Service Department Cost Allocation - Anna Lee

Service Department Cost Allocation - Anna Lee

Service Department Cost Allocation - Anna Lee

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

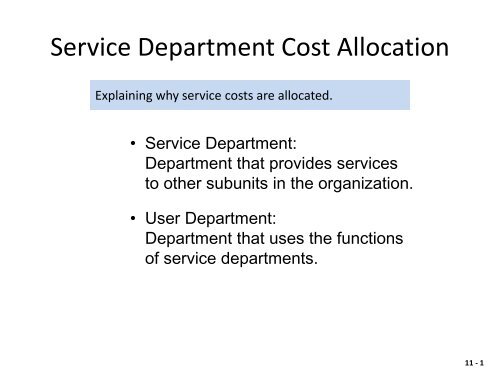

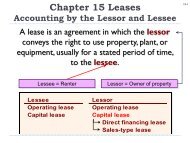

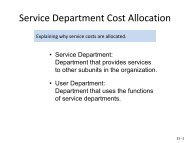

LO1<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>• Intermediate cost center:<strong>Cost</strong> center whose costs are chargedto other departments in the organization.• Final cost center:<strong>Cost</strong> center, such as a production ormarketing department, whose costsare not allocated to another cost center.11 - 2

LO1<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>Basic Data for <strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> AssociationCarlyle Coal CompanyInformationSystems (S1) a<strong>Service</strong> <strong>Department</strong>Administration(S2) b<strong>Department</strong>s:Administration (S2)Information Systems (S1)Hilltop Mine (P1)Pacific Mine (P2)Total (to be distributed)hours100,000-0-20,00080,000200,00050%01040100%employees)-0-2,0005,0003,00010,0000%205030100%a<strong>Allocation</strong> base for S1: Computer hours; <strong>Cost</strong> to be allocated: $800,000b<strong>Allocation</strong> base for S2: Number of employees; <strong>Cost</strong> to be allocated: $5,000,00011 - 4

<strong>Cost</strong> <strong>Allocation</strong>: Direct Method• Direct method:Charges costs of service departments to user departmentswithout making allocations among service departments.<strong>Service</strong> <strong>Department</strong>:Information Systems(S1)<strong>Service</strong> <strong>Department</strong>:Administration(S2)User <strong>Department</strong>:Hilltop Mine(P1)User <strong>Department</strong>:Pacific Mine(P2)11 - 5

LO2<strong>Cost</strong> <strong>Allocation</strong>: Direct Method<strong>Service</strong> <strong>Department</strong><strong>Cost</strong> <strong>Allocation</strong>Direct<strong>Cost</strong>Hilltop Mine(P1)Percent Applicable toPacific Mine(P2)Total<strong>Service</strong> <strong>Department</strong>:Information Systems (S1)Administration (S2)<strong>Service</strong> <strong>Department</strong>:Information Systems (S1)Administration (S2)Total allocated$ 800,0005,000,000Direct<strong>Cost</strong>$ 800,0005,000,000$5,800,000Note: Under this method, S1 costs doesn’t allocate to S2.20.0% a62.5% bHilltop Mine(P1)$ 160,000 c3,125,000 d$3,285,000a20.0% = 20,000 hours ÷ (20,000 hours + 80,000 hours)b62.5% = 5,000 employees ÷ (5,000 employees + 3,000 employees)c$160,000 = 20% × $800,000d$3,125,000 = 62.5% × $5,000,00080.0%37.5%Amount Applicable toPacific Mine(P2)$ 640,0001,875,000$2,515,000100.0%100.0%Total$ 800,0005,000,000$5,800,00011 - 6

<strong>Cost</strong> <strong>Allocation</strong>: Step Method• The step method allocates some servicedepartment costs to other service departments.• Once an allocation is made from a servicedepartment no further allocations are madeback to that service department.• Generally, allocate in order of proportion ofservices provided to other service departments.11 - 7

LO3<strong>Cost</strong> <strong>Allocation</strong>: Step Method<strong>Cost</strong> Flow Diagram: Step Method – Carlyle Coal Company<strong>Service</strong> <strong>Department</strong>:Information Systems(S1)ComputerhoursUser <strong>Department</strong>:Hilltop Mine(P1)<strong>Service</strong> <strong>Department</strong>:Administration(S2)EmployeesUser <strong>Department</strong>:Pacific Mine(P2)11 - 8

