Unit - Anna Lee

Unit - Anna Lee

Unit - Anna Lee

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

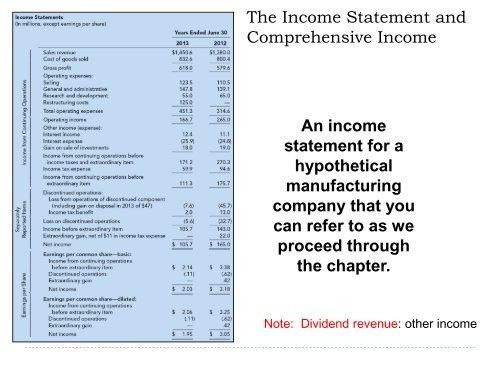

The Income Statement and<br />

Comprehensive Income<br />

An income<br />

statement for a<br />

hypothetical<br />

manufacturing<br />

company that you<br />

can refer to as we<br />

proceed through<br />

the chapter.<br />

Note: Dividend revenue: other income

4-2<br />

Separately Reported Items<br />

Reported separately, net of taxes:<br />

Discontinued<br />

operations<br />

Extraordinary<br />

items

4-3<br />

Intraperiod Income Tax Allocation<br />

Income Tax Expense must be associated with<br />

each component of income that causes it.<br />

Show Income Tax<br />

Expense related to<br />

Income from Continuing<br />

Operations.<br />

Report effects of<br />

Discontinued Operations and<br />

Extraordinary Items net of<br />

related income tax effect.

4-4<br />

Discontinued Operations<br />

As part of the continuing process to converge U.S. GAAP and<br />

international standards, the FASB and IASB have been working<br />

together to develop a common definition and a common set of<br />

disclosures for discontinued operations.<br />

The proposed ASU (Accounting Standards Updates) defines a<br />

discontinued operation as a “component” that either (a) has<br />

been disposed of or (b) is classified as held for sale, and<br />

represents one of the following:<br />

1. a separate major line of business or major geographical area<br />

of operations,<br />

2. part of a single coordinated plan to dispose of a separate<br />

major line of business or geographical area of operations, or<br />

3. a business that meets the criteria to be classified as held for<br />

sale on acquisition.

Reporting Discontinued Operations<br />

Reporting for Components Sold<br />

4-5<br />

1. Income or loss from<br />

operations of the component<br />

from the beginning of the<br />

reporting period to the<br />

disposal date.<br />

2. Gain or loss on the disposal of<br />

the component’s assets.<br />

Reporting for Components Held For Sale<br />

1. Income or loss from<br />

operations of the component<br />

from the beginning of the<br />

reporting period to the end<br />

of the reporting period.<br />

2. An “impairment loss”<br />

if asset’s carrying value (book value) ><br />

(fair value - cost to sell, i.e., net<br />

realizable value).<br />

1 & 2 can be combined or separately<br />

reported.<br />

If 1 & 2 are combined, the impairment<br />

loss must be disclosed.

Impairment of Value<br />

Accounting treatment differs.<br />

Test for<br />

impairment<br />

of value when<br />

considered<br />

for sale.<br />

4-6<br />

Long-term assets<br />

to be held and used<br />

Long-term assets<br />

held for sale<br />

Tangible and<br />

intangible<br />

with finite<br />

useful lives<br />

Intangibles<br />

with<br />

indefinite<br />

useful lives<br />

Test for impairment of value<br />

when it is suspected that book<br />

value may not be recoverable.<br />

Goodwill<br />

Test for<br />

impairment of<br />

value at least<br />

annually.<br />

Other than<br />

Goodwill: Test<br />

for impairment<br />

of value when it<br />

is likely that<br />

the fair value of<br />

a reporting unit<br />

is less than its<br />

book value.

4-7<br />

Finite-Life Assets to be Held and Used<br />

Measurement – Step 1<br />

An asset is impaired when . . .<br />

The undiscounted<br />

sum of its estimated<br />

future cash flows<br />

<<br />

Its<br />

book<br />

value<br />

Recoverability Test

4-8<br />

Finite-Life Assets to be Held and Used<br />

Impairment<br />

loss =<br />

Measurement – Step 2<br />

Book<br />

value<br />

–<br />

Fair<br />

value<br />

Reported in the income<br />

statement as a separate<br />

component of operating<br />

expenses<br />

Market value, price of similar assets,<br />

or PV of future net cash inflows.<br />

Undiscounted future<br />

Fair value<br />

cash flows<br />

$0 $125<br />

$250<br />

Case 1: $50 book value.<br />

No loss recognized<br />

Case 3: $275 book value.<br />

Loss = $275 BV– $125 FV<br />

Case 2: $250 > $150 book value. No loss recognized

4-9<br />

Assets Held for Sale<br />

Assets held for sale:<br />

assets that management<br />

has committed to sell immediately in<br />

their present condition and<br />

for which sale is probable.<br />

Impairment<br />

loss<br />

=<br />

Book<br />

value<br />

–<br />

Fair value less<br />

cost to sell (NRV)

4-10<br />

U.S. GAAP vs. IFRS<br />

Impairment of Value: Property, Plant, and<br />

Equipment and Finite-Life Intangible Assets<br />

<br />

<br />

Assets are tested for impairment<br />

when events or changes<br />

indicates that book value may<br />

not be recoverable.<br />

An impairment loss is required<br />

when an asset’s book value ><br />

the undiscounted sum of the<br />

estimated future cash flows.<br />

<br />

<br />

Assets must be assessed for<br />

circumstances of impairment at<br />

the end of each reporting period.<br />

An impairment loss is required<br />

when an asset’s book value ><br />

Recoverable amount: higher<br />

of the asset’s value-in-use (present<br />

value of estimated future cash<br />

flow) and fair value less costs to<br />

sell (NRV).

