Chap 18 - Anna Lee

Chap 18 - Anna Lee

Chap 18 - Anna Lee

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

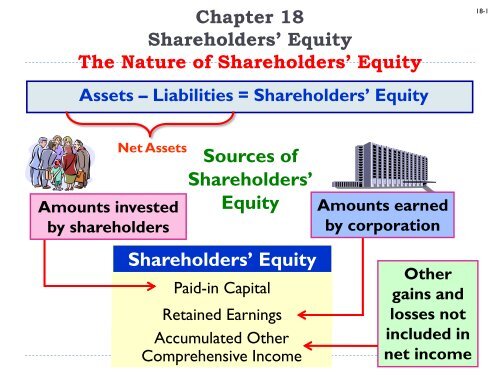

<strong>Chap</strong>ter <strong>18</strong><br />

Shareholders’ Equity<br />

The Nature of Shareholders’ Equity<br />

<strong>18</strong>-1<br />

Assets – Liabilities = Shareholders’ Equity<br />

Amounts invested<br />

by shareholders<br />

Net Assets<br />

Sources of<br />

Shareholders’<br />

Equity<br />

Shareholders’ Equity<br />

Paid-in Capital<br />

Retained Earnings<br />

Accumulated Other<br />

Comprehensive Income<br />

Amounts earned<br />

by corporation<br />

Other<br />

gains and<br />

losses not<br />

included in<br />

net income

<strong>18</strong>-2<br />

Financial Reporting Overview<br />

Shareholders' Equity<br />

Paid-in capital:<br />

Captial stock:<br />

Preferred stock - $100 par value; 1,000 shares<br />

authorized; 400 shares issued and<br />

outstanding $ 40,000<br />

Common stock - $10 par value; 60,000 shares<br />

authorized; 20,000 shares issued and<br />

outstanding 200,000<br />

Additional paid-in capital in excess of par value<br />

From issuance of preferred stock 10,000<br />

From issuance of common stock 300,000<br />

Total paid-in capital $ 550,000<br />

Retained earnings 121,500<br />

Accumulated other comprehensive income:<br />

Net unrealized holding gains (losses) on investments (35,000)<br />

Gains (losses) from foreign currency translation 22,000 (13,000)<br />

Treasury stock (at cost) (10,000)<br />

Total shareholders' equity $ 648,500

Accumulated Other Comprehensive Income<br />

Accumulated other comprehensive income<br />

includes four types of gains and losses<br />

not included in net income.<br />

<strong>18</strong>-3<br />

Net holding<br />

gains (losses) on<br />

investments.<br />

Gains (losses)<br />

from and<br />

amendments to<br />

retirement<br />

benefit plans<br />

(e.g., Prior<br />

service costs).<br />

Gains (losses) from<br />

foreign currency<br />

translations<br />

(exchange rates).<br />

Deferred gains<br />

(losses) from<br />

derivatives.

<strong>18</strong>-4<br />

Holdings of Less Than 20%<br />

Available-for-Sale Securities<br />

Illustration:<br />

Securities Fair Value Adjustment (AFS) 99,800<br />

Unrealized Holding Gain or Loss—Equity 99,800

Unrealized Holding Gain or Loss - OCI<br />

12/31/2010 35,550 12/31/2011 99,800<br />

12/31/11 close 64,250<br />

12/31/2011 64,250<br />

Security Fair Value Adjustment<br />

12/31/2011 99,800 12/31/2010 35,550<br />

12/31/2011 64,250<br />

Accum Other Comprehensive Income (AOIC)<br />

12/31/11 64,250

Accumulated Other Comprehensive Income<br />

Comprehensive income reporting:<br />

<strong>18</strong>-6<br />

• Comprehensive income created during the<br />

reporting period is reported either in the<br />

“statement of comprehensive income”<br />

immediately following the income statement<br />

or as “an additional section of the income<br />

statement”.<br />

• The comprehensive income accumulated<br />

over the current and prior periods is also<br />

reported as accumulated other<br />

comprehensive income (AOIC) in the<br />

“balance sheet”.