LO3<strong>Cost</strong> <strong>Allocation</strong>: Step Method<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>Direct<strong>Cost</strong>(S1)Percent Applicable to(S2)(P1)(P2)Total<strong>Service</strong> Dept.:(S1)(S2)$ 800,0005,000,0000.0%0.0%50.0% a0.0%10.0% b62.5% d40.0% c37.5% e100.0%100.0%a50.0% = 100,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hours)b10.0% = 20,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hours)c40.0% = 80,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hoursd62.5% = 5,000 employees ÷ (5,000 employees + 3,000 employees)e37.5% = 3,000 employees ÷ (5,000 employees + 3,000 employees)11 - 9

LO3<strong>Cost</strong> <strong>Allocation</strong>: Step Method<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>ToFrom(S1)(S2)(P1)(P2)TotalDept. costs(S1)(S2)$800,000(800,000)-0-$ -0-$5,000,000400,000 f(5,400,000)$ -0-Note: Under Step method, S1 costs does allocate to S2.f50.0% × $800,000g10.0% × $800,000h40.0% × $800,000I62.5% × $5,400,000j37.5% × $5,400,000k$5,800,000 of service department costs wereultimately allocated to production departments.$ -0-80,000 g3,375,000 i$3,455,000$ -0-320,000 h2,025,000 j$2,345,000$5,800,000 k$5,800,000 k11 - 10

<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal Method• The reciprocal method recognizes all servicesprovided by any service department, includingservices provided to other service departments.• It accounts for cost flows among servicedepartments providing services to each other.• It requires a simultaneous equation solution.11 - 11

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal Method<strong>Cost</strong> Flow Diagram: Reciprocal Method – Carlyle Coal Company<strong>Service</strong> <strong>Department</strong>:Information Systems(S1)ComputerhoursUser <strong>Department</strong>:Hilltop Mine(P1)<strong>Service</strong> <strong>Department</strong>:Administration(S2)EmployeesUser <strong>Department</strong>:Pacific Mine(P2)11 - 12

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal Method1. Write the costs of each service departmentin equation form.Total <strong>Service</strong><strong>Department</strong> costsDirect costs of the= +<strong>Service</strong> <strong>Department</strong><strong>Cost</strong>s allocated to the<strong>Service</strong> <strong>Department</strong>2. Solve equations simultaneously usingmatrix algebra.11 - 13

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal MethodTotal <strong>Service</strong><strong>Department</strong> costsDirect cost of the= +<strong>Service</strong> <strong>Department</strong><strong>Cost</strong>s allocated to the<strong>Service</strong> <strong>Department</strong>S1 = $ 800,000 + 0.20 S2S2 = $5,000,000 + 0.50 S1Substituting the first equation into the second yields:S2 = $5,000,000 + 0.50($800,000 + 0.20 S2)S2 = $5,000,000 + $400,000 + 0.10 S20.9 S2 = $5,400,000 S2 = $6,000,000Substituting the value of S2 back into the first equation gives:S1 = $800,000 + 0.20($6,000,000)S1 = $2,000,00011 - 14

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal Method<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>Total<strong>Cost</strong>(S1)Percent Applicable to(S2)(P1)(P2)Total<strong>Service</strong> Dept.:(S1)(S2)$2,000,0006,000,0000.0%20.0% d50.0% a0.0%10.0% b50.0% e40.0% c30.0% f100.0%100.0%a50.0% = 100,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hours)b10.0% = 20,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hours)c40.0% = 80,000 hours ÷ (100,000 hours + 20,000 hours + 80,000 hoursd20.0% = 2,000 employees ÷ (2,000 employees + 5,000 employees + 3,000 employees)e50.0% = 5,000 employees ÷ (2,000 employees + 5,000 employees + 3,000 employees)f30.0% = 3,000 employees ÷ (2,000 employees + 5,000 employees + 3,000 employees11 - 15

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal Method<strong>Service</strong> <strong>Department</strong> <strong>Cost</strong> <strong>Allocation</strong>ToFrom(S1)(S2)(P1)(P2)TotalDirect costs(S1)(S2)$ 800,000(2,000,000) a1,200,000 e$ -0-$5,000,0001,000,000 b(6,000,000) f$ -0-$ -0-200,000 c3,000,000 g$3,200,000$ -0-800,000 d1,800,000 h$2,600,000$5,800,000 i$5,800,000 iaTotal costs of S1b<strong>Cost</strong>s allocated from S1 (50% × $2,000,000)c10.0% × $2,000,000d40.0% × $2,000,000e<strong>Cost</strong>s allocated from S2 (20% × $6,000,000)fTotal costs of S2g50% × $6,000,000h30% × $6,000,000I$5,800,000 of service department costs were ultimatelyallocated to production departments.11 - 16