4-11<br />

U.S. GAAP vs. IFRS<br />

Impairment of Value: Property, Plant, and<br />

Equipment and Finite-Life Intangible Assets<br />

<br />

<br />

The impairment loss: book value<br />

- fair value.<br />

Reversals of impairment losses are<br />

prohibited.<br />

The impairment loss: book value -<br />

recoverable amount (the higher of<br />

the asset’s value-in-use and fair<br />

value less costs to sell).<br />

<br />

An impairment loss is reversed if<br />

the circumstances that caused the<br />

impairment are resolved.

4-12<br />

Finite-Life Assets to be Held and Used<br />

Because Acme Auto Parts has seen its sales steadily decrease due to the<br />

decline in new car sales, Acme’s management believes that equipment<br />

that originally cost $350 million, with a $200 million book value, may not<br />

be recoverable. Management estimates that future undiscounted cash<br />

flows associated with the equipment’s remaining useful life will be only<br />

$140 million, and that the equipment’s fair value is $120 million.<br />

Has Acme suffered an impairment loss and, if so, how should it be<br />

recorded?<br />

Step 1<br />

$140 million < $200 million<br />

Impairment loss is indicated.

4-13<br />

Finite-Life Assets to be Held and Used<br />

Because Acme Auto Parts has seen its sales steadily decrease due to the<br />

decline in new car sales, Acme’s management believes that equipment<br />

that originally cost $350 million, with a $200 million book value, may not<br />

be recoverable. Management estimates that future undiscounted cash<br />

flows associated with the equipment’s remaining useful life will be only<br />

$140 million, and that the equipment’s fair value is $120 million. Has<br />

Acme suffered an impairment loss and, if so, how should it be recorded?<br />

Step 2<br />

Impairment loss = $200 million BV – $120 million FV = $80 million<br />

Impairment loss ................................... 80,000,000<br />

Accumulated depreciation ................... 150,000,000<br />

Equipment ……………………. 230,000,000<br />

To record impairment loss.

Indefinite-Life Intangibles<br />

4-14<br />

Goodwill<br />

(Special treatment)<br />

Other Indefinitelife<br />

intangibles<br />

Step 1 If BV of reporting unit<br />

> FV, impairment indicated.<br />

Step 2 Loss = BV of goodwill<br />

- implied value of goodwill.<br />

One-Step Process<br />

If asset’s BV > FV,<br />

recognize<br />

impairment loss.<br />

A reporting unit is an operating segment of a company or a component of an<br />

operating segment for which discrete financial information is available (and<br />

segment managers regularly review the operating results of that component).<br />

Implied value = segment’s (reporting unit’s) FV – segment’s net assets (excluding<br />

good will)

4-15<br />

U.S. GAAP vs. IFRS<br />

Impairment of Value: Indefinite-Life Intangible<br />

Assets Other Than Goodwill<br />

<br />

Indefinite-life intangible assets<br />

other than goodwill are tested for<br />

impairment at least annually.<br />

<br />

Indefinite-life intangible assets<br />

other than goodwill are tested for<br />

impairment at least annually.<br />

<br />

The impairment loss: = book value<br />

- fair value.<br />

<br />

The impairment loss = book value<br />

- recoverable amount (the<br />

higher of the asset’s value-in-use<br />

(present value of estimated future<br />

cash flows) and fair value less costs<br />

to sell (NRV)).

4-16<br />

U.S. GAAP vs. IFRS (cont’d)<br />

Impairment of Value: Indefinite-Life Intangible<br />

Assets Other Than Goodwill<br />

<br />

<br />

Reversals of impairment losses are<br />

prohibited.<br />

If certain criteria are met,<br />

indefinite-life intangible assets are<br />

combined for the required annual<br />

impairment test.<br />

<br />

<br />

An impairment loss is reversed if<br />

the circumstances that caused the<br />

impairment are resolved.<br />

Indefinite-life intangible assets may<br />

not be combined with other<br />

indefinite-life intangible assets for<br />

the required annual impairment<br />

test.

4-17<br />

U.S. GAAP vs. IFRS<br />

Impairment of Value: Goodwill<br />

<br />

<br />

<br />

Goodwill is tested for impairment<br />

when it is likely that the fair value<br />

of a reporting unit is less than its<br />

book value.<br />

Reversals of impairment losses are<br />

prohibited.<br />

The level of testing (reporting<br />

unit) is a segment or a component<br />

of an operating segment for which<br />

discrete financial information is<br />

available.<br />

<br />

<br />

<br />

Goodwill is tested for impairment<br />

at least annually.<br />

Reversals of impairment losses are<br />

prohibited.<br />

The level of testing (cashgenerating<br />

unit) is the smallest<br />

identifiable group of assets that<br />

generates cash flows that are<br />

largely independent of the cash<br />

flows from other assets.

U.S. GAAP vs. IFRS<br />

4-18<br />

Impairment of Value: Goodwill<br />

<br />

Measurement of an impairment<br />

loss is a two-step process. In step<br />

one the fair value of the reporting<br />

unit is compared to its book value.<br />

A loss is indicated if the fair value<br />

is less than the book value. In<br />

step two, the impairment loss is<br />

calculated as the excess of book<br />

value of goodwill over the implied<br />

fair value of goodwill.<br />

<br />

Measurement of an impairment<br />

loss is a one-step process. The<br />

recoverable amount of the cashgenerating<br />

unit is compared to its<br />

book value. If the recoverable<br />

amount is < BV, 1 st , reduce<br />

goodwill, 2 nd , reduce other assets.

