Chapter 1 - Anna Lee

Chapter 1 - Anna Lee

Chapter 1 - Anna Lee

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

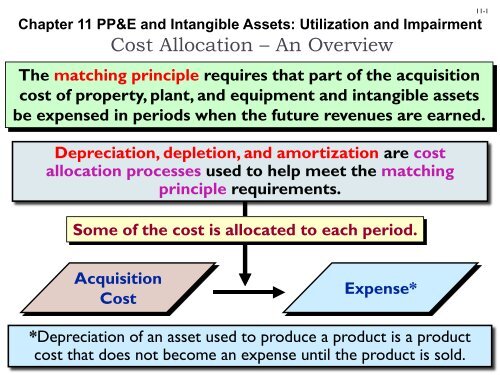

<strong>Chapter</strong> 11 PP&E and Intangible Assets: Utilization and ImpairmentCost Allocation – An OverviewThe matching principle requires that part of the acquisitioncost of property, plant, and equipment and intangible assetsbe expensed in periods when the future revenues are earned.11-1Depreciation, depletion, and amortization are costallocation processes used to help meet the matchingprinciple requirements.Some of the cost is allocated to each period.AcquisitionCostExpense**Depreciation (Balance Sheet) of an asset used to produce (Income a product Statement) is a productcost that does not become an expense until the product is sold.

Cost Allocation – An Overview11-2AssetCategoryProperty, Plant, &EquipmentNatural ResourceDebitDepreciationDepletionAccount CreditedAccumulatedDepreciationNatural ResourceAssetIntangible Amortization Intangible AssetCaution! Depreciation, depletion, and amortizationare processes of cost allocation, not valuation!Depreciationon the BalanceSheet

11-3Measuring Cost AllocationCost allocation requires three piecesof information for each asset:ServiceLifeAllocationBaseAllocationMethodThe estimated expecteduse from an asset.The systematic approachused for allocation.Total amount of cost to be allocated.Cost – Residual Value (at end of useful life)

11-4DepreciationTime-based MethodsStraight-line (SL)Accelerated Methods Sum-of-the-years'-digits (SYD)Declining Balance (DB)Group andcompositemethodsTaxdepreciationActivity-based methodsUnits-of-production method (UOP).

11-5Straight-LineThe most widelyused and most easilyunderstood method.Results in the sameamount of depreciation ineach year of the asset’sservice life.Example: On January 1, we purchase equipment for$50,000 cash. The equipment has an estimatedservice life of 5 years and estimated residual value of$5,000.What is the annual straight-line depreciation?

Depreciation11-6Straight-LineAnnualStraight-line $ 50,000 – $ 5,000=Depreciation5=$9,000Life in YearsAccumulated Accumulated UndepreciatedDepreciation Depreciation Depreciation BalanceYear (debit) (credit) Balance (book value)$ 50,0001 $ 9,000 $ 9,000 $ 9,00041,0002 9,000 9,000 18,000 32,0003 9,000 9,000 27,000 23,0004 9,000 9,000 36,000 14,0005 9,000 9,000 45,000 5,000$ 45,000 $ 45,000BV at the end of the asset’suseful life = Residual Value.Residual Value

11-7Accelerated MethodsAccelerated methods result in more depreciation inthe early years of an asset’s useful life and lessdepreciation in later years of an asset’s useful life.Note that total depreciation over the asset’s usefullife is the same as the straight-line method.Sum-of-the-years’-digits (SYD) depreciationSYDDepreciation=(Cost–ResidualValue)×Remaining Years ofUseful LifeSum-of-the-Years'Digits

11-8Sum-of-the-Years’-Digits (SYD)Sum-of-the-Years'Digits(SYD)= ( UsefulLife× [ UsefulLife2+ 1 ] )Example: On January 1, we purchase equipment for $50,000cash. The equipment has a service life of 5 years and anestimated residual value of $5,000. Using SYD depreciation,compute depreciation for the first two years.SYD = ( 5 × [ 5 + 1 ] ) ÷ 2= 30 ÷ 2= 15

