- Page 1 and 2:

Amadeus Annual Report 2010

- Page 4:

Index CEO message__________________

- Page 8:

Amadeus at a glance 1

- Page 12:

12 | Amadeus Annual Report 2010 Ann

- Page 16:

16 | Amadeus Annual Report 2010 Ann

- Page 20:

20 | Amadeus Annual Report 2010 Ann

- Page 24:

24 | Amadeus Annual Report 2010 Ann

- Page 28:

28 | Amadeus Annual Report 2010 Ann

- Page 32:

32 | Amadeus Annual Report 2010 Ann

- Page 36:

36 | Amadeus Annual Report 2010 Ann

- Page 40:

40 | Amadeus Annual Report 2010 Ann

- Page 44:

44 | Amadeus Annual Report 2010 Ann

- Page 48:

48 | Amadeus Annual Report 2010 Ann

- Page 52:

52 | Amadeus Annual Report 2010 Ann

- Page 56:

56 | Amadeus Annual Report 2010 Ann

- Page 60:

60 | Amadeus Annual Report 2010 Ann

- Page 64:

64 | Amadeus Annual Report 2010 Ann

- Page 68:

68 | Amadeus Annual Report 2010 Ann

- Page 72:

72 | Amadeus Annual Report 2010 Ann

- Page 76:

76 | Amadeus Annual Report 2010 Ann

- Page 80:

80 | Amadeus Annual Report 2010 Ann

- Page 84:

84 | Amadeus Annual Report 2010 Ann

- Page 88:

26 Economic, social and environment

- Page 92:

92 | Amadeus Annual Report 2010 Ann

- Page 96:

96 | Amadeus Annual Report 2010 Ann

- Page 100:

100 | Amadeus Annual Report 2010 An

- Page 104:

104 | Amadeus Annual Report 2010 An

- Page 108:

108 | Amadeus Annual Report 2010 An

- Page 112:

112 | Amadeus Annual Report 2010 An

- Page 116:

116 | Amadeus Annual Report 2010 Co

- Page 120:

CONSOLIDATED FINANCIAL INFORMATION

- Page 126:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 130:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 134:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 138:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 142:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 146:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 150:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 154:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 158:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 162:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 166:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 170:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 174:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 178:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 182:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 186:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 190:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 194:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 198:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 202:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 206:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 210:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 214:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 218:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 222:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 226:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 230:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 234:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 238:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 242:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 246:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 250:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 254:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 258:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 262:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 266:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 270:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 274:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 278:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 282:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 286:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 290:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 294:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 298:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 302:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 306:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 310:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 314:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 318:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 322:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 326:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 330:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 334: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 338: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 342: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 346: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 350: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 354: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 358: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 362: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 366: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 370: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 374: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 378: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 382: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 388: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 392: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 396: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 400: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 404: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 408: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 412: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 416: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 420: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 424: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 428: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 432: AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 436:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 440:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 444:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 448:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 452:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 456:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 460:

AMADEUS IT HOLDING, S.A. AND SUBSID

- Page 464:

CORPORATE GOVERNANCE ANNUAL REPORT

- Page 468:

Please specify the most significant

- Page 472:

A.8 Please complete the following t

- Page 476:

B.1.2 Please complete the following

- Page 480:

EXTERNAL INDEPENDENT BOARD MEMBERS

- Page 484:

Executive Officer (CEO) of the Amad

- Page 488:

(a) (b) (c) (d) those boards of whi

- Page 492:

Other Benefits Amount in thousands

- Page 496:

Meeting, the prorating of amounts i

- Page 500:

Issues considered in the remunerati

- Page 504:

B.1.18 Please specify whether the B

- Page 508:

NO B.1.25 Please specify whether th

- Page 512:

Please specify, if applicable, the

- Page 516:

Company Group Total Amount for non-

- Page 520:

B.1.43 Please specify whether the C

- Page 524:

Submission of proposals to the Boar

- Page 528:

The Audit Committee will prepare an

- Page 532:

B.2.5. Please indicate, where appli

- Page 536:

C.6. Please describe the mechanisms

- Page 540:

If so, please specify the circumsta

- Page 544:

The Company, at the time of calling

- Page 548:

SECOND.- Review and, if thought fit

- Page 552:

4. In the case of representation gr

- Page 556:

c) Transactions whose effect is equ

- Page 560:

(v) The creation or acquisition of

- Page 564:

explain, where applicable, why form

- Page 568:

Complies 23. That all Board members

- Page 572:

The circumstances described in subs

- Page 576:

38. That, in calculating any remune

- Page 580:

c) They must be chaired by independ

- Page 584:

and Internal Audit Departments). Th

- Page 588:

57. That, in addition to the functi

- Page 592:

Stephan Gemkow 83 Francesco Loredan

- Page 596:

AMADELUX Investments, S.A. Airline

- Page 600:

Board of Directors When these Annua

- Page 604:

FINANCIAL INFORMATION 2010 AND ANNU

- Page 612:

AMADEUS IT HOLDING, , S.A. BALANCE

- Page 616:

AMADEUS IT HOLDING, S.A. STATEMENT

- Page 620:

AMADEUS IT HOLDING, , S.A. STATEMEN

- Page 624:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 628:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 632:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 636:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 640:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 644:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 648:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 652:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 656:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 660:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 664:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 668:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 672:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 676:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 680:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 684:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 688:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 692:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 696:

AMADEUS ADEUS IT HOLDING, , S.A. NO

- Page 700:

AMADEUS IT HOLDING, S.A NOTES TO TH

- Page 704:

AMADEUS IT HOLDING, S.A NOTES TO TH

- Page 708:

AMADEUS IT HOLDING, S.A NOTES TO TH

- Page 712:

AMADEUS IT HOLDING, S.A NOTES TO TH

- Page 716:

AMADEUS IT HOLDING, S.A NOTES TO TH

- Page 720:

INDEX 1 Summary 1 1.1 Introduction

- Page 724:

1.1.1 Key operating highlights The

- Page 728:

• Travel Guard, a worldwide leade

- Page 732:

• In the e-Commece area, in 2010

- Page 736:

1.1.3 Presentation of Financial Inf

- Page 740:

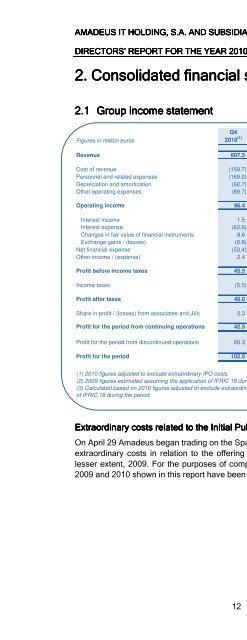

2. CONSOLIDATED FINANCIAL AL STATEM

- Page 744:

IFRIC 18 clarifies the accounting t

- Page 748:

Cost of revenue increased by 4.8% f

- Page 752:

- Regionalisation efforts, with the

- Page 756:

2.1.7 Share in profit / (losses) fr

- Page 760:

2.2 Statement of financial position

- Page 764:

Table 4 Q4 Q4 % Full Year Full Year

- Page 768:

Reconciliation with financial state

- Page 772:

3. SEGMENT REPORTING 3.1 Distributi

- Page 776:

Table 6 Full Year % of Total Air Fu

- Page 780:

In addition, the following also had

- Page 784:

Our IT transactional revenue per PB

- Page 788:

4. OTHER FINANCIAL INFORMATION 4.1

- Page 792:

6. OTHER ADDITIONAL INFORMATION 6.1

- Page 796:

6.4 Treasury Shares These shares ar

- Page 800:

Sensitivity of fair value to parall

- Page 804:

6.6 Subsequent Events On the Februa

- Page 808:

7.1.3 Direct or indirect significan

- Page 812:

Directors shall cease to hold offic

- Page 816:

private contract or otherwise, this

- Page 820:

FORM ANNUAL CORPORATE GOVERNANCE RE

- Page 824:

% of share capital affected: 56.34

- Page 828:

accordance with the procedure provi

- Page 832:

Please specify any resignations fro

- Page 836:

Mergers in London. Name of member M

- Page 840:

B.1.7 Please identify any Board mem

- Page 844:

Statutory benefits 0 Stock options

- Page 848:

EBERHARD HAAG TOMAS LOPEZ FERNEBRAN

- Page 852:

The Company is authorized to contra

- Page 856:

B.1.17 Please identify any Board me

- Page 860:

when they are subject to any of the

- Page 864:

B.1.28 Please specify whether there

- Page 868:

is, in turn, general counsel. His a

- Page 872:

Explanation of procedure (a) (b) (c

- Page 876:

B.2 Board of Directors’ Committee

- Page 880:

e) to be familiar with the Company

- Page 884:

f) to analyze, formulate and period

- Page 888:

C. RELATED-PARTY TRANSACTIONS C.1.

- Page 892:

The general risk management control

- Page 896:

% quorum different from that establ

- Page 900:

Details of measures The Chairman sh

- Page 904:

SIXTEENTH.- Delegation to the Board

- Page 908:

E.11 Please state whether the Compa

- Page 912:

account of different clients may fr

- Page 916:

11. That in the event of any extern

- Page 920:

N/A 18. That the Secretary of the B

- Page 924:

28. That companies publish and upda

- Page 928:

35. That the remuneration policy ap

- Page 932:

vi) The remuneration received from

- Page 936:

50. That the Audit Committee shall

- Page 940:

Complies 54. That the majority of t

- Page 944:

With regard to the most significant

- Page 948:

Section B.1.29 At the Audit Committ

- Page 952:

Date and signature: This Annual Cor

- Page 956:

© 2011 Amadeus IT Group SA | 1DMA