4-19<br />

Impairment of Goodwill<br />

Simmons Company recorded $150 million of goodwill when it acquired<br />

Blake Company. Blake continues to operate as a separate company and is<br />

considered to be a reporting unit. At the end of the current year Simmons<br />

noted the following related to Blake: (1) book value of net assets, including<br />

$150 million of goodwill, is $500 million; (2) fair value of Blake is $400 million;<br />

and (3) fair value of Blake’s identifiable net assets, excluding goodwill, is<br />

$350 million. Is goodwill impaired and, if so, by what amount?<br />

Step 1<br />

$500 million net assets > $400 million FV<br />

Impairment loss is indicated.

4-20<br />

Impairment of Goodwill<br />

Simmons Company recorded $150 million of goodwill when it acquired<br />

Blake Company. Blake continues to operate as a separate company and is<br />

considered to be a reporting unit. At the end of the current year Simmons<br />

noted the following related to Blake: (1) book value of net assets, including<br />

$150 million of goodwill, is $500 million; (2) fair value of Blake is $400<br />

million; and (3) fair value of Blake’s identifiable net assets, excluding goodwill,<br />

is $350 million. Is goodwill impaired and, if so, by what amount?<br />

Step 2<br />

Determination of implied goodwill<br />

Fair value of Blake $ 400,000,000<br />

Fair value of Blake's net assets excluding goodwill 350,000,000<br />

Implied value of goodwill $ 50,000,000<br />

Measure of impairment loss<br />

Book value of goodwill $ 150,000,000<br />

Implied value of goodwill 50,000,000<br />

Impairment loss $ 100,000,000

4-21<br />

Extraordinary Items<br />

An extraordinary item is a material<br />

event or transaction that is both:<br />

1. Unusual in nature, and<br />

2. Infrequent in occurrence<br />

Extraordinary items are reported net<br />

of related taxes

4-22<br />

Items Not Extraordinary<br />

1. Write-downs of receivables, inventories, intangible<br />

assets.<br />

2. Gains & losses from foreign currencies exchange or<br />

translation.<br />

3. Gains & losses on disposal of a component or entity.<br />

4. Other gains or losses from sale of abandonment of<br />

property, plant, & equipment.<br />

5. Strikes<br />

6. Adjustments of accruals on long-term contracts.

4-23<br />

U. S. GAAP vs. IFRS<br />

The scarcity of extraordinary gains and losses reported in<br />

corporate income statements and the desire to converge<br />

U.S. and international accounting standards could guide<br />

the FASB to the elimination of the extraordinary item<br />

classification.<br />

<br />

Report extraordinary items<br />

separately in the income<br />

statement.<br />

<br />

Prohibits reporting extraordinary<br />

items in the income statement or<br />

notes.

4-24<br />

Unusual or Infrequent Items<br />

Items that are material and are<br />

either unusual or infrequent—but not<br />

both—are included as separate<br />

items in continuing operations, not<br />

net of tax.

4-25<br />

Accounting Changes<br />

Type of Accounting<br />

Changes<br />

Change in Accounting<br />

Principle<br />

Change in Accounting<br />

Estimate<br />

Change in Reporting<br />

Entity<br />

Definition<br />

Change from one GAAP method<br />

to another GAAP method<br />

Revision of an estimate<br />

because of new information or<br />

new experience<br />

Preparation of financial<br />

statements for an accounting<br />

entity other than the entity that<br />

existed in the previous period

4-26<br />

Change in Accounting Principle<br />

Occurs when changing from one GAAP method to<br />

another GAAP method, for example, a change from LIFO<br />

to FIFO<br />

GAAP requires that most voluntary accounting changes be<br />

accounted for retrospectively by revising prior years’<br />

financial statements.<br />

For mandated changes in accounting principles, the FASB<br />

often allows companies to choose to account for the<br />

change retrospectively or as a separately reported<br />

item below extraordinary items.

4-27<br />

Change in Accounting Principle - Example<br />

Change in Accounting Principle: Gaubert Inc. decided in<br />

March 2012 to change from FIFO to weighted-average inventory<br />

pricing. Gaubert’s income before taxes, using the new weightedaverage<br />

method in 2012, is $30,000.<br />

Pretax Income Data<br />

Calculation of a Change in<br />

Accounting Principle<br />

Income Statement<br />

Presentation of a Change<br />

in Accounting Principle<br />

(Based on 30% tax rate)<br />

Under the retrospective approach, the co. recasts the prior year’s income<br />

Numbers under the new method.

4-28<br />

Changes in Estimates<br />

ESTIMATED<br />

service life<br />

ESTIMATED<br />

residual value<br />

Changes in estimates are accounted for prospectively.<br />

The book value less any residual value at the date of change is<br />

depreciated over the remaining useful life. A disclosure note<br />

should describe the effect of a change.<br />

Example: On January 1, equipment was purchased that cost<br />

$30,000, has a useful life of 10 years, and no residual value. At the<br />

beginning of the fourth year, it was decided that there were only 5<br />

years remaining, instead of 7 years.<br />

Calculate depreciation for the fourth<br />

year using the straight-line method.

4-29<br />

Changes in Estimates<br />

Asset cost $ 30,000<br />

Accumulated depreciation<br />

($3,000 per year × 3 years) 9,000<br />

Remaining book value 21,000<br />

Divide by remaining life ÷ 5<br />

Revised annual depreciation $ 4,200

4-30<br />

Change in Depreciation Method<br />

A change in depreciation, amortization, or depletion<br />

method is considered a change in accounting estimate that<br />

is a result of (achieved by) a change in accounting principle.<br />

We account for these changes prospectively,<br />

exactly as we would any other change in estimate.<br />

On January 1, 2011, Matrix Inc. purchased office equipment for $400,000.<br />

Matrix expected a residual value $40,000, and a service life of 5 years.<br />

Matrix uses the double-declining-balance method to depreciate this type of<br />

asset. During 2013, the company switched from double-declining balance to<br />

straight-line depreciation. The residual value remained at $40,000. Let’s<br />

determine the amount of depreciation to be recorded for 2013.