<strong>18</strong>-7<br />

Defining Derivatives<br />

Financial instruments that derive their value from values of<br />

other assets (e.g., stocks, bonds, or commodities).<br />

Three different types of derivatives:<br />

1. Financial forwards or financial futures.<br />

2. Options.<br />

3. Swaps (e.g. interest rate Swaps, Currency Swaps)

<strong>18</strong>-8<br />

Who Uses Derivatives, and Why<br />

‣ Producers and Consumers<br />

‣ Speculators and Arbitrageurs<br />

(Arbitrageur: One who profits from the<br />

differences in price when the same, or<br />

extremely similar, security , currency, or<br />

commodity is traded on two or more<br />

markets.)<br />

LO 9 Explain who uses derivative and why.

<strong>18</strong>-9<br />

Basic Principles in Accounting for Derivatives<br />

<br />

<br />

<br />

<br />

Recognize derivatives in the financial statements as<br />

assets and liabilities.<br />

Report derivatives at fair value.<br />

Recognize gains and losses resulting from<br />

speculation in derivatives immediately in income.<br />

Report gains and losses resulting from hedge<br />

transactions differently, depending on the type of<br />

hedge.

<strong>18</strong>-10<br />

U.S. GAAP vs. IFRS<br />

Terminology Differences<br />

Capital stock:<br />

<br />

<br />

<br />

<br />

Common stock.<br />

Preferred stock.<br />

Paid‐in capital—excess of<br />

par, common.<br />

Paid‐in capital—excess of<br />

par, preferred.<br />

Share capital:<br />

<br />

<br />

<br />

<br />

Ordinary shares.<br />

Preference shares.<br />

Share premium, ordinary<br />

shares.<br />

Share premium, preference<br />

shares.

<strong>18</strong>-11<br />

U.S. GAAP vs. IFRS<br />

Terminology Differences<br />

<br />

Accumulated other<br />

comprehensive income:<br />

<br />

Reserves:<br />

<br />

Net gains (losses) on<br />

investment ― AOCI.<br />

<br />

Investment revaluation<br />

reserve.<br />

<br />

Net gains (losses) foreign<br />

currency translation —AOCI.<br />

<br />

Translation reserve.<br />

<br />

PP&E Fair value adjustments not<br />

permitted.<br />

<br />

Revaluation reserve.<br />

<br />

Retained earnings.<br />

<br />

Retained earnings.<br />

<br />

Total shareholders’ equity.<br />

<br />

Total equity.<br />

<br />

Presented after liabilities<br />

<br />

Often presented before liabilities.

<strong>18</strong>-12<br />

The Corporate Organization<br />

Advantages of a corporation<br />

Continuous<br />

existence<br />

Easy<br />

ownership<br />

transfer<br />

Easy to<br />

raise capital<br />

Limited<br />

liability<br />

Disadvantages of a corporation<br />

Double<br />

taxation<br />

Government<br />

regulation

<strong>18</strong>-13<br />

Types of Corporations<br />

Not-for-profit corporations include<br />

hospitals, charities, and government<br />

agencies such as FDIC.<br />

Publicly-held corporations<br />

whose shares are widely<br />

owned by the general public.<br />

Privately-held corporations<br />

whose shares are owned by<br />

only a few individuals.

<strong>18</strong>-14<br />

Hybrid Organizations<br />

S Corporation<br />

Limited liability protection of a corporation.<br />

Maximum number of owners.<br />

Limited liability company<br />

Limited liability protection of a corporation.<br />

All owners may be involved in management<br />

without losing limited liability protection.<br />

No limit on number of owners.<br />

Limited liability partnership<br />

Owners are liable for their own actions but not<br />

entirely liable for actions of other partners.<br />

Double<br />

taxation<br />

avoided.

The Model Business Corporation Act<br />

(serves as a guide for the corporation statutes of most states)<br />

<strong>18</strong>-15<br />

Nature and location of business activities.<br />

Number and classes of shares authorized.<br />

Articles of incorporation<br />

are filed with the state.<br />

State issues a<br />

corporate charter.<br />

Shares of<br />

stock issued.<br />

Board of directors<br />

appoint officers.<br />

Board of directors<br />

elected by<br />

shareholders.

<strong>18</strong>-16<br />

Fundamental Share Rights<br />

Right to vote.<br />

Preemptive<br />

right to maintain<br />

percentage<br />

ownership.<br />

Right to share<br />

in profits when<br />

dividends are<br />

declared.<br />

Right to share<br />

in distribution of<br />

assets if company<br />

is liquidated.

