Merrill Lynch International Investment Funds Audited Annual Report ...

Merrill Lynch International Investment Funds Audited Annual Report ...

Merrill Lynch International Investment Funds Audited Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

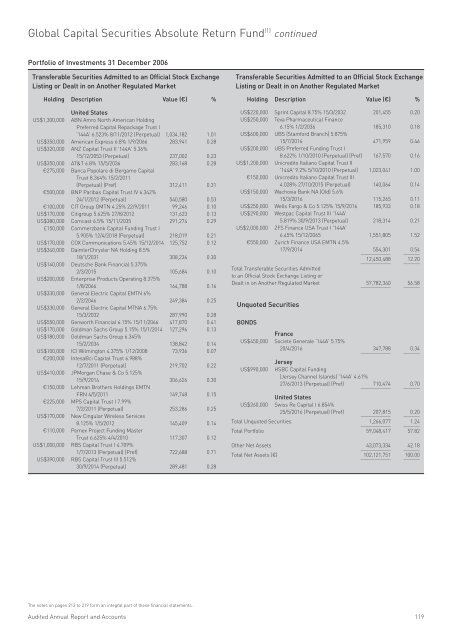

Global Capital Securities Absolute Return Fund (1) continued<br />

Portfolio of <strong>Investment</strong>s 31 December 2006<br />

Transferable Securities Admitted to an Official Stock Exchange<br />

Listing or Dealt in on Another Regulated Market<br />

Holding Description Value (€) %<br />

United States<br />

US$1,300,000 ABN Amro North American Holding<br />

Preferred Capital Repackage Trust I<br />

'144A' 6.523% 8/11/2012 (Perpetual) 1,034,182 1.01<br />

US$350,000 American Express 6.8% 1/9/2066 283,941 0.28<br />

US$320,000 ANZ Capital Trust II '144A' 5.36%<br />

15/12/2053 (Perpetual) 237,002 0.23<br />

US$350,000 AT&T 6.8% 15/5/2036 283,168 0.28<br />

€275,000 Banca Popolare di Bergamo Capital<br />

Trust 8.364% 15/2/2011<br />

(Perpetual) (Pref) 312,411 0.31<br />

€500,000 BNP Paribas Capital Trust IV 6.342%<br />

24/1/2012 (Perpetual) 540,580 0.53<br />

€100,000 CIT Group GMTN 4.25% 22/9/2011 99,246 0.10<br />

US$170,000 Citigroup 5.625% 27/8/2012 131,623 0.13<br />

US$380,000 Comcast 6.5% 15/11/2035 291,274 0.29<br />

£150,000 Commerzbank Capital Funding Trust I<br />

5.905% 12/4/2018 (Perpetual) 218,019 0.21<br />

US$170,000 COX Communications 5.45% 15/12/2014 125,752 0.12<br />

US$340,000 DaimlerChrysler NA Holding 8.5%<br />

18/1/2031 308,236 0.30<br />

US$140,000 Deutsche Bank Financial 5.375%<br />

2/3/2015 105,684 0.10<br />

US$200,000 Enterprise Products Operating 8.375%<br />

1/8/2066 164,788 0.16<br />

US$330,000 General Electric Capital EMTN 6%<br />

2/2/2046 249,384 0.25<br />

US$330,000 General Electric Capital MTNA 6.75%<br />

15/3/2032 287,990 0.28<br />

US$550,000 Genworth Financial 6.15% 15/11/2066 417,870 0.41<br />

US$170,000 Goldman Sachs Group 5.15% 15/1/2014 127,296 0.13<br />

US$180,000 Goldman Sachs Group 6.345%<br />

15/2/2034 138,842 0.14<br />

US$100,000 ICI Wilmington 4.375% 1/12/2008 73,936 0.07<br />

€200,000 IntesaBci Capital Trust 6.988%<br />

12/7/2011 (Perpetual) 219,702 0.22<br />

US$410,000 JPMorgan Chase & Co 5.125%<br />

15/9/2014 306,626 0.30<br />

€150,000 Lehman Brothers Holdings EMTN<br />

FRN 4/5/2011 149,748 0.15<br />

€225,000 MPS Capital Trust I 7.99%<br />

7/2/2011 (Perpetual) 253,286 0.25<br />

US$170,000 New Cingular Wireless Services<br />

8.125% 1/5/2012 145,409 0.14<br />

€110,000 Pemex Project Funding Master<br />