4-31<br />

Change in Depreciation Method<br />

Depreciation - 2011 $ 160,000 ($400,000 × 40%)<br />

Depreciation - 2012 96,000 [($400,000 - $160,000) × 40%]<br />

Total Depreciation $ 256,000<br />

Cost of asset $ 400,000<br />

Less: Accumulated depreciation 256,000<br />

Undepreciated balance $ 144,000<br />

Less: residual value (40,000)<br />

New depreciable amount 104,000<br />

Remaining service life ÷ 3<br />

Annual depreciation $ 34,667<br />

December 31, 2013:<br />

Depreciation expense ................................... 34,667<br />

Accumulated depreciation................ 34,667<br />

To record depreciation expense.

Beginning inventory<br />

Plus: Net purchases<br />

Less: Ending inventory<br />

Cost of goods sold<br />

Corrections of Errors<br />

Example: Inventory Errors<br />

Revenues<br />

Less: Cost of goods sold<br />

Less: Other expenses<br />

Net income<br />

When analyzing inventory errors, it’s<br />

helpful to visualize the way cost of goods<br />

sold, net income, and retained earnings are<br />

determined.<br />

Beginning retained earnings<br />

Plus: net income<br />

Less: Dividends<br />

Ending retained earnings<br />

4-32

4-33<br />

Inventory Errors<br />

• Overstatement of ending inventory<br />

◦ Understates cost of goods sold and<br />

◦ Overstates pretax income.<br />

• Understatement of ending inventory<br />

◦ Overstates cost of goods sold and<br />

◦ Understates pretax income.

4-34<br />

Inventory Errors<br />

• Overstatement of beginning inventory<br />

◦ Overstates cost of goods sold and<br />

◦ Understates pretax income.<br />

• Understatement of beginning inventory<br />

◦ Understates cost of goods sold and<br />

◦ Overstates pretax income.

Correction of Inventory Errors -<br />

Summary<br />

4-35<br />

Discovered the Following Year:<br />

Example: If an inventory error was made in 2013, but not discovered<br />

until 2014 (the following year), the 2013 financial statements were<br />

incorrect as a result of the error. The error should be retrospectively<br />

restated to reflect the correct inventory amount, cost of goods sold, net<br />

income, and retained earnings when the comparative 2014 and 2013<br />

financial statements are issued for 2014.<br />

Dr. Retained Earnings<br />

Cr. Inventory<br />

Discovered Subsequent to the Following Year:<br />

Example: If an error was made in 2013, but not discovered until 2015,<br />

No correcting entry is needed in 2015. The error has self-corrected and<br />

no prior period adjustment is needed.

4-36<br />

Correction of Errors<br />

Errors occur when transactions are either<br />

recorded incorrectly or not recorded at all.<br />

Errors<br />

Discovered in<br />

Same Year<br />

Reverse original erroneous journal entry<br />

and record the appropriate journal entry.<br />

Material Errors<br />

Discovered in<br />

Subsequent Year<br />

Record a prior period adjustment to the<br />

beginning retained earnings balance in a<br />

statement of shareholders’ equity.<br />

Previous years’ financial statements that<br />

are incorrect as a result of the error are<br />

retrospectively restated to reflect the<br />

correction.

4-37<br />

Corrections of Errors (Cont’d)<br />

In addition, a disclosure note is needed to describe the nature of<br />

the error and the impact of its correction on net income, income<br />

before extraordinary items, and earnings per share.

4-38<br />

Corrections of Errors<br />

– Sales Rev & Accounts Receivable Overstated<br />

Example: in 2013, Hillsboro Co. determined that it incorrectly<br />

overstated its accounts receivable and sales revenue by<br />

$100,000 in 2010. In 2013, Hillboro makes the following entry<br />

to correct for this error (ignore income taxes).<br />

Retained earnings 100,000<br />

Accounts receivable 100,000

4-39<br />

Earnings Per Share<br />

- Special Reporting Issues<br />

BEPS =<br />

Net income - Preferred dividends<br />

Weighted average number of shares outstanding<br />

<br />

<br />

<br />

An important business indicator.<br />

Measures the dollars earned by each share of common<br />

stock.<br />

Must be disclosed on the income statement.

Earnings Per Share<br />

- Example<br />

4-40<br />

Earnings Per Share: In 2012, Hollis Corporation reported net<br />

income of $1,000,000. It declared and paid preferred stock<br />

dividends of $250,000. During 2012, Hollis had a weighted<br />

average of 190,000 common shares outstanding. Compute<br />

Hollis’s 2012 earnings per share.<br />

Net income - Preferred dividends<br />

Weighted average number of shares outstanding<br />

$1,000,000<br />

190,000<br />

- $250,000<br />

= $3.95 per share

Special Reporting Issues<br />

4-41<br />

Assume that the co. had 100,000 shares outstanding for the entire year.<br />

Divide by<br />

weightedaverage<br />

shares<br />

outstanding<br />

EPS

4-42<br />

Earnings Per Share Disclosure<br />

One of the most widely used ratios is earnings per<br />

share (EPS), which shows the amount of income<br />

earned by a company expressed on a per share basis.<br />

Basic EPS<br />

Diluted EPS<br />

Net income less preferred dividends<br />

Weighted-average number of<br />

common shares outstanding for the<br />

period<br />

Reflects the potential dilution that could<br />

occur for companies that have certain<br />

securities outstanding that are convertible<br />

into common shares or stock options that<br />

could create additional common shares if<br />

the options were exercised.