Authorized, Issued, and<br />

Outstanding Shares<br />

<strong>18</strong>-17<br />

Authorized shares are the maximum<br />

number of shares of capital stock that<br />

can be sold to the public.<br />

Issued<br />

shares are<br />

authorized<br />

shares of<br />

stock that<br />

have been<br />

sold.<br />

Unissued<br />

shares are<br />

authorized<br />

shares of<br />

stock that<br />

never have<br />

been sold.

Authorized, Issued, and<br />

Outstanding Shares<br />

<strong>18</strong>-<strong>18</strong><br />

Authorized<br />

Shares<br />

Outstanding shares are<br />

issued shares that are<br />

owned by stockholders.<br />

Issued<br />

Shares<br />

Retired shares:<br />

Repurchased and<br />

retired; have the<br />

same status as<br />

authorized but<br />

unissued shares.<br />

Outstanding<br />

Shares<br />

Treasury<br />

Shares<br />

Retired<br />

Shares<br />

Unissued<br />

Shares<br />

Treasury shares: issued<br />

shares that have been<br />

repurchased by the<br />

corporation, but not<br />

retired.

Capital Stock<br />

<strong>18</strong>-19<br />

Par value stock<br />

No-par stock<br />

<br />

<br />

Dollar amount per share is<br />

stated in the corporate<br />

charter, no restriction on the<br />

assigned value. It is the<br />

minimum legal capital.<br />

Par value has no relationship<br />

to market value.<br />

<br />

<br />

Dollar amount per share<br />

is not designated in<br />

corporate charter.<br />

Corporations can assign a<br />

stated value per share<br />

(treated as if par value).<br />

Legal capital is . . .<br />

The amount recorded as common stock or preferred stock.<br />

The least amount the stock buyers must contribute to the firm<br />

when stock is issued, otherwise it constitutes a legal capital<br />

deficiency.<br />

The amount of capital, required by state law, that must remain<br />

invested in the business.<br />

Refers to par value, stated value, or full amount paid for no-par<br />

stock.

<strong>18</strong>-20<br />

Capital Stock<br />

Common stock is the basic voting stock of the<br />

corporation. It ranks after preferred stock for dividend<br />

and liquidation distribution. Dividends are determined<br />

by the board of directors.<br />

Generally does not<br />

have voting rights.<br />

Usually has a<br />

par or stated value.<br />

Preferred<br />

Stock<br />

Dividend and liquidation<br />

preference over<br />

common stock.<br />

May be convertible ( holder’s<br />

option), or callable (by co. at a<br />

stated value; to retire).

<strong>18</strong>-21<br />

Preferred Stock Dividends<br />

Are usually stated as a % of the par or stated value.<br />

May be cumulative or noncumulative.<br />

May be partially participating, fully participating,<br />

or nonparticipating.<br />

Unpaid dividends must be paid in full before<br />

any distributions to common stock.<br />

Dividends in arrears are not liabilities, but<br />

the per share and aggregate amounts must<br />

be disclosed.

<strong>18</strong>-22<br />

U.S. GAAP vs. IFRS<br />

Distinction between Debt and Equity<br />

for Preferred Stock<br />

<br />

Preferred stock normally is<br />

reported as equity, but is reported<br />

as debt with the dividends<br />

reported in the income statement<br />

as interest expense if it is<br />

“mandatorily redeemable”<br />

preferred stock.<br />

<br />

Most non-mandatorily redeemable<br />

preferred stock (preference<br />

shares) also is reported as debt as<br />

well as some preference shares<br />

that aren’t redeemable. Under<br />

IFRS (IAS No. 32), the critical<br />

feature that distinguishes a liability<br />

is if the issuer is or can be<br />

required to deliver cash (or<br />

another financial instrument) to<br />

the holder.

<strong>18</strong>-23<br />

Shares Issued for Cash<br />

10,000 shares of stock are issued for $100,000 cash.<br />

$1 Par<br />

Value<br />

Cash ....................................................... 100,000<br />

Common stock, par value .............. 10,000<br />

Paid-in capital – excess of par …… 90,000<br />

To record issue of common stock.<br />

No Par<br />

Value<br />

Cash ....................................................... 100,000<br />

Common stock ............................. 100,000<br />

To record issue of common stock.<br />

No Par,<br />

$1 Stated<br />

Value<br />

Cash ................................................................... 100,000<br />

Common stock, stated value ..................... 10,000<br />

Paid-in capital – excess of stated value …. 90,000<br />

To record issue of common stock.