LO4<strong>Cost</strong> <strong>Allocation</strong>: Reciprocal MethodComparison of Direct, Step, and Reciprocal MethodsMethod Hilltop Mine Pacific Mine TotalDirectStepReciprocal$3,285,0003,455,0003,200,000$2,515,0002,345,0002,600,000$5,800,0005,800,0005,800,00011 - 17

The Reciprocal Methodand Decision MakingL.O. 5 Use the reciprocal method for decisions.• Suppose that the variable cost in Information <strong>Service</strong>s (S1)is $200,000 (out of the total of $800,000) and the variablecost in Administration (S2) is $3,500,000 (out of $5,000,000).• Let's repeat the reciprocal cost analysis substitutingthe variable costs from the total costs.11 - 18

LO5The Reciprocal Methodand Decision MakingTotal <strong>Service</strong><strong>Department</strong> costsDirect cost of the= +<strong>Service</strong> <strong>Department</strong><strong>Cost</strong>s allocated to the<strong>Service</strong> <strong>Department</strong>S1 = $ 200,000 + 0.20 S2S2 = $3,500,000 + 0.50 S1Substituting the first equation into the second yields:S2 = $3,500,000 + 0.50($200,000 + 0.20 S2)S2 = $3,500,000 + $100,000 + 0.10 S20.9 S2 = $3,600,000 S2 = $4,000,000Substituting the value of S2 back into the first equation gives:S1 = $200,000 + 0.20($4,000,000)S1 = $1,000,00011 - 19

The Reciprocal Methodand Decision Making• The total variable cost of Information <strong>Service</strong>s, when youconsider the use of Administration by Information <strong>Service</strong>sis $1,000,000.• The total cost savings that would come from eliminatingInformation <strong>Service</strong>s are the $1,000,000 variable costsplus any avoidable fixed costs.11 - 20

<strong>Allocation</strong> of Joint <strong>Cost</strong>sJoint cost is the cost of a manufacturing process with two or moreoutputs produced together up to a split-off point.Split-offpointHi-grade coal: 15,000 unitsSales value: $300,000Mining costs$270,000(Joint <strong>Cost</strong>s)Lo-grade coal: 30,000 unitsSales value: $450,000(Separable <strong>Cost</strong>s)11 - 21

<strong>Allocation</strong> of Joint <strong>Cost</strong>s2 Methods of <strong>Allocation</strong>:Net realizable value methodPhysical quantities method• Net realizable value method:Joint cost allocation based on the proportionalvalues of the products at the split-off point.• Net realizable value (NRV):Sales value of each product at the split-off pointminus disposable cost.• Estimated net realizable value:If the sales value at split-off is not available, use theestimated NRV method. That is sales price of a final productminus additional processing costs necessary to preparea product for sale (disposable cost).11 - 22

Net Realizable Value MethodFinal sales valueLess: Additional processing costsNet realizable value at split-off pointProportionate share:= $300,000 ÷ $750,000= $450,000 ÷ $750,000Allocated joint costs:= $270,000 × 40%= $270,000 × 60%ExampleCarlyle Coal CompanyJoint <strong>Allocation</strong> – NRV Method(no additional processing costs)Hi-Grade Lo-Grade Total$300,000-0-$300,00040%$108,000$450,000-0-$450,00060%$162,000$750,000-0-$750,00011 - 23

Net Realizable Value MethodCarlyle Coal CompanyFor the Month of MarchSales valueLess: Allocated joint costsGross marginGross margin as a percent of salesHi-Grade Lo-Grade Total$300,000108,000$192,00064%$450,000162,000$288,00064%$750,000270,000$480,00064%11 - 24

Estimating NRV• When no sales value exists for outputs at the split-off point,the estimated NRV should be determined.Further Processing of Coal:<strong>Cost</strong> Flows –Carlyle Coal CompanySplit-offpointHi-grade coal: 15,000 unitsSales value: $300,000Mining costs$270,000Lo- to Mid-grade coal:30,000 units$50,000 processing costSales value: $550,00011 - 25