4-43<br />

Computing Earnings Per Share<br />

Earnings per share indicates the income earned by each share of<br />

common stock.<br />

<br />

<br />

Companies report earnings per share only for common stock.<br />

When the income statement contains intermediate<br />

components of income (such as discontinued operations or<br />

extraordinary items), companies should disclose earnings per<br />

share for each component.<br />

Illustration 16-7

4-44<br />

EPS - Simple Capital Structure<br />

<br />

<br />

<br />

Simple Structure--Only common stock; no potentially<br />

dilutive securities.<br />

Complex Structure--Potentially dilutive securities are<br />

present.<br />

“Dilutive” means the ability to influence the EPS in a<br />

downward direction.

4-45<br />

EPS - Simple Capital Structure<br />

Preferred Stock Dividends<br />

Subtracts the current-year preferred stock dividend from net<br />

income to arrive at income available to common stockholders.<br />

Preferred dividends are subtracted on cumulative preferred<br />

stock, whether declared or not.

4-46<br />

EPS - Simple Capital Structure<br />

Weighted-Average Number of Shares<br />

Companies must weight the shares by the fraction of the period<br />

they are outstanding.<br />

When stock dividends or share splits occur, companies need to<br />

restate the shares outstanding before the share dividend or split.

4-47<br />

EPS - Simple Capital Structure<br />

Illustration: Franks Inc. has the following changes in its common<br />

stock during the period.<br />

Compute the weighted-average number of shares outstanding<br />

for Frank Inc.

4-48<br />

Weighted-average Number of Shares Outstanding<br />

Weighted-average Number of Shares Outstanding<br />

Dates Outstanding (A) Shares Outstanding (B) Fraction of Year Weighted Shares (AxB)<br />

1/1 - 12/31 90,000 90,000<br />

4/1 - 12/31 30,000 9/12 22,500<br />

7/1 - 12/31 (39,000) 6/12 (19,500)<br />

11/1 - 12/31 60,000 2/12 10,000<br />

Weighted-average<br />

# of shares<br />

outstanding 103,000

4-49<br />

EPS - Complex Capital Structure<br />

Complex Capital Structure exists when a business has<br />

<br />

<br />

convertible securities,<br />

options, warrants, or other rights<br />

that upon conversion or exercise could dilute earnings per<br />

share.<br />

Company is required to report both basic and diluted<br />

earnings per share.

EPS - Complex Capital Structure<br />

Diluted EPS includes the effect of all potential dilutive common<br />

shares that were outstanding during the period.<br />

4-50<br />

Companies will not report diluted EPS if the securities in their capital<br />

structure are antidilutive. Ignore antidilutive securities in all calculations<br />

and in computing diluted earnings per share.<br />

The effect of the conversion or exercise of potential common shares<br />

would increase rather than decrease the EPS, they are referred to as<br />

“Antidilutive Securities”.

4-51<br />

EPS - Complex Capital Structure<br />

Diluted EPS – Convertible Securities<br />

Measure the dilutive effects of potential conversion on EPS<br />

using the if-converted method.<br />

This method for a convertible bond assumes:<br />

(1) the conversion at the beginning of the period (or at<br />

the time of issuance of the security, if issued during<br />

the period), and<br />

(2) the elimination of related interest, net of tax.

4-52<br />

EPS - Complex Capital Structure<br />

Example - Convertible Bonds: In 2012 Buraka Enterprises issued, at par,<br />

75, $1,000, 8% bonds, each convertible into 100 shares of common<br />

stock. Buraka had revenues of $17,500 and expenses other than<br />

interest and taxes of $8,400 for 2013. (Assume that the tax rate is 40%.)<br />

Throughout 2013, 2,000 shares of common stock were<br />

outstanding; none of the bonds was converted or redeemed.<br />

Instructions<br />

(a) Compute diluted earnings per share for 2013.<br />

(b) Assume same facts as those for Part (a), except the 75 bonds were<br />

issued on September 1, 2013 (rather than in 2012), and none have<br />

been converted or redeemed.