11-9Sum-of-the-Years'-Digits (SYD)SYDDepreciation=(Cost–ResidualValue)×RemainingYears ofSum-of-the-Years' Digits=( $ 50,000 – $ 5,000 ) ×= $ 15,000 Depreciation in Year 1= ( $ 50,000 –5,000= $ 12,000 Depreciation in Year 2$) ×515415

DepreciationSum-of-the-Years'-Digits (SYD)Accumulated UndepreciatedDepreciation Depreciation BalanceFraction (debit) Balance (book value)$ 50,0005/15 $ 15,000 $ 15,00035,0004/15 12,000 27,000 23,0003/15 9,000 36,000 14,0002/15 6,000 42,000 8,0001/15 3,000 45,000 5,000$ 45,00011-101600014000Residual Value120001000080006000400020000Life in Years

Declining-Balance (DB) Methods11-11DB depreciation Based on the straight-line ratemultiplied by an accelerationfactor. Computations initially ignoreresidual value.Stop depreciating when:BV = Residual ValueDouble-Declining-Balance (DDB) depreciationis computed as follows:DDB =BookValue× ( 2 × Straight-line Rate )Note that the new book value (declines each year) isused in the formula.

11-12Declining-Balance (DB) MethodsExample: on January 1, we purchase equipment for$50,000 cash. The equipment has a service life of 5 yearsand an estimated residual value of $5,000.What is depreciation for the first two years usingdouble-declining-balance?DDB =BookValue× ( 2 × Straight-line Rate )= $ 50,000 × ( 2 × 20% )= $ 20,000 1st Year Depreciation= ($50,000 - $20,000) × (2 × 20%)= $ 12,000 2nd Year Depreciation

Depreciation11-13Declining-Balance (DB) MethodsAccumulated UndepreciatedDepreciation Depreciation BalanceYear (debit) Balance (book value)$ 50,0001 $ 20,000 $ 20,00030,0002 12,000 32,000 18,0003 7,200 39,200 10,8004 4,320 43,520 6,4805 1,480 45,000 5,000$ 45,00020000180001600014000120001000080006000400020000Depreciation forced so that BV = Residual Value.1 2 Life 3 in Years 4 5

11-14Units-of-ProductionDepreciationrate per unitof activity=Acquisitioncost– ResidualvalueEstimated life in unitsof activityDepreciation =Depreciationrate per unitof activity×Units ofactivity

11-15Units-of-ProductionExample: On January 1, we purchased equipment for $50,000cash. The equipment is expected to produce 100,000 unitsduring its life and has an estimated residual value of $5,000.If 22,000 units were produced this year, what is the amount ofdepreciation?Depreciation $50,000 – $5,000=rate per unit 100,000= $0.45Depreciation =Depreciationrate per unit×Units ofoutput= $0.45 × 22,000= $9,900

Use of Various Depreciation Methods11-16

11-17U.S. GAAP vs. IFRSComponent Depreciation, Depreciable Base, andResidual ValueComponent (item) depreciation isallowed (not required) but notoften used in practice.The depreciable base isdetermined by subtractingestimated residual value from cost.Annual reviews of residual valuesare not required.Each component of an item ofproperty, plant, and equipment isrequired to depreciate separatelyif its cost is significant to the totalcost of the item.Depreciable base is determined bysubtracting estimated residualvalue from cost. IFRS requires areview of residual values annually.

Group and Composite Methods11-18Both methods depreciate assets collectively not individually.Group method: Assets are grouped by common characteristicssuch as similar service lives and other attributes, e.g., fleet of deliveryvehicles (trucks, vans).Composite method: Assets are physically dissimilar, but areaggregated anyway for convenience, e.g., one manufacturing plant assets,even though they all may have widely devise service lives.Average depreciation rate = total depreciation amount per year (1 st yr.)/ total asset costs ((calculated after the initial depreciation amount peryear is determined (P 599)).Annual depreciation (including new assets) = the average rate × thetotal group acquisition cost.Accumulated depreciation records are not maintained for individualassets.

11-19Group and Composite Methods – Cont’d If assets in the group are sold, or new assets added,the composite rate remains the same. When an asset in the group is sold or retired, debitaccumulated depreciation for the difference betweenthe asset’s cost and the proceeds. No gain or loss isrecorded.