Trust 6.625% 4/4/2010 117,307 0.12<br />

US$1,000,000 RBS Capital Trust I 4.709%<br />

1/7/2013 (Perpetual) (Pref) 722,688 0.71<br />

US$390,000 RBS Capital Trust III 5.512%<br />

30/9/2014 (Perpetual) 289,481 0.28<br />

Transferable Securities Admitted to an Official Stock Exchange<br />

Listing or Dealt in on Another Regulated Market<br />

Holding Description Value (€) %<br />

US$220,000 Sprint Capital 8.75% 15/3/2032 201,455 0.20<br />

US$250,000 Teva Pharmaceutical Finance<br />

6.15% 1/2/2036 185,310 0.18<br />

US$600,000 UBS (Stamford Branch) 5.875%<br />

15/7/2016 471,959 0.46<br />

US$200,000 UBS Preferred Funding Trust I<br />

8.622% 1/10/2010 (Perpetual) (Pref) 167,570 0.16<br />

US$1,200,000 Unicredito Italiano Capital Trust II<br />

'144A' 9.2% 5/10/2010 (Perpetual) 1,023,041 1.00<br />

€150,000 Unicredito Italiano Capital Trust III<br />

4.028% 27/10/2015 (Perpetual) 140,064 0.14<br />

US$150,000 Wachovia Bank NA (Old) 5.6%<br />

15/3/2016 115,265 0.11<br />

US$250,000 Wells Fargo & Co 5.125% 15/9/2016 185,933 0.18<br />

US$290,000 Westpac Capital Trust III '144A'<br />

5.819% 30/9/2013 (Perpetual) 218,314 0.21<br />

US$2,000,000 ZFS Finance USA Trust I '144A'<br />

6.45% 15/12/2065 1,551,805 1.52<br />

€550,000 Zurich Finance USA EMTN 4.5%<br />

17/9/2014<br />

___________<br />

554,301<br />

______<br />

0.54<br />

___________<br />

12,450,488<br />

______<br />

12.20<br />

Total Transferable Securities Admitted<br />

to an Official Stock Exchange Listing or<br />

Dealt in on Another Regulated Market<br />

___________<br />

57,782,340<br />

______<br />

56.58<br />

Unquoted Securities<br />

BONDS<br />

France<br />

US$450,000 Societe Generale '144A' 5.75%<br />

20/4/2016<br />

___________<br />

347,788<br />

______<br />

0.34<br />

US$990,000<br />

Jersey<br />

HSBC Capital Funding<br />

(Jersey Channel Islands) '144A' 4.61%<br />

27/6/2013 (Perpetual) (Pref)<br />

___________<br />

710,474<br />

______<br />

0.70<br />

United States<br />

US$260,000 Swiss Re Capital I 6.854%<br />

25/5/2016 (Perpetual) (Pref)<br />

___________<br />

207,815<br />

______<br />

0.20<br />

Total Unquoted Securities<br />

___________<br />

1,266,077<br />

______<br />

1.24<br />

Total Portfolio 59,048,417 57.82<br />

Other Net Assets<br />

___________<br />

43,073,334<br />

______<br />

42.18<br />

Total Net Assets (€)<br />

___________<br />

102,121,751<br />

______<br />

100.00<br />

The notes on pages 213 to 219 form an integral part of these financial statements.<br />

<strong>Audited</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts 119