4-53<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2013.<br />

Calculation of Net Income<br />

Revenues $17,500<br />

Expenses 8,400<br />

Bond interest expense (75 x $1,000 x 8%) 6,000<br />

Income before taxes 3,100<br />

Income tax expense (40%) 1,240<br />

Net income $ 1,860

4-54<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2013.<br />

When calculating Diluted EPS, begin with Basis EPS.<br />

Basic EPS<br />

Net income = $1,860<br />

Weighted average shares = 2,000<br />

= $.93

4-55<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2013.<br />

When calculating Diluted EPS, begin with Basic EPS.<br />

Diluted EPS<br />

$1,860<br />

2,000<br />

+ $6,000 (1 - .40)<br />

+<br />

7,500<br />

$5,460<br />

= = $.57<br />

9,500<br />

Basic EPS<br />

= .93<br />

Effect on EPS = .48<br />

Adjustment for interest: interest is adjusted (added back as net income)<br />

at “net of tax” if the 75 bonds are converted.<br />

7,500 shares = 75x 100 shares, if converted

4-56<br />

EPS - Complex Capital Structure<br />

(b) Assume bonds were issued on Sept. 1, 2013 .<br />

Calculation of Net Income<br />

Revenues $ 17,500<br />

Expenses 8,400<br />

Bond interest expense (75 x $1,000 x 8% x 4/12) 2,000<br />

Income before taxes 7,100<br />

Income taxes (40%) 2,840<br />

Net income $ 4,260

4-57<br />

EPS - Complex Capital Structure<br />

(b) Assume bonds were issued on Sept. 1, 2013 .<br />

When calculating Diluted EPS, begin with Basic EPS.<br />

Diluted EPS<br />

$4,260<br />

2,000<br />

+<br />

+<br />

$2,000 (1 - .40)<br />

7,500 x 4/12 yr.<br />

$5,460<br />

= = $1.21<br />

4,500<br />

Basic EPS<br />

= 2.13<br />

Effect on EPS = .48<br />

2,000 interest = 6,000 x 4/12

4-58<br />

EPS - Complex Capital Structure<br />

Variation-Convertible Preferred Stock: Prior to 2012, Barkley<br />

Company issued 40,000 shares of 6% convertible, cumulative preferred<br />

stock, $100 par value. Each share is convertible into 5 shares of<br />

common stock. Net income for 2012 was $1,200,000. There were<br />

600,000 common shares outstanding during 2012. There were no<br />

changes during 2012 in the number of common or preferred shares<br />

outstanding.<br />

Instructions<br />

(a) Compute diluted earnings per share for 2012.

4-59<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2012.<br />

When calculating Diluted EPS, begin with Basic EPS.<br />

Basic EPS<br />

Net income $1,200,000 – Pfd. Div. $240,000*<br />

Weighted average shares = 600,000<br />

= $1.60<br />

* 40,000 shares x $100 par x 6% = $240,000 dividend

4-60<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2012.<br />

When calculating Diluted EPS, begin with Basic EPS.<br />

Diluted EPS<br />

$1,200,000 – $240,000<br />

600,000<br />

+<br />

+<br />

$240,000<br />

200,000*<br />

=<br />

$1,200,000<br />

800,000<br />

=<br />

Basic EPS = 1.60<br />

Effect on<br />

EPS = 1.20<br />

$1.50<br />

*(40,000 x 5)

4-61<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2012 assuming each<br />

share of preferred is convertible into 3 shares of common stock.<br />

Diluted EPS<br />

$1,200,000 – $240,000<br />

600,000<br />

+<br />

+<br />

$240,000<br />

120,000*<br />

=<br />

$1,200,000<br />

720,000<br />

=<br />

$1.67<br />

Basic EPS = 1.60<br />

Effect on<br />

EPS = 2.00<br />

*(40,000 x 3)

4-62<br />

EPS - Complex Capital Structure<br />

P16-8 (a) Compute diluted earnings per share for 2012 assuming<br />

each share of preferred is convertible into 3 shares of common<br />

stock.<br />

Diluted EPS<br />

Basic = Diluted EPS<br />

$1,200,000 – $240,000<br />

600,000<br />

Basic EPS = 1.60<br />

+<br />

+<br />

$240,000<br />

120,000*<br />

Antidilutive<br />

Effect on<br />

EPS = 2.00<br />

=<br />

$1,200,000<br />

720,000<br />

$1.67<br />

*(40,000 x 3)<br />

Because the $1.67 DEPS is > the $1.60 BEPS, the effective is antidilutive.<br />

=

4-63<br />

EPS - Complex Capital Structure<br />

Diluted EPS – Options and Warrants<br />

Measure the dilutive effects of potential conversion using the<br />

treasury-stock method.<br />

This method assumes:<br />

(1) company exercises the options or warrants at the<br />

beginning of the year (or date of issue if later), and<br />

(2) that it uses those proceeds to purchase common<br />

stock for the treasury.

4-64<br />

EPS - Complex Capital Structure<br />

Example - EPS with Options: Zambrano Company’s net income for 2012<br />

is $40,000. The only potentially dilutive securities outstanding were<br />

1,000 options issued during 2011, each exercisable for one share at $8.<br />

None has been exercised, and 10,000 shares of common were<br />

outstanding during 2012. The average market price of the stock during<br />

2012 was $20.<br />

Instructions<br />

(a) Compute diluted earnings per share.<br />

(b) Assume the 1,000 options were issued on October 1, 2012 (rather<br />

than in 2011). The average market price during the last 3 months of<br />

2012 was $20.

4-65<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2012.<br />

Treasury-Stock Method<br />

Proceeds if shares issued (1,000 x $8) $8,000<br />

Purchase price for treasury shares $20<br />

Shares assumed purchased 400<br />

Shares assumed issued 1,000<br />

Incremental share increase 600<br />

÷

4-66<br />

EPS - Complex Capital Structure<br />

(a) Compute diluted earnings per share for 2012; the options were<br />

issued at beginning of the year.<br />

When calculating Diluted EPS, begin with Basic EPS.<br />

Diluted EPS<br />

$40,000<br />

10,000<br />

+<br />

+<br />

600<br />

=<br />

$40,000<br />

= $3.77<br />

10,600<br />

Basic EPS<br />

= 4.00<br />

Options

4-67<br />

EPS - Complex Capital Structure<br />

(b) Compute diluted earnings per share assuming the 1,000 options<br />

were issued on October 1, 2012.<br />

Treasury-Stock Method<br />

Proceeds if shares issued (1,000 x $8) $ 8,000<br />

Purchase price for treasury shares $ 20<br />

Shares assumed purchased 400<br />

Shares assumed issued 1,000<br />

Incremental share increase 600<br />

Weight for 3 months assumed outstanding 3/12<br />

Weighted incremental share increase 150<br />

÷<br />

x

4-68<br />

EPS - Complex Capital Structure<br />

(b) Compute diluted earnings per share assuming the 1,000 options<br />

were issued on October 1, 2012.<br />

Diluted EPS<br />

$40,000<br />

10,000<br />

+<br />

150<br />

=<br />

$40,000<br />

= $3.94<br />

10,150<br />

Basic EPS<br />

= 4.00<br />

Options

4-69<br />

EPS - Complex Capital Structure<br />

EPS Presentation and Disclosure<br />

A company should show BEPS (if only has common stocks<br />

outstanding) and DEPS (if has both common stocks and dilutive<br />

“potential common stocks” (PCS)) for:<br />

<br />

<br />

<br />

Income from continuing operations,<br />

Income before extraordinary items, and<br />

Net income.<br />

Per share amounts for a discontinued operation or an extraordinary<br />

item should be presented on the face of the income statement or in<br />

the notes.