11-20U.S. GAAP vs. IFRSValuation of Property, Plant, and Equipment (P 600)Property, plant, and equipment isreported in the balance sheet atcost less accumulateddepreciation (book value).Revaluation is prohibited.Property, plant, and equipment maybe reported at cost lessaccumulated depreciation, oralternatively, at fair value(revaluation), even if FV is higher(P 601).If revaluation is elected, all assetswithin a class of property, plant, andequipment are required to berevalued on a regular basis.Revaluation is used infrequently.

11-21Depletion of Natural ResourcesAs natural resources are “usedup,” or depleted, the cost of thenatural resources must beallocated to the units extracted.The approach is based onthe units-of-productionmethod.Depletion Rateper Unit=Cost of NaturalResource– ResidualValueEstimated Recoverable UnitsTotalDepletionCost=Unit DepletionRate×UnitsExtracted

Depletion of Natural ResourcesExample: ABC Mining acquired a tract of land containing ore deposits.Total costs of acquisition and development were $1,100,000. ABCestimated the land contained 40,000 tons of ore, and that the land will besold for $100,000 after the coal is mined. What is ABC’s depletion rate?For the year ABC mined 13,000 tons, and sold 10,000 tons.What is the total amount of depletion for the year?Depletion rate = 1,000,000 ÷ 40,000 tons = $25 per tonDepletion = 10,000 tons × $25per ton = $250,000J E:Depletion - Ore 250,000Ore Inventory 75,000Accumulated Depletion (13,000 x 25) 325,000(or debit Depletion credit “Ore Deposit” instead of credit “Accum Depletion)Balance SheetOre Deposit 1,100,000Less: accumulated depletion 325,000 775,00011-22

U.S. GAAP vs. IFRS11-23Valuation of Biological AssetsBiological assets, such as timbertracts, are valued at cost lessaccumulated depletion.Biological assets are valued at fairvalue less estimated costs to sell(harvest and delivery), i.e., netrealizable value. Changes in fairvalue are recognized in theincome statement.

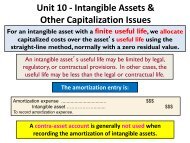

11-24Amortization of Intangible AssetsFor an intangible asset with a finite useful life, we allocatecapitalized costs over the asset’s useful life using thestraight-line method, normally with a zero residual value.An intangible asset’s useful life may be limited by legal,regulatory, or contractual provisions. In other cases, theuseful life may be less than the legal or contractual life.The amortization entry is:Amortization expense .................................. $$$Intangible asset ………………........ $$$To record amortization expense.A contra-asset account is generally not used whenrecording the amortization of intangible assets.

11-25Amortization of Intangible AssetsExample: Torch Inc. has developed a new device. Patentregistration costs consisted of $2,000 in attorney fees and$1,000 in federal registration fees. The device has a useful lifeof 5 years.What is Torch’s amortization expense for year 1?Amortization = Cost ÷ Contractual life= $3,000 ÷ 5 years= $ 600 per yearAmortization expense ................................... 600Patent ………………........................ 600To record amortization of patent.

Indefinite Life Intangible Assets notSubject to Amortization11-26Goodwill and TrademarksNot amortized.Subject to assessmentfor impairment ofvalue and may bewritten down.

11-27U.S. GAAP vs. IFRSValuation of Intangible AssetsIntangible assets are reported atcost less accumulatedamortization.U.S. GAAP prohibits revaluation ofany intangible asset.Intangible assets may be reportedat (1) cost less accumulatedamortization or (2) fair value, iffair value can be determined byreference to an active market.If revaluation is chosen, all assetswithin the class of intangibles mustbe revalued on a regular basis.Goodwill cannot be revalued.

Partial-Period Depreciation(see P 609 example)11-28Pro-rating the depreciation based on thedate of acquisition is time-consuming andcostly. A commonly used alternative isthe . . .Half-Year ConventionTake ½ of a year of depreciation in the year ofacquisition, and the other ½ in the year ofdisposal.

