Merrill Lynch International Investment Funds Audited Annual Report ...

Merrill Lynch International Investment Funds Audited Annual Report ...

Merrill Lynch International Investment Funds Audited Annual Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

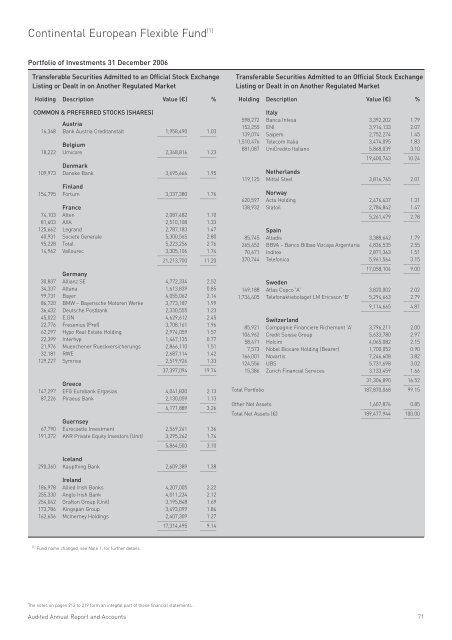

Continental European Flexible Fund (1)<br />

Portfolio of <strong>Investment</strong>s 31 December 2006<br />

Transferable Securities Admitted to an Official Stock Exchange<br />

Listing or Dealt in on Another Regulated Market<br />

Holding Description Value (€) %<br />

COMMON & PREFERRED STOCKS (SHARES)<br />

Austria<br />

16,348 Bank Austria Creditanstalt<br />

___________<br />

1,958,490<br />

______<br />

1.03<br />

Belgium<br />

18,222 Umicore<br />

___________<br />

2,348,816<br />

______<br />

1.23<br />

Denmark<br />

109,973 Danske Bank<br />

___________<br />

3,695,666<br />

______<br />

1.95<br />

Finland<br />

154,795 Fortum<br />

___________<br />

3,337,380<br />

______<br />

1.76<br />

France<br />

74,103 Alten 2,087,482 1.10<br />

81,603 AXA 2,510,108 1.33<br />

125,662 Legrand 2,787,183 1.47<br />

40,931 Societe Generale 5,300,565 2.80<br />

95,228 Total 5,223,256 2.76<br />

14,962 Vallourec<br />

___________<br />

3,305,106<br />

______<br />

1.74<br />

___________<br />

21,213,700<br />

______<br />

11.20<br />

Germany<br />

30,837 Allianz SE 4,772,334 2.52<br />

34,337 Altana 1,613,839 0.85<br />

99,731 Bayer 4,055,062 2.14<br />

86,720 BMW – Bayerische Motoren Werke 3,773,187 1.99<br />

36,432 Deutsche Postbank 2,330,555 1.23<br />

45,022 E.ON 4,629,612 2.45<br />

22,776 Fresenius (Pref) 3,708,161 1.96<br />

62,297 Hypo Real Estate Holding 2,974,059 1.57<br />

22,399 Interhyp 1,467,135 0.77<br />

21,976 Muenchener Rueckversicherungs 2,866,110 1.51<br />

32,181 RWE 2,687,114 1.42<br />

129,227 Symrise<br />

___________<br />

2,519,926<br />

______<br />

1.33<br />

___________<br />

37,397,094<br />

______<br />

19.74<br />

Greece<br />

147,297 EFG Eurobank Ergasias 4,041,830 2.13<br />

87,226 Piraeus Bank<br />

___________<br />

2,130,059<br />

______<br />

1.13<br />

___________<br />

6,171,889<br />

______<br />

3.26<br />

Guernsey<br />

67,790 Eurocastle <strong>Investment</strong> 2,569,241 1.36<br />

191,372 KKR Private Equity Investors (Unit)<br />

___________<br />

3,295,262<br />

______<br />

1.74<br />

___________<br />

5,864,503<br />

______<br />

3.10<br />

Iceland<br />

290,360 Kaupthing Bank<br />

___________<br />

2,609,389<br />

______<br />

1.38<br />

Ireland<br />

186,978 Allied Irish Banks 4,207,005 2.22<br />

255,330 Anglo Irish Bank 4,011,234 2.12<br />

254,042 Grafton Group (Unit) 3,195,848 1.69<br />

173,786 Kingspan Group 3,493,099 1.84<br />

162,656 McInerney Holdings<br />

___________<br />

2,407,309<br />

______<br />

1.27<br />

___________<br />

17,314,495<br />

______<br />

9.14<br />

Transferable Securities Admitted to an Official Stock Exchange<br />

Listing or Dealt in on Another Regulated Market<br />

Holding Description Value (€) %<br />

Italy<br />

598,272 Banca Intesa 3,392,202 1.79<br />

153,255 ENI 3,914,133 2.07<br />

139,074 Saipem 2,752,274 1.45<br />

1,510,476 Telecom Italia 3,474,095 1.83<br />

881,087 UniCredito Italiano<br />

___________<br />

5,868,039<br />

______<br />

3.10<br />

___________<br />

19,400,743<br />

______<br />

10.24<br />

Netherlands<br />

119,125 Mittal Steel<br />

___________<br />

3,816,765<br />

______<br />

2.01<br />

Norway<br />

620,597 Acta Holding 2,476,637 1.31<br />

138,932 Statoil<br />

___________<br />

2,784,842<br />

______<br />

1.47<br />

___________<br />

5,261,479<br />

______<br />

2.78<br />

Spain<br />

85,745 Altadis 3,388,642 1.79<br />

265,452 BBVA – Banco Bilbao Vizcaya Argentaria 4,836,535 2.55<br />

70,671 Inditex 2,871,363 1.51<br />

370,744 Telefonica<br />

___________<br />

5,961,564<br />

______<br />

3.15<br />

___________<br />

17,058,104<br />

______<br />

9.00<br />

Sweden<br />

149,188 Atlas Copco 'A' 3,820,002 2.02<br />

1,734,405 Telefonaktiebolaget LM Ericsson 'B'<br />

___________<br />

5,294,663<br />

______<br />

2.79<br />

___________<br />

9,114,665<br />

______<br />

4.81<br />

Switzerland<br />

85,921 Compagnie Financiere Richemont 'A' 3,796,211 2.00<br />

106,962 Credit Suisse Group 5,633,780 2.97<br />

58,471 Holcim 4,065,082 2.15<br />

7,573 Nobel Biocare Holding (Bearer) 1,700,052 0.90<br />

166,001 Novartis 7,246,608 3.82<br />

124,556 UBS 5,731,698 3.02<br />

15,386 Zurich Financial Services<br />

___________<br />

3,133,459<br />

______<br />

1.66<br />

___________<br />

31,306,890<br />

______<br />

16.52<br />

Total Portfolio 187,870,068 99.15<br />

Other Net Assets<br />

___________<br />

1,607,876<br />

______<br />

0.85<br />

Total Net Assets (€)<br />

___________<br />

189,477,944<br />

______<br />

100.00<br />

(1) Fund name changed, see Note 1, for further details.<br />

The notes on pages 213 to 219 form an integral part of these financial statements.<br />

<strong>Audited</strong> <strong>Annual</strong> <strong>Report</strong> and Accounts 71