4-70<br />

EPS - Complex Capital Structure<br />

Complex capital structures and dual presentation of EPS require the<br />

following additional disclosures in note form.<br />

1. Description of pertinent rights and privileges of the various securities<br />

outstanding.<br />

2. A reconciliation of the numerators and denominators of the basic and<br />

diluted per share computations, including individual income and share<br />

amount effects of all securities that affect EPS.<br />

3. The effect given preferred dividends in determining income available to<br />

common stockholders in computing basic EPS.<br />

4. Securities that could potentially dilute basic EPS in the future that were<br />

excluded in the computation because they would be antidilutive.<br />

5. Effect of conversions subsequent to year-end, but before issuing<br />

statements (subsequent event).

Revenue Recognition Before Delivery<br />

Completed Contract and Percentage-of-Completion<br />

Methods Compared<br />

4-71<br />

Example: At the beginning of 2013, the Harding Construction Company<br />

received a contract to build an office building for $5 million. The project is<br />

estimated to take three years to complete. According to the contract,<br />

Harding will bill the buyer in installments over the construction period<br />

according to a prearranged schedule. Information related to the contract is<br />

as follows:

Accounting for the Cost of Construction<br />

and Accounts Receivable<br />

4-72<br />

With both the completed contract and percentage-ofcompletion<br />

methods, all costs of construction are recorded in<br />

an asset account called construction in progress.

Gross Profit Recognition—General<br />

Approach<br />

4-73<br />

In both methods the same<br />

amounts of revenue, cost,<br />

and gross profit are<br />

recognized.<br />

In both methods we add<br />

gross profit to the<br />

construction in progress<br />

asset.

4-74<br />

How to Determine Gross Profit and Revenue<br />

– Completed Contract Method 3 steps<br />

How To Calculate Gross Profit and Revenue :<br />

1. % of completion = cost incurred/Total actual and estimated cost<br />

2. Gross profit recognized = % of completion x Estimated total gross profit (that is "Contract price - Total actual and estimated cost")<br />

3. Revenue recognized for long-term contract for the year = Gross profit recognized + Cost of construction<br />

Demonstration for Relevant Amounts in 2013 Journal Entry<br />

1. % of completion for 2013 = 1500000/3750000 = 40%<br />

2. 500,000, Gross Profit for 2013 = 40% x (5000000 - 3750000)<br />

3. 2,000,000 Revenue = 500,000 + 1,500,000

Gross Profit Recognition<br />

- Completed Contract<br />

4-75<br />

The same journal entry is recorded to close out the billings<br />

on construction contract and construction in progress<br />

accounts under the completed contract and percentage-ofcompletion<br />

methods.

Timing of Gross Profit Recognition<br />

- Completed Contract Method<br />

4-76<br />

Under the completed contract method, all revenues<br />

and expenses related to the project are recognized<br />

when the contract is completed.

Timing of Gross Profit Recognition<br />

- the Percentage-of-Completion Method<br />

4-77<br />

Under the percentage-of-completion method, profit<br />

is recognized over the life of the project as the<br />

project is completed.<br />

We determine the amount of gross profit recognized in each<br />

period using the following logic:

Percentage-of-Completion Method<br />

Allocation of Gross Profit<br />

4-78

Percentage-of-Completion Method<br />

- Allocation of Gross Profit<br />

4-79<br />

Notice that the gross profit recognized in each period is<br />

added to the construction in progress account.<br />

Percentage-of-Completion<br />

Construction in<br />

Progress<br />

Billings on<br />

Construction Contract<br />

2013 construction costs 1,500,000 1,200,000 2013 billings<br />

2013 gross profit 500,000 2,000,000 2014 billings<br />

End balance, 2013 2,000,000 1,800,000 2015 billings<br />

2014 construction costs 1,000,000 5,000,000 Balance, before closing<br />

2014 gross profit 125,000<br />

End balance, 2014 3,125,000<br />

2015 construction costs 1,600,000<br />

2015 gross profit 275,000<br />

Balance, before closing 5,000,000

Percentage-of-Completion Method<br />

Income Statement - Allocation of Gross Profit<br />

4-80<br />

The income statement for each year will report<br />

the appropriate revenue and cost of<br />

construction amounts.

4-81<br />

Income Recognition<br />

The same total amount of profit or loss is recognized under<br />

both the completed contract and the percentage-ofcompletion<br />

methods, but the timing of recognition differs.<br />

Percentage-of-Completion<br />

Completed Contract<br />

Gross profit recognized:<br />

2013 $500,000 –0–<br />

2014 125,000 –0–<br />

2015 275,000 $900,000<br />

Total gross profit $900,000 $900,000

4-82<br />

Balance Sheet Recognition<br />

The balance in the construction in progress account<br />

differs between methods because of the earlier<br />

gross profit recognition that occurs under the<br />

percentage-of-completion method.