11-29Changes in EstimatesESTIMATEDservice lifeESTIMATEDresidual valueChanges in estimates are accounted for prospectively.The book value less any residual value at the date of change isdepreciated over the remaining useful life. A disclosure noteshould describe the effect of a change.Example: On January 1, equipment was purchased that cost$30,000, has a useful life of 10 years, and no residual value. At thebeginning of the fourth year, it was decided that there were only 5years remaining, instead of 7 years.Calculate depreciation for the fourthyear using the straight-line method.

11-30Changes in EstimatesAsset cost $ 30,000Accumulated depreciation($3,000 per year × 3 years) 9,000Remaining book value 21,000Divide by remaining life ÷ 5Revised annual depreciation $ 4,200What happens if we changedepreciation methods?

11-31Change in Depreciation MethodA change in depreciation, amortization, or depletionmethod is considered a change in accounting estimate thatis a result of (achieved by) a change in accounting principle.We account for these changes prospectively,exactly as we would any other change in estimate.On January 1, 2011, Matrix Inc. purchased office equipment for $400,000.Matrix expected a residual value $40,000, and a service life of 5 years.Matrix uses the double-declining-balance method to depreciate this type ofasset. During 2013, the company switched from double-declining balance tostraight-line depreciation. The residual value remained at $40,000. Let’sdetermine the amount of depreciation to be recorded for 2013.

11-32Change in Depreciation MethodDepreciation - 2011 $ 160,000 ($400,000 × 40%)Depreciation - 2012 96,000 [($400,000 - $160,000) × 40%]Total Depreciation $ 256,000Cost of asset $ 400,000Less: Accumulated depreciation 256,000Undepreciated balance $ 144,000Less: residual value (40,000)New depreciable amount 104,000Remaining service life ÷ 3Annual depreciation $ 34,667December 31, 2013:Depreciation expense ................................... 34,667Accumulated depreciation................ 34,667To record depreciation expense.

11-33Inventory ErrorsBeginning inventoryPlus: Net purchasesLess: Ending inventoryCost of goods soldRevenuesLess: Cost of goods soldLess: Other expensesNet incomeBeginning retained earningsPlus: net incomeLess: DividendsEnding retained earningsWhen analyzing inventory errors, it’shelpful to visualize the way cost of goodssold, net income, and retained earnings aredetermined.

11-34Inventory Errors• Overstatement of ending inventory◦ Understates cost of goods sold and◦ Overstates pretax income.• Understatement of ending inventory◦ Overstates cost of goods sold and◦ Understates pretax income.

11-35Inventory Errors• Overstatement of beginning inventory◦ Overstates cost of goods sold and◦ Understates pretax income.• Understatement of beginning inventory◦ Understates cost of goods sold and◦ Overstates pretax income.

Inventory Errors11-36Discovered the Following Year:If an error was made in 2013, but not discovered until 2014 (the followingyear), the 2013 financial statements were incorrect as a result of theerror. The error should be retrospectively restated to reflect the correctinventory amount, cost of goods sold, net income, and retained earningswhen the comparative 2014 and 2013 financial statements are issued for2014.Dr. Retained EarningsCr. InventoryDiscovered Subsequent to the Following Year:If an error was made in 2013, but not discovered until 2015, Nocorrecting entry is needed in 2015. The error has self-corrected andno prior period adjustment is needed.

11-37Error CorrectionSummary:Errors found in a subsequent accounting periodare corrected by . . .1. Make entries torestate theincorrect accountbalances to thecorrect amount.2. Reporting thecorrection as aprior periodadjustment toBeginning R/E.3. Restating theprior period’sfinancialstatements.In addition, a disclosure note is needed to describe the nature ofthe error and the impact of its correction on net income, incomebefore extraordinary items, and earnings per share.

Impairment of ValueAccounting treatment differs.Test forimpairmentof value whenconsideredfor sale.11-38Long-term assetsto be held and usedLong-term assetsheld for saleTangible andintangiblewith finiteuseful livesIntangibleswithindefiniteuseful livesTest for impairment of valuewhen it is suspected that bookvalue may not be recoverable.GoodwillTest forimpairment ofvalue at leastannually.Other thanGoodwill: Testfor impairmentof value when itis likely thatthe fair value ofa reporting unitis less than itsbook value.

