contingent<br />

liabilities<br />

External<br />

Revenues<br />

Capital<br />

expenditure (*)<br />

Non-Current<br />

Assets (**)<br />

Barbados $ 2,776,476 $ 1,886,217 $ 224,062 $ 239,043 $ 4,408 $ 35,855<br />

Bahamas 3,247,194 2,595,134 252,722 208,855 2,308 213,757<br />

Cayman 1,802,882 1,398,173 135,760 125,252 456 166,915<br />

Eastern Caribbean 1,014,736 895,633 118,020 97,241 2,774 14,646<br />

Curaçao 603,264 513,401 73,526 77,426 2,477 7,432<br />

Jamaica 883,730 796,353 23,359 22,263 383 5,488<br />

BVI 128,287 107,487 19,873 15,651 - 2,069<br />

Belize 531,883 458,483 25,717 25,537 149 1,842<br />

Other 1,412,126 1,326,018 138,565 88,890 1,802 28,597<br />

12,400,578 9,976,899 1,011,604 900,158 14,757 476,601<br />

Eliminations (1,898,001) (993,091) - (150,609) - (14,063)<br />

$ 10,502,577 $ 8,983,808 $ 1,011,604 $ 749,549 $ 14,757 $ 462,538<br />

* Capital expenditure is shown by geographical area in which the property and equipment or intangible assets are located.<br />

** Non-current assets relate only to property and equipment and intangible assets.<br />

Credit rating system and credit quality per class of financial assets<br />

Credit Quality<br />

A mapping between the Group’s internal ratings and the ratings used by external agencies is shown in the table below.<br />

As part of the Group’s risk-rating methodology, the risk assessed includes a review of external ratings of the obligor.<br />

The obligor rating assessment takes into consideration the Group’s financial assessment of the obligor, the industry, and<br />

the economic environment of the country in which the obligor operates. In certain circumstances, where a guarantee<br />

from a third party exists, both the obligor and the guarantor will be assessed.<br />

Quality per FCIB Standard & Poor’s equivalent Moody’s Investor Services<br />

High grade AAA to BBB- Aaa to Baa3<br />

Standard BB+ to B- Ba to B3<br />

Substandard CCC+ to CC Caa1 to Ca<br />

Impaired D C<br />

A credit scoring methodology is used to assess Personal customers and a grading model is used for Corporate clients and<br />

an ageing analysis of the portfolio assists in the development of a consistent internal-risk rating system. This risk rating<br />

system is used for portfolio management, risk limit setting, product pricing, and in the determination of economic capital.<br />

The effectiveness of the risk rating system and the parameters associated with the risk ratings are monitored within<br />

Credit Risk Management and are subject to an annual review.<br />

The credit quality of financial assets is managed using internal credit ratings.<br />

With the exception of investment securities amounting to $ nil (2009 - $52,181) that were classified as substandard, all<br />

other securities are standard or high grade.<br />

67