4-83<br />

Balance Sheet Recognition<br />

Billings on construction contract are subtracted<br />

from construction in progress to determine balance<br />

sheet presentation.<br />

CIP > Billings<br />

Asset<br />

Billings > CIP<br />

Liability

4-84<br />

U. S. GAAP vs. IFRS<br />

There are similarities and differences between<br />

IFRS and U.S. GAAP when considering revenue<br />

recognition for long-term construction<br />

contracts.<br />

<br />

Requires percentage-ofcompletion<br />

when reliable<br />

estimates can be made.<br />

<br />

Requires percentage-ofcompletion<br />

when reliable<br />

estimates can be made.<br />

<br />

Requires completed contract<br />

method when reliable estimates<br />

can’t be made.<br />

<br />

Requires cost recovery method<br />

when reliable estimates can’t be<br />

made.

Revenue Recognition after Delivery<br />

Installment Sales Method & Cost Recovery Method<br />

Recognizing revenue when goods and services are delivered assumes we are able to<br />

make reasonable estimates of amounts due from customers that potentially might be<br />

uncollectible. For product sales, this also includes amounts not collectible due to<br />

customers returning the products they purchased. Otherwise, we would violate one of the<br />

requirements of the revenue realization principle—that there must be reasonable<br />

certainty as to the collectibility of cash from the customer.<br />

4-85<br />

In a few situations in which uncertainties are so severe that they could cause a delay<br />

in recognizing revenue from a sale of a product or service. For each of these situations,<br />

notice that the accounting is essentially the same—deferring recognition of the gross<br />

profit arising from a sale of a product or service until uncertainties have been<br />

resolved.<br />

Installment sales can be accounted for using the installment sales method or the cost<br />

recovery method.<br />

The installment sales method recognizes the gross profit by applying the gross profit<br />

percentage on the sale to the amount of cash actually collected.<br />

The cost recovery method defers all gross profit recognition until cash equal to the cost<br />

of the item sold has been collected.

4-86<br />

Installment Sales Method<br />

On November 1, 2013, the Belmont Corporation, a real<br />

estate developer, sold a tract of land for $800,000. The<br />

sales agreement requires the customer to make four<br />

equal annual payments of $200,000 plus interest on<br />

each November 1, beginning November 1, 2013. The<br />

land cost $560,000 to develop. The company’s fiscal<br />

year ends on December 31.<br />

Gross Profit<br />

$240,000 ÷ $800,000<br />

= 30%<br />

Amount Allocated to:<br />

Gross<br />

Date<br />

Cash<br />

Collected<br />

Cost<br />

(70%)<br />

Profit<br />

(30%)<br />

Nov. 1, 2013 $ 200,000 $ 140,000 $ 60,000<br />

Nov. 1, 2014 200,000 140,000 60,000<br />

Nov. 1, 2015 200,000 140,000 60,000<br />

Nov. 1, 2016 200,000 140,000 60,000<br />

Totals $ 800,000 $ 560,000 $ 240,000

Installment Sales Method<br />

4-87<br />

11/1/2013<br />

Record installment sales:<br />

Cash 200,000<br />

Installment receivable 600,000<br />

Cost of Goods Sold 560,000<br />

Inventory 560,000<br />

Installment Sales 800,000<br />

During 2013, Belmont Corporation collected<br />

$200,000 on its installment sales.<br />

This entry records the realized gross profit by<br />

adjusting the deferred gross profit account.

4-88<br />

Cost Recovery Method<br />

On November 1, 2013, the Belmont Corporation, a real<br />

estate developer, sold a tract of land for $800,000. The<br />

sales agreement requires the customer to make four<br />

equal annual payments of $200,000 plus interest on<br />

each November 1, beginning November 1, 2013. The<br />

land cost $560,000 to develop. The company’s fiscal<br />

year ends on December 31.<br />

Date<br />

Cash<br />

Collected<br />

Cost<br />

Recovery<br />

Gross Profit<br />

Recognized<br />

Nov. 1, 2013 $ 200,000 $ 200,000 $ -<br />

Nov. 1, 2014 200,000 200,000 -<br />

Nov. 1, 2015 200,000 160,000 40,000<br />

Nov. 1, 2016 200,000 - 200,000<br />

Totals $ 800,000 $ 560,000 $ 240,000

Cost Recovery Method<br />

4-89

4-90<br />

Revenue Recognition Prior to Delivery<br />

Long-term<br />

Contracts<br />

Completed<br />

Contract Method<br />

Percentage-of-<br />

Completion<br />

Method

Revenue Recognition – General Principles<br />

generally occurs (1) when earned and when realized or<br />

realizable.<br />

FASB Concepts Statement No. 5:<br />

Revenue is not recognized until earned. Revenues are considered to have been<br />

earned when the entity has substantially accomplished what it must do to be<br />

entitled to the benefits represented by the revenues.<br />

Revenues are realized when goods or services are exchanged for cash or<br />

claims to cash. Revenues are realizable when related assets received in<br />

exchanges are readily convertible to known amounts of cash or claims to cash.<br />

Short and Sweet Tricks:<br />

(1). Earned = work is done.<br />

(2). (a) Realized = cash was exchanged.<br />

(b) Realizable = claim to cash.<br />

C, D, E, F: Collectability (1); Delivery (1); Evidence of an arrangement (2);<br />

Fee is fixed or determinable (2) (SOP 97-2 Software Revenue Recognition)<br />

4-91

Measuring Assets and Liabilities<br />

- Fair Value Valuation Techniques<br />

4-92<br />

Fair value: is the price that would be received to sell and<br />

asset or paid to transfer a liability in an orderly market<br />

participants at the measurement date.<br />

Market approached: based valuation on market<br />

information.<br />

Income approach: by estimating future amounts (earnings<br />

or cash flows) and converting those amounts to a single<br />

present value.<br />

Cost approach: estimating the amount that would be<br />

required to buy or construct an asset of similar quality<br />

and condition.

4-93<br />

Fair Value Hierarchy<br />

U.S. GAAP gives companies the option to report some or all of<br />

their financial assets and liabilities at fair value.