11-39Finite-Life Assets to be Held and UsedMeasurement – Step 1An asset is impaired when . . .The undiscountedsum of its estimatedfuture cash flows

11-40Finite-Life Assets to be Held and UsedImpairmentloss =Measurement – Step 2Bookvalue–FairvalueReported in the incomestatement as a separatecomponent of operatingexpensesMarket value, price of similar assets,or PV of future net cash inflows.Undiscounted futureFair valuecash flows$0 $125$250Case 1: $50 book value.No loss recognizedCase 3: $275 book value.Loss = $275 BV– $125 FVCase 2: $250 > $150 book value. No loss recognized

11-41Assets Held for SaleAssets held for sale:assets that managementhas committed to sell immediately intheir present condition andfor which sale is probable.Impairmentloss=Bookvalue–Fair value lesscost to sell (NRV)

11-42U.S. GAAP vs. IFRSImpairment of Value: Property, Plant, andEquipment and Finite-Life Intangible AssetsAssets are tested for impairmentwhen events or changesindicates that book value maynot be recoverable.An impairment loss is requiredwhen an asset’s book value >the undiscounted sum of theestimated future cash flows.Assets must be assessed forcircumstances of impairment atthe end of each reporting period.An impairment loss is requiredwhen an asset’s book value >Recoverable amount: higherof the asset’s value-in-use (presentvalue of estimated future cashflow) and fair value less costs tosell (NRV).

11-43U.S. GAAP vs. IFRSImpairment of Value: Property, Plant, andEquipment and Finite-Life Intangible AssetsThe impairment loss: book value- fair value.Reversals of impairment losses areprohibited. The impairment loss: book value -recoverable amount (the higher ofthe asset’s value-in-use and fairvalue less costs to sell).An impairment loss is reversed ifthe circumstances that caused theimpairment are resolved.

11-44Finite-Life Assets to be Held and UsedBecause Acme Auto Parts has seen its sales steadily decrease due to thedecline in new car sales, Acme’s management believes that equipmentthat originally cost $350 million, with a $200 million book value, may notbe recoverable. Management estimates that future undiscounted cashflows associated with the equipment’s remaining useful life will be only$140 million, and that the equipment’s fair value is $120 million.Has Acme suffered an impairment loss and, if so, how should it berecorded?Step 1$140 million < $200 millionImpairment loss is indicated.

11-45Finite-Life Assets to be Held and UsedBecause Acme Auto Parts has seen its sales steadily decrease due to thedecline in new car sales, Acme’s management believes that equipmentthat originally cost $350 million, with a $200 million book value, may notbe recoverable. Management estimates that future undiscounted cashflows associated with the equipment’s remaining useful life will be only$140 million, and that the equipment’s fair value is $120 million. HasAcme suffered an impairment loss and, if so, how should it be recorded?Step 2Impairment loss = $200 million BV – $120 million FV = $80 millionImpairment loss ................................... 80,000,000Accumulated depreciation ................... 150,000,000Equipment ……………………. 230,000,000To record impairment loss.

Indefinite-Life Intangibles11-46Goodwill(Special treatment)Other IndefinitelifeintangiblesStep 1 If BV of reporting unit> FV, impairment indicated.Step 2 Loss = BV of goodwill- implied value of goodwill.One-Step ProcessIf asset’s BV > FV,recognizeimpairment loss.A reporting unit is an operating segment of a company or a component of anoperating segment for which discrete financial information is available (andsegment managers regularly review the operating results of that component).Implied value = segment’s (reporting unit’s) FV – segment’s net assets (excludinggood will)

11-47U.S. GAAP vs. IFRSImpairment of Value: Indefinite-Life IntangibleAssets Other Than GoodwillIndefinite-life intangible assetsother than goodwill are tested forimpairment at least annually.Indefinite-life intangible assetsother than goodwill are tested forimpairment at least annually.The impairment loss: = book value- fair value.The impairment loss = book value- recoverable amount (thehigher of the asset’s value-in-use(present value of estimated futurecash flows) and fair value less coststo sell (NRV)).