Shares Issued for<br />

Noncash Consideration<br />

<strong>18</strong>-24<br />

Apply the general valuation principle by using fair<br />

value of stock given up or fair value of asset<br />

received, whichever is more clearly evident.<br />

If market values cannot be determined, use<br />

appraised values.

More Than One Security<br />

Issued for a Single Price<br />

<strong>18</strong>-25<br />

Allocate the lump-sum received based on the relative fair<br />

values of the two securities.<br />

If only one fair value is known, allocate a portion of the lumpsum<br />

received based on that fair value and allocate the<br />

remainder to the other security.<br />

Toys Inc. issued 5,000 shares of common stock, $10 par value,<br />

and 3,000 shares of preferred stock, $5 par value, for $450,000.<br />

The market values of the common stock and<br />

preferred stock were $55 and $75, respectively.<br />

Calculate the additional paid-in<br />

capital for each class of stock.

More Than One Security<br />

Issued for a Single Price<br />

<strong>18</strong>-26<br />

Market* % Allocation** Par^ Excess^^<br />

Common Stock $ 275,000 55% $ 247,500 $ 50,000 $ 197,500<br />

Preferred Stock 225,000 45% 202,500 15,000 <strong>18</strong>7,500<br />

Total $ 500,000 100% $ 450,000 $ 65,000 $ 385,000<br />

* Market Value: ^ Par Value:<br />

Common: $55 × 5,000 shares Common: $10 × 5,000 shares<br />

Preferred: $75 × 3,000 shares Preferred: $5 × 3,000 shares<br />

**Allocation:<br />

^^Excess:<br />

Common: $450,000 × 55% Common: $247,500 - $50,000 par<br />

Preferred: $450,000 × 45% Preferred: $202,500 - $15,000 par<br />

Cash ............................................................................ 450,000<br />

Common stock, $10 par ..................................... 50,000<br />

Paid-in capital – excess of par common ……….. 197,500<br />

Preferred stock, $5 par 15,000<br />

Paid-in capital – excess of par preferred ………. <strong>18</strong>7,500<br />

To record issue of common and preferred stock.

<strong>18</strong>-27<br />

Share Issue Costs<br />

Registration fees<br />

Underwriter commissions<br />

Printing and clerical costs<br />

Legal and accounting fees<br />

Promotional costs<br />

Share issue costs reduce net proceeds<br />

from selling shares, resulting in a lower<br />

amount of additional paid-in capital.

<strong>18</strong>-28<br />

Share Buybacks<br />

A corporation might reacquire shares of its stock to . . .<br />

support the market price.<br />

increase earnings per share.<br />

distribute in stock option plans.<br />

issue as a stock dividend.<br />

use in mergers and acquisitions.<br />

thwart takeover attempts.<br />

Companies can account<br />

for the reacquired<br />

shares by retiring them<br />

or by holding them as<br />

treasury shares.

<strong>18</strong>-29<br />

Accounting for Retired Shares<br />

When shares are formally retired, we reduce the same capital<br />

accounts that were increased when the shares were issued –<br />

common or preferred stock, and additional paid-in capital.<br />

Price paid is less than issue price.<br />

5,000 shares of $2 par value stock that were issued<br />

for $20 per share are reacquired for $17 per share.<br />

Common stock ............................................................ 10,000<br />

Paid-in capital – excess of par common …………….... 90,000<br />

Paid-in capital – share repurchase …………….. 15,000<br />

Cash ……………………………………………….. 85,000<br />

To record repurchase and retirement of common stock.

<strong>18</strong>-30<br />

Accounting for Retired Shares<br />

Price paid is more than issue price.<br />

5,000 shares of $2 par value stock that were issued<br />

for $20 per share are reacquired for $25 per share.<br />

Common stock ............................................................ 10,000<br />

Paid-in capital – excess of par common ………………. 90,000<br />

Paid-in capital – share repurchase …………………….. 25,000<br />

Cash ……………………………………………….. 125,000<br />

To record repurchase and retirement of common stock.<br />

Reduce Retained Earnings if the Paid-in Capital- share repurchase<br />

has an insufficient credit balance.