Estimating NRVCarlyle Coal CompanyFor the Month of MarchSales valueLess: Additional cost to processEstimated NRV at split-off<strong>Allocation</strong> of joint costsGross marginGross margin as a percent of salesHi-Grade Mid-Grade Total$300,000 $550,000to mid-grade — coal 50,000$300,000 $500,000101,250 a —— 168,750 b$198,750 $331,25066% 60%$850,00050,000$800,000101,250168,750$530,00062%a($300,000 ÷ $800,000) × $270,000b($500,000 ÷ $800,000) × $270,00011 - 26

Physical Quantities Method• Joint cost allocation is based on measurement ofthe volume, weight, or other physical measure ofthe joint products at the split-off point.When to use:1. Output product prices are volatile.2. Significant processing occurs between thesplit-off point and the first point of marketability.3. Product prices are not set by the market.11 - 27

Physical Quantities MethodCarlyle Coal CompanyFor the Month of MarchQuantity (tons)Sales value<strong>Allocation</strong> of joint costsGross marginGross margin as a percent of salesHi-Grade Lo-Grade Total15,000$300,00090,000 a$210,00070%30,000$450,000180,000 b$270,00060%45,000$750,000270,000$480,00064%a(15,000 tons ÷ 45,000 tons) × $270,000b(30,000 tons ÷ 45,000 tons) × $270,00011 - 28

By-products• By-products are outputs of joint production processesthat are relatively minor in quantity or value. Joint costsare usually not allocated to a by-product, instead,market value of by-product is reported as follows:• Method 1:The net realizable value from sale of the by-productsis deducted from the joint costs (as a contra productioncost) before allocation to the main products.• Method 2:The proceeds from sale of the by-product are treatedas other revenue (other income).11 - 29

By-products – Method 1Carlyle Coal CompanyFor the Month of MarchHi-GradeLo-GradeDustby-productTotalSales valueLess: Additional processing costsNet realizable value at split-off pointDeduct: Sales value of by-product aAllocated remaining joint costs aGross marginGross margin as a percent of sales$300,000-0-$300,000-0-102,000 b$198,00066%$450,000-0-$450,000-0-153,000 c$297,00066%$15,000-0-$15,00015,000-0--0-0%$765,000-0-$765,00015,000255,000$495,00065%a Note: Joint costs adjusted for sales value of by-product (dust) (765,000 – 15,000 = 750,000)b($300,000 ÷ $750,000) or 40% × ($270,000 Joint cost – $15,000)c($450,000 ÷ $750,000) or 60% × ($270,000 – $15,000)11 - 30

Carlyle Coal CompanyFor the Month of MarchQuantity (tons)Sales value<strong>Allocation</strong> of joint costsGross marginGross margin as a percent of sales15,000$300,000108,000$192,00064%30,000$450,000162,000$288,00064%45,000$750,000270,000$480,00064%(300,000÷ 750,000) = 40% 270,000 x 40% = 108,000(450,000÷ 750,000) = 60% 270,000 x 60% = 162,000

By-products – Method 2Carlyle Coal CompanyFor the Month of MarchHi-GradeLo-GradeDustTotalSales valueLess: Additional processing costsNet realizable value at split-off pointAllocated joint costs aGross marginGross margin as a percent of sales$300,000-0-$300,000108,000 b$192,00064%$450,000-0-$450,000162,000 c$288,00064%$15,000-0-$15,000-0-$15,000100%$765,000-0-$765,000270,000$495,00065%aJoint costs adjusted for sales value of by-product (dust)b($300,000 ÷ $750,000) or 40% × $270,000 joint cost = 108,000. 15,000 is not deductedfrom joint cost, instead, it is reported as other income.c($450,000 ÷ $750,000) or 60% × $270,000 = 162,00011 - 32

Sell or Process Further• Suppose CCC can sell Lo-grade coal for $450,000at the split-off point or process it further to makemid-grade coal.• Mid-grade coal would sell for $550,000 andadditional processing costs would be $50,000.Additional revenue: $100,000?Additional cost: $ 50,00011 - 33

Sell or Process FurtherDifferential AnalysisCarlyle Coal CompanySellLo-GradeCoalProcessFurther(Mid-Grade)DifferentialRevenue/<strong>Cost</strong>sRevenuesLess: Separate processing costsMargin$450,000-0-$450,000$550,00050,000$500,000$100,00050,000$ 50,000Net gain fromprocessingfurther11 - 34