11-48U.S. GAAP vs. IFRS (cont’d)Impairment of Value: Indefinite-Life IntangibleAssets Other Than GoodwillReversals of impairment losses areprohibited.If certain criteria are met,indefinite-life intangible assets arecombined for the required annualimpairment test.An impairment loss is reversed ifthe circumstances that caused theimpairment are resolved.Indefinite-life intangible assets maynot be combined with otherindefinite-life intangible assets forthe required annual impairmenttest.

11-49U.S. GAAP vs. IFRSImpairment of Value: GoodwillGoodwill is tested for impairmentwhen it is likely that the fair valueof a reporting unit is less than itsbook value.Reversals of impairment losses areprohibited.The level of testing (reportingunit) is a segment or a componentof an operating segment for whichdiscrete financial information isavailable.Goodwill is tested for impairmentat least annually.Reversals of impairment losses areprohibited.The level of testing (cashgeneratingunit) is the smallestidentifiable group of assets thatgenerates cash flows that arelargely independent of the cashflows from other assets.

U.S. GAAP vs. IFRS11-50Impairment of Value: GoodwillMeasurement of an impairmentloss is a two-step process. In stepone the fair value of the reportingunit is compared to its book value.A loss is indicated if the fair valueis less than the book value. Instep two, the impairment loss iscalculated as the excess of bookvalue of goodwill over the impliedfair value of goodwill.Measurement of an impairmentloss is a one-step process. Therecoverable amount of the cashgeneratingunit is compared to itsbook value. If the recoverableamount is < BV, 1 st , reducegoodwill, 2 nd , reduce other assets.

11-51Impairment of GoodwillSimmons Company recorded $150 million of goodwill when it acquiredBlake Company. Blake continues to operate as a separate company and isconsidered to be a reporting unit. At the end of the current year Simmonsnoted the following related to Blake: (1) book value of net assets, including$150 million of goodwill, is $500 million; (2) fair value of Blake is $400 million;and (3) fair value of Blake’s identifiable net assets, excluding goodwill, is$350 million. Is goodwill impaired and, if so, by what amount?Step 1$500 million net assets > $400 million FVImpairment loss is indicated.

11-52Impairment of GoodwillSimmons Company recorded $150 million of goodwill when it acquiredBlake Company. Blake continues to operate as a separate company and isconsidered to be a reporting unit. At the end of the current year Simmonsnoted the following related to Blake: (1) book value of net assets, including$150 million of goodwill, is $500 million; (2) fair value of Blake is $400million; and (3) fair value of Blake’s identifiable net assets, excluding goodwill,is $350 million. Is goodwill impaired and, if so, by what amount?Step 2Determination of implied goodwillFair value of Blake $ 400,000,000Fair value of Blake's net assets excluding goodwill 350,000,000Implied value of goodwill $ 50,000,000Measure of impairment lossBook value of goodwill $ 150,000,000Implied value of goodwill 50,000,000Impairment loss $ 100,000,000

Expenditures Subsequentto Acquisition11-53Type ofExpenditure Definition Usual Accounting TreatmentRepairs andMaintenanceExpenditures to maintaina given level of benefitsExpense in the period incurredAdditionsThe addition of a new majorcomponent to an existing assetCapitalize and depreciate over theremaining useful life of the originalasset, or over the useful life of theaddition, whichever is shorterImprovementsThe replacement ofa major componentCapitalize and depreciate over theuseful life of the improved assetRearrangementsExpenditures to restructurean asset without addition,replacement, or improvementIf expenditures are material andclearly increase future benefits,capitalize and depreciate overthe future periods benefited

U.S. GAAP vs. IFRS11-54Costs of Defending Intangible RightsLitigation costs to successfullydefend intangible rights arecapitalized and amortized over theremaining useful life of the asset.Litigation costs are expensed,except in rare situations when anexpenditure increases futurebenefits.

Appendix 11A – Comparison withMACRS (for Tax return)11-55Most corporations use the ModifiedAccelerated Cost Recovery System(MACRS) for tax purposes.Providesfor rapidwrite-offIgnoresresidualvalueRates basedon asset“class lives”