<strong>18</strong>-31<br />

Accounting for Treasury Stock<br />

Treasury stock usually does not have:<br />

Voting rights.<br />

Dividend rights.<br />

Preemptive rights.<br />

Liquidation rights.<br />

Treasury stock is reported as an unallocated reduction<br />

of total Shareholders’ Equity.<br />

Acquisition of Treasury Stock<br />

Recorded at cost to acquire (cost method).<br />

Resale of Treasury Stock<br />

Treasury Stock credited for cost.<br />

Difference between cost and issuance price is (generally)<br />

recorded in paid-in capital—share repurchase.

<strong>18</strong>-32<br />

Accounting for Treasury Stock<br />

On 5/1/12, Photos-in-a-Second reacquired 3,000 shares of its<br />

common stock at $55 per share. On 12/3/13, Photos-in-a-Second<br />

reissued 1,000 shares of the stock at $75 per share. Which of the<br />

following would be included in the 12/3/13 entry<br />

a. Credit Cash for $165,000.<br />

b. Debit Treasury Stock for $75,000.<br />

c. Credit Treasury Stock for $55,000.<br />

d. Credit Cash for $75,000.<br />

May 1, 2012:<br />

Treasury stock .............................................. 165,000<br />

Cash ................................................... 165,000<br />

To record purchase of treasury stock.<br />

December 3, 2013:<br />

Cash ............................................................. 75,000<br />

Treasury stock ....................................<br />

55,000 (cost)<br />

Paid-in capital – share repurchase …. 20,000<br />

To record reissue of treasury stock.

<strong>18</strong>-33<br />

Where We’re Headed<br />

The FASB and IASB are working to establish a common standard for<br />

presenting information in the financial statements, An important part<br />

of the proposal involves the organization of elements of the balance<br />

sheet, statement of comprehensive income, and statement of cash<br />

flows into a common set of classifications.<br />

A key feature of the new format is that each of the financial<br />

statements will include classifications by operating, investing, and<br />

financing activities (similar to the current statement of cash flows).<br />

Operating and investing activities will be included within a new<br />

category, “business” activities. Each statement also will include three<br />

additional groupings: discontinued operations, income taxes, and multicategory<br />

transactions (if needed).

Retained Earnings<br />

Represents the undistributed earnings of the<br />

company since its inception.<br />

<strong>18</strong>-34<br />

Balance January 1, 2013 $ 106,500<br />

Net income 25,000<br />

Cash dividends (10,000)<br />

Balance December 31, 2013 $ 121,500<br />

The statement of retained earnings may also contain the<br />

correction of a prior period accounting error, called a prior<br />

period adjustment.<br />

Any portion of a dividend not representing a distribution of<br />

earnings (liquidating dividend) should be debited to additional<br />

paid-in capital rather than retained earnings.<br />

Any restrictions on retained earnings must be disclosed in<br />

the notes to the financial statements.

<strong>18</strong>-35<br />

Accounting for Cash Dividends<br />

Declared by board of<br />

directors.<br />

Creates liability at<br />

declaration.<br />

Not legally<br />

required.<br />

Requires sufficient<br />

Retained Earnings and<br />

Cash.<br />

Declaration date<br />

Board of directors declares a $10,000 cash dividend.<br />

Record a liability.<br />

Declaration Date:<br />

Retained earnings ........................................ 10,000<br />

Dividends payable .............................. 10,000<br />

To record declaration of cash dividend.

Dividend Dates<br />

Ex-dividend date<br />

A stock is said to be selling ex-dividend on the day that it<br />

loses the right to receive the latest declared dividend,<br />

usually 2 business days before the date of record. A person<br />

who buys the stock before the ex-dividend date is entitled<br />

for the dividend. The first day the shares trade without the<br />

right to receive the declared dividend. (No entry)<br />

Date of Record<br />

Stockholders holding shares on this date will receive<br />

the dividend. (No entry)<br />

Date of Payment<br />

Record the dividend payment to stockholders.<br />

Date of Payment:<br />

Dividends payable ........................................ 10,000<br />

Cash ……………….............................. 10,000<br />

To record payment of cash dividend.<br />

<strong>18</strong>-36

Property Dividends (P 1104 for JE)<br />

<br />

<br />

<br />

Distributions of non-cash assets.<br />

Record at fair value of noncash asset (via revaluating the<br />

asset) at the date of declaration.<br />

Recognize gain or loss for difference between book value and<br />

fair value.<br />

Accounting for Stock Dividends (P 1105 for JE)<br />

Corporations may issue stock dividends to<br />

• Reduce the market price per share of stock to make the shares more<br />

affordable for investors to purchase.<br />

• Signal that the management expects strong financial performance<br />

in the future.<br />

• Remind stockholders of the accounting wealth in the company,<br />

while preserving cash and reduce the existing balance in<br />

retained earnings.<br />

<strong>18</strong>-37

<strong>18</strong>-38<br />

Accounting for Stock Dividends<br />

Distribution of additional shares of stock to owners.<br />

No change in total<br />

stockholders’ equity,<br />

because dr. retained<br />

earnigns cr. stock and<br />

APIC. .<br />

Small<br />

Stock dividend < 25% of<br />

outstanding shares<br />

Record at current fair<br />

value of stock.<br />

All stockholders retain same<br />

percentage ownership.<br />

No change in<br />

par values.<br />

Large<br />

Stock dividend > 25%<br />

Record at par<br />

value of stock.

<strong>18</strong>-39<br />

Accounting for Stock Dividends<br />

CarCo declares and distributes a 20% stock<br />

dividend on 5 million common shares. Par value<br />

is $1 and market value is $20. The required<br />

journal entry would be:<br />

Retained earnings ..................................................... 20,000,000<br />

Common stock …………………………………. 1,000,000<br />

Paid-in capital – excess of par common …….. 19,000,000<br />

To record declaration and distribution of small stock dividend.<br />

5,000,000 shares × 20 % = 1,000,000 shares issued × $20 = $20,000,000

<strong>18</strong>-40<br />

Stock Splits<br />

Stock splits change the par value per share and the number of<br />

shares outstanding, but the total par value is unchanged, and no<br />

journal entry is required.<br />

Assume that a corporation had 3,000 shares of<br />

$2 par value common stock outstanding before<br />

a 2–for–1 stock split.<br />

Before<br />

Split<br />

After<br />

Split<br />

Common Stock Shares 3,000 6,000<br />

Par Value per Share $ 2.00 $ 1.00<br />

Total Par Value $ 6,000 $ 6,000<br />

Increase<br />

Decrease<br />

No<br />

Change

Stock Splits Effected in the<br />

Form of Large Stock Dividends<br />

A stock distribution of 25% or higher, can be accounted as<br />

(1) a large stock dividend or (2) a stock split. Thus a<br />

100% stock dividend could be labeled as a 2-for-1 stock split. However,<br />

it is costly to have the par value per share changed. Thus count it as a<br />

stock dividend rather than stock split.<br />

Matrix Inc. declares and distributes a 2-for-1 stock split effected in<br />

the form of a 100% stock dividend. The company has 1,000,000, $1<br />

par value common stock outstanding. The stock is trading in the<br />

open market for $14 per share. The per share par value of the<br />

shares is not to be changed.<br />

<strong>18</strong>-41<br />

Paid-in capital – excess of par common …................. 1,000,000<br />

Common stock ……………..……………………. 1,000,000<br />

To record declaration and distribution of 2-for-1 stock<br />

split effected in the form of a 100% stock dividend.

Reverse Stock Split and Fractional Shares<br />

Reverse Stock Split:<br />

1. The motivation for declaring a reverse stock split is to increase market price.<br />

2. It occurs particular during stock market downturn.<br />

3. No journal entry is required.<br />

e.g., a 1-for-4 reverse stock split, a 1MM shares, $1 par per share, would become<br />

250K shares, $4 per share.<br />

Fractional Shares:<br />

1. A stock dividend or stock split results in some shareholders being entitled to<br />

fractional of whole shares.<br />

e.g., a 25% stock dividend or a 5-for-4 stock split; a shareholder owning<br />

10 shares would be entitled to 2.5 shares.<br />

2. Cash payments are made to the fractional shares. In above example, the<br />

shareholder would receive 2 shares plus $5 assuming the market value at the<br />

declaration